PG&E 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

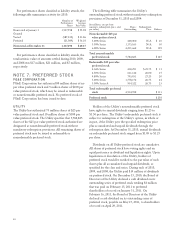

NOTE 4: DEBT

LONG-TERM DEBT

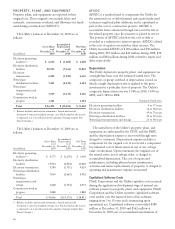

The following table summarizes PG&E Corporation’s and

the Utility’s long-term debt:

December 31,

(in millions) 2010 2009

PG&E Corporation

Convertible subordinated notes, 9.50%,

due 2010 $—$ 247

Less: current portion —(247)

Total convertible subordinated notes — —

Senior notes, 5.75%, due 2014 350 350

Unamortized discount (1) (2)

Total senior notes 349 348

Total PG&E Corporation long-term

debt, net of current portion 349 348

Utility

Senior notes:

4.20% due 2011 500 500

6.25% due 2013 400 400

4.80% due 2014 1,000 1,000

5.625% due 2017 700 700

8.25% due 2018 800 800

3.50% due 2020 800 —

6.05% due 2034 3,000 3,000

5.80% due 2037 950 700

6.35% due 2038 400 400

6.25% due 2039 550 550

5.40% due 2040 800 550

Less: current portion (500) —

Unamortized discount, net of

premium (52) (35)

Total senior notes 9,348 8,565

Pollution control bonds:

Series 1996 C, E, F, 1997 B, variable

rates (1), due 2026 (2) 614 614

Series 1996 A, 5.35%, due 2016 (3) 200 200

Series 2004 A–D, 4.75%, due 2023 (3) 345 345

Series 2008 G and F, 3.75% (4), due

2018 and 2026 —95

Series 2009 A–D, variable rates (5), due

2016 and 2026 (6) 309 309

Series 2010 E, 2.25%, due 2026 (7) 50 —

Less: current portion (309) (95)

Total pollution control bonds 1,209 1,468

Total Utility long-term debt, net of

current portion 10,557 10,033

Total consolidated long-term debt, net of

current portion $ 10,906 $ 10,381

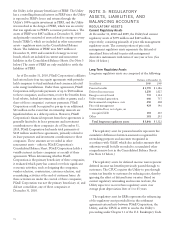

(1) At December 31, 2010, interest rates on these bonds and the related

loans ranged from 0.26% to 0.31%.

(2) Each series of these bonds is supported by a separate direct-pay letter

of credit that expires on February 26, 2012. Although the stated

maturity date is 2026, each series will remain outstanding only if the

Utility extends or replaces the letter of credit related to the series or

otherwise obtains a consent from the issuer to the continuation of the

series without a credit facility.

(3) The Utility has obtained credit support from insurance companies for

these bonds.

(4) These bonds bore interest at 3.75% per year through September 19,

2010, and were subject to mandatory tender on September 20, 2010.

The Utility repurchased these bonds on September 20, 2010.

(5) At December 31, 2010, interest rates on these bonds and the related

loans ranged from 0.22% to 0.29%.

(6) Each series of these bonds is supported by a separate direct-pay letter

of credit that expires on October 29, 2011. The Utility may choose to

provide a substitute letter of credit for any series of these bonds,

subject to a rating requirement.

(7) These bonds bear interest at 2.25% per year through April 1, 2012; are

subject to mandatory tender on April 2, 2012; and may be remarketed

in a fixed or variable rate mode.

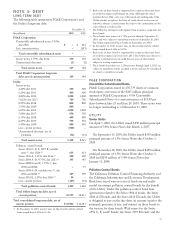

PG&E CORPORATION

Convertible Subordinated Notes

PG&E Corporation issued 16,370,779 shares of common

stock upon conversion of the $247 million principal

amount of PG&E Corporation’s 9.5% Convertible

Subordinated Notes at a conversion price of $15.09 per

share between June 23 and June 29, 2010. These notes were

no longer outstanding as of December 31, 2010.

UTILITY

SeniorNotes

On April 1, 2010, the Utility issued $250 million principal

amount of 5.8% Senior Notes due March 1, 2037.

On September 15, 2010, the Utility issued $550 million

principal amount of 3.5% Senior Notes due October 1,

2020.

On November 18, 2010, the Utility issued $250 million

principal amount of 3.5% Senior Notes due October 1,

2020 and $250 million of 5.4% Senior Notes due

January 15, 2040.

PollutionControl Bonds

The California Pollution Control Financing Authority and

the California Infrastructure and Economic Development

Bank have issued various series of fixed rate and multi-

modal tax-exempt pollution control bonds for the benefit

of the Utility. Under the pollution control bond loan

agreements related to the Series 1996 A bonds, the Series

2004 A–D bonds, and the Series 2010 E bonds, the Utility

is obligated to pay on the due dates an amount equal to the

principal; premium, if any; and interest on these bonds to

the trustees for these bonds. With respect to the Series

1996 C, E, and F bonds; the Series 1997 B bonds; and the

75