PG&E 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

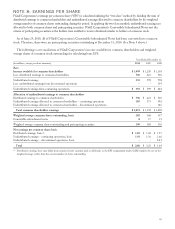

In calculating diluted EPS during the period PG&E Corporation’s Convertible Subordinated Notes were outstanding,

PG&E Corporation applied the “if-converted” method to reflect the dilutive effect of the Convertible Subordinated Notes

to the extent that the impact is dilutive when compared to basic EPS. In addition, PG&E Corporation applies the treasury

stock method of reflecting the dilutive effect of outstanding stock-based compensation in the calculation of diluted EPS.

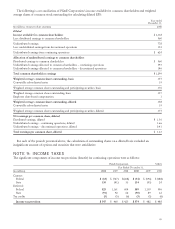

The following is a reconciliation of PG&E Corporation’s income available for common shareholders and weighted

average shares of common stock outstanding for calculating diluted EPS:

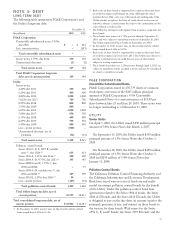

Year ended

December 31,

(in millions, except per share amounts) 2010 2009

Diluted

Income available for common shareholders $ 1,099 $ 1,220

Add earnings impact of assumed conversion of participating securities:

Interest expense on convertible subordinated notes, net of tax 815

Unrealized loss on embedded derivative, net of tax –2

Income available for common shareholders and assumed conversion $ 1,107 $ 1,237

Weighted average common shares outstanding, basic 382 368

Add incremental shares from assumed conversions:

Convertible subordinated notes 817

Employee share-based compensation 21

Weighted average common shares outstanding, diluted 392 386

Total earnings per common share, diluted $ 2.82 $ 3.20

84