PG&E 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Series 2009 A–D bonds, which currently bear interest at

variable rates, the Utility reimburses the letter of credit

providers for their payments to the trustee for these

bonds, or if a letter of credit provider fails to pay under its

respective letter of credit, the Utility is obligated to pay

the principal; premium, if any; and interest on those

bonds. All payments on the Series 1996 C, E, and F

bonds; the Series 1997 B bonds; and the Series 2009 A–D

bonds are made through draws on separate direct-pay

letters of credit for each series issued by a financial

institution.

The Utility has obtained credit support from insurance

companies for the Series 1996 A bonds and the Series

2004 A–D bonds such that if the Utility does not pay the

principal and interest on any series of these insured

bonds, the bond insurer for that series will pay the

principal and interest.

On April 8, 2010, the California Infrastructure and

Economic Development Bank issued $50 million of

tax-exempt pollution control bonds Series 2010 E due

November 1, 2026 and loaned the proceeds to the Utility.

The proceeds were used to refund the corresponding

related series of pollution control bonds issued in 2005

that were repurchased by the Utility in 2008. The Series

2010 E bonds bear interest at 2.25% per year through

April 1, 2012 and are subject to mandatory tender on

April 2, 2012 at a price of 100% of the principal amount

plus accrued interest. Thereafter, this series of bonds may

be remarketed in a fixed or variable rate mode. Interest is

currently payable semi-annually in arrears on April 1 and

October 1.

On September 20, 2010, the Utility repurchased $50

million principal amount of pollution control bonds

Series 2008 F and $45 million principal amount of

pollution control bonds Series 2008 G that were subject

to mandatory tender on the same date. The Utility, as

bondholder, will be both the payer and the recipient of

principal and interest payments until the bonds are

remarketed to the public. As of December 31, 2010, the

bonds have not been remarketed to the public.

All of the pollution control bonds were used to

finance or refinance pollution control and sewage and

solid waste disposal facilities at the Geysers geothermal

power plant or at the Utility’s Diablo Canyon nuclear

power plant and were issued as “exempt facility bonds”

within the meaning of the Internal Revenue Code of

1954, as amended. In 1999, the Utility sold the Geysers

geothermal power plant to Geysers Power Company, LLC

pursuant to purchase and sale agreements stating that

Geysers Power Company, LLC will use the bond-financed

facilities solely as pollution control facilities. The Utility

has no knowledge that Geysers Power Company, LLC

intends to cease using the bond-financed facilities solely

as pollution control facilities.

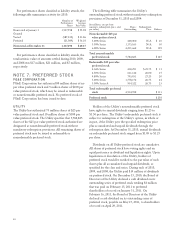

REPAYMENT SCHEDULE

PG&E Corporation’s and the Utility’s combined aggregate principal repayment amounts of long-term debt at

December 31, 2010 are reflected in the table below:

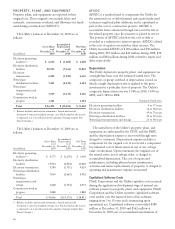

(in millions, except interest rates) 2011 2012 2013 2014 2015 Thereafter Total

Long-term debt:

PG&E Corporation

Average fixed interest rate – – – 5.75% – – 5.75%

Fixed rate obligations $ – $ – $ – $ 350 $ – $ – $ 350

Utility

Average fixed interest rate 4.20% 2.25% 6.25% 4.80% – 5.85% 5.67%

Fixed rate obligations $ 500 $ 50 (2) $ 400 $ 1,000 $ – $ 8,545 $ 10,495

Variable interest rate as of December 31, 2010 0.27% 0.28% – – – – 0.28%

Variable rate obligations $ 309 (1) $ 614 (3) $–$–$– $–$923

Less: current portion (809) – – – – – (809)

Total consolidated long-term debt $ – $ 664 $ 400 $ 1,350 $ – $ 8,545 $ 10,959

(1) These bonds, due from 2016 through 2026, are backed by direct-pay letters of credit that expire on October 29, 2011. The bonds will be subject to a

mandatory redemption unless the letter of credit is extended or replaced, or the issuer consents to the continuation of these series without a credit

facility. Accordingly, the bonds have been classified for repayment purposes in 2011.

(2) These bonds, due in 2026, are subject to mandatory tender on April 2, 2012 and may be remarketed in a fixed or variable rate mode. Accordingly,

the bonds have been classified for repayment purposes in 2012.

(3) These bonds, due in 2026, are backed by direct-pay letters of credit that expire on February 26, 2012. The bonds will be subject to a mandatory

redemption unless the letters of credit are extended or replaced. Accordingly, the bonds have been classified for repayment purposes in 2012.

76