PG&E 2010 Annual Report Download - page 32

Download and view the complete annual report

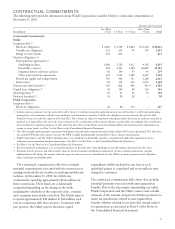

Please find page 32 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CONTINGENCIES

PG&E Corporation and the Utility have significant

contingencies, including Chapter 11 disputed claims,

claims arising from the San Bruno accident, tax matters,

legal matters, and environmental matters, which are

discussed in Notes 9, 13, and 15 of the Notes to the

Consolidated Financial Statements.

CAPITAL EXPENDITURES

UTILITY

The Utility’s capital expenditures for property, plant, and

equipment totaled $3.9 billion in 2010, $3.9 billion in

2009, and $3.7 billion in 2008. The Utility expects that

capital expenditures will total approximately $3.7 billion in

2011. The amount of capital expenditures differs from the

amount of rate base additions used for regulatory purposes

primarily because capital expenditures are not added to rate

base until the assets are placed in service.

The Utility makes various capital investments in its

electric generation and electric and natural gas transmission

and distribution infrastructure to maintain and improve

system reliability, safety, and customer service; to extend the

life of or replace existing infrastructure; and to add new

infrastructure to meet already authorized growth. The CPUC

authorizes most of the Utility’s revenue requirements to

recover forecasted capital expenditures in multi-year GRCs

and gas transmission and storage rate cases. The FERC

authorizes revenue requirements to recover forecasted capital

expenditures related to electric transmission operations in

TO rate cases. (See “Regulatory Matters” below.)

In addition, from time to time, the CPUC authorizes the

Utility to collect additional revenue requirements to recover

capital expenditures related to specific projects. During 2010,

the Utility incurred capital expenditures relating to specific

CPUC-authorized projects, including the continuing

installation of advanced electric and gas meters using

SmartMeter™technology, electric and gas distribution

reliability improvements, and the construction of the new

Colusa Generation Station, which commenced operations in

December 2010. The CPUC also has authorized the Utility

to develop renewable generation facilities using photovoltaic

technology. Other projects are discussed below.

The Utility’s ability to invest in its electric and natural

gas systems and develop new generation facilities is subject

to many risks, including risks related to securing adequate

and reasonably priced financing, obtaining and complying

with terms of permits, meeting construction budgets and

schedules, and satisfying operating and environmental

performance standards. (See “Risk Factors” below.)

PROPOSED OAKLEY GENERATION FACILITY

On December 16, 2010, the CPUC voted to permit the

Utility to enter into an amended purchase and sale

agreement with Contra Costa Generating Station LLC for

the development and construction of the 586-megawatt

(“MW”) Oakley Generating Station, a natural gas-fired,

combined-cycle generation facility proposed to be located

in Oakley, California. Under the amended agreement, the

guaranteed commercial availability date has been shifted

from June 1, 2014 to June 1, 2016. Under the CPUC

decision, if the Utility acquires the facility before January 1,

2016, the Utility’s associated costs cannot be recovered

through rates until after January 1, 2016. Instead, the

Utility’s ability to recover its costs before January 1, 2016

would depend on the amount of electric generation

revenues produced by the facility. If the Utility acquires the

facility after January 1, 2016, the Utility’s associated costs

would be recoverable through rates. The Utility and the

developer are currently negotiating an additional

amendment to the purchase and sale agreement to reflect

the CPUC’s decision. The Utility is uncertain whether and

when the proposed amendment will be executed.

During January 2011, several parties filed applications

for rehearing of the CPUC decision. PG&E Corporation

and the Utility are unable to predict whether the CPUC

will modify its decision based on these applications.

PROPOSED MANZANA WIND FACILITY

On December 21, 2010, a proposed decision was issued in

the CPUC proceeding to consider the Utility’s December

2009 application for approval of a purchase and sales

agreement for the proposed 246 MW Manzana wind

project and for authority to recover the estimated capital

costs of $911 million in rates. On January 14, 2011, the

counterparty to the agreement gave the Utility notice that

it was exercising its right to terminate the agreement. On

January 19, 2011, the Utility requested that the CPUC

permit the Utility to withdraw the original application. It is

uncertain whether or when the CPUC will grant the

Utility’s request to withdraw the application.

OFF-BALANCE SHEET

ARRANGEMENTS

PG&E Corporation and the Utility do not have any

off-balance sheet arrangements that have had, or are

reasonably likely to have, a current or future material effect

on their financial condition, changes in financial

condition, revenues or expenses, results of operations,

liquidity, capital expenditures, or capital resources, other

than those discussed in Note 2 (PG&E Corporation’s tax

equity financing agreements) and Note 15 of the Notes to

the Consolidated Financial Statements (the Utility’s

commodity purchase agreements).

28