PG&E 2010 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

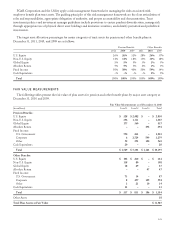

Natural Gas Supply, Transportation,and Storage

Commitments

The Utility purchases natural gas directly from producers

and marketers in both Canada and the United States to

serve its core customers. The contract lengths and

quantities of the Utility’s portfolio of natural gas

procurement contracts can fluctuate based on market

conditions. The Utility also contracts for natural gas

transportation from the points at which the Utility takes

delivery (typically in Canada and the southwestern United

States) to the points at which the Utility’s natural gas

transportation system begins. In addition, the Utility has

contracted for gas storage services in northern California in

order to better meet core customers’ winter peak loads. At

December 31, 2010, the Utility’s undiscounted obligations

for natural gas purchases, natural gas transportation

services, and natural gas storage were as follows:

(in millions)

2011 $ 710

2012 273

2013 191

2014 170

2015 161

Thereafter 1,128

Total (1) $ 2,633

(1) Amounts above include firm transportation contracts for the Ruby

Pipeline (a 1.5 billion cubic feet per day (“bcf/d”) pipeline that is

currently under construction and expected to become operational in

the summer of 2011; and the Utility has contracted for a capacity of

approximately 0.4 bcf/d).

Payments for natural gas purchases, natural gas

transportation services, and natural gas storage amounted

to $1.6 billion in 2010, $1.4 billion in 2009, and $2.7

billion in 2008.

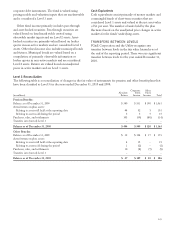

NuclearFuel Agreements

The Utility has entered into several purchase agreements

for nuclear fuel. These agreements have terms ranging from

1 to 14 years and are intended to ensure long-term fuel

supply. The contracts for uranium and for conversion and

enrichment services provide for 100% coverage of reactor

requirements through 2016, while contracts for fuel

fabrication services provide for 100% coverage of reactor

requirements through 2017. The Utility relies on a number

of international producers of nuclear fuel in order to

diversify its sources and provide security of supply. Pricing

terms are also diversified, ranging from market-based prices

to base prices that are escalated using published indices.

New agreements are primarily based on forward market

pricing. Price increases in the uranium and enrichment

service markets are providing upward pressure on nuclear

fuel costs starting in 2011.

At December 31, 2010, the undiscounted obligations

under nuclear fuel agreements were as follows:

(in millions)

2011 $ 84

2012 69

2013 105

2014 132

2015 191

Thereafter 1,057

Total $ 1,638

Payments for nuclear fuel amounted to $144 million in

2010, $141 million in 2009, and $157 million in 2008.

OtherCommitments and Operating Leases

The Utility has other commitments relating to operating

leases. At December 31, 2010, the future minimum

payments related to other commitments were as follows:

(in millions)

2011 $ 25

2012 22

2013 19

2014 14

2015 11

Thereafter 73

Total $ 164

Payments for other commitments and operating leases

amounted to $25 million in 2010, $22 million in 2009, and

$41 million in 2008. PG&E Corporation and the Utility

had operating leases on office facilities expiring at various

dates from 2011 to 2020. Certain leases on office facilities

contain escalation clauses requiring annual increases in rent

ranging from 1% to 4%. The rentals payable under these

leases may increase by a fixed amount each year, a

percentage of a base year, or the consumer price index.

Most leases contain extension options ranging between one

and five years.

Underground Electric Facilities

At December 31, 2010, the Utility was committed to

spending approximately $236 million for the conversion of

existing overhead electric facilities to underground electric

facilities. These funds are conditionally committed

depending on the timing of the work, including the

schedules of the respective cities, counties, and

communications utilities involved. The Utility expects to

spend approximately $42 million to $60 million each year

in connection with these projects. Consistent with past

practice, the Utility expects that these capital expenditures

will be included in rate base as each individual project is

completed and recoverable in rates charged to customers.

108