PG&E 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Utility does not assume customer credit risk nor take title

to the electricity being delivered to the customer.

Therefore, the Utility presents the electricity revenues for

amounts delivered to customers net of the cost of

electricity delivered by the DWR.

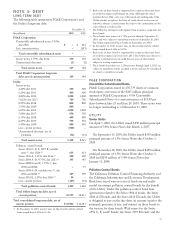

INCOME TAXES

PG&E Corporation and the Utility use the liability method

of accounting for income taxes. Income tax provision

(benefit) includes current and deferred income taxes

resulting from operations during the year. Investment tax

credits are deferred and amortized to income over time.

The Utility amortizes its investment tax credits over the life

of the related property in accordance with regulatory

treatment. PG&E Corporation amortizes its investment tax

credits over the projected investment recovery period or

the life of the arrangement for its tax equity arrangements.

(See Note 9 below.)

PG&E Corporation and the Utility recognize a tax

benefit if it is more likely than not that a tax position taken

or expected to be taken in a tax return will be sustained

upon examination by taxing authorities based on the

merits of the position. The tax benefit recognized in the

financial statements is measured based on the largest

amount of benefit that is greater than 50% likely of being

realized upon settlement. The difference between a tax

position taken or expected to be taken in a tax return and

the benefit recognized and measured pursuant to this

guidance represents an unrecognized tax benefit.

PG&E Corporation files a consolidated U.S. federal

income tax return that includes domestic subsidiaries in

which its ownership is 80% or more. In addition, PG&E

Corporation files a combined state income tax return in

California. PG&E Corporation and the Utility are parties

to a tax-sharing agreement under which the Utility

determines its income tax provision (benefit) on a stand-

alone basis.

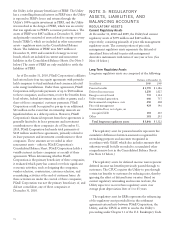

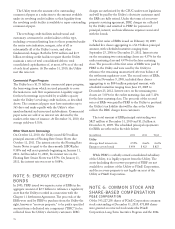

NUCLEAR DECOMMISSIONING TRUSTS

The Utility’s nuclear power facilities consist of two units at

Diablo Canyon and the retired facility at Humboldt Bay.

Nuclear decommissioning requires the safe removal of

nuclear facilities from service and the reduction of residual

radioactivity to a level that permits termination of the

Nuclear Regulatory Commission (“NRC”) license and

release of the property for unrestricted use. The Utility’s

nuclear decommissioning costs are recovered from

customers through rates.

The Utility classifies its investments held in the nuclear

decommissioning trust as “available-for-sale.” As the

Utility’s nuclear decommissioning trust assets are managed

by external investment managers, the Utility does not have

the ability to sell its investments at their discretion.

Therefore, all unrealized losses are considered other-than-

temporary impairments. Gains or losses on the nuclear

decommissioning trust investments are refundable or

recoverable, respectively, from customers. Therefore, trust

earnings are deferred and included in the regulatory

liability for recoveries in excess of the ARO. There is no

impact on the Utility’s earnings or accumulated other

comprehensive income. The cost of debt and equity

securities sold is determined by specific identification.

ACCOUNTING FOR DERIVATIVES AND HEDGING

ACTIVITIES

Derivative instruments are recorded in PG&E

Corporation’s and the Utility’s Consolidated Balance

Sheets at fair value, unless they qualify for the normal

purchase and sales exception. Changes in the fair value of

derivative instruments are recorded in earnings or, to the

extent that they are recoverable through regulated rates, are

deferred and recorded in regulatory accounts. Derivative

instruments may be designated as cash flow hedges when

they are entered into in order to hedge variable price risk

associated with the purchase of commodities. For cash flow

hedges, fair value changes are deferred in accumulated

other comprehensive income and recognized in earnings as

the hedged transactions occur, unless they are recovered in

rates, in which case they are recorded in regulatory

accounts.

As of September 30, 2009, the Utility de-designated all

cash flow hedge relationships. Due to the regulatory

accounting treatment described above, the de-designation

of cash flow hedge relationships had no impact on net

income or the Consolidated Balance Sheets.

The normal purchase and sales exception to derivative

accounting requires, among other things, physical delivery

of quantities expected to be used or sold over a reasonable

period in the normal course of business. Transactions for

which the normal purchase and sales exception is elected

are not reflected in the Consolidated Balance Sheets at fair

value. They are accounted for under the accrual method of

accounting. Therefore, expenses are recognized as incurred.

PG&E Corporation and the Utility offset the cash

collateral paid or cash collateral received against the fair

value amounts recognized for derivative instruments

executed with the same counterparty under a master

netting arrangement where the right of offset exists and

where PG&E Corporation and the Utility intends to set off.

(See Note 10 below.)

70