PG&E 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the Utility is the primary beneficiary of PERF. The Utility

has a controlling financial interest in PERF since the Utility

is exposed to PERF’s losses and returns through the

Utility’s 100% equity investment in PERF, and the Utility

was involved in the design of PERF, which was an activity

that was significant to PERF’s economic performance. The

assets of PERF were $897 million at December 31, 2010

and primarily consisted of assets related to energy recovery

bonds (“ERBs”), which are included in other noncurrent

assets – regulatory assets in the Consolidated Balance

Sheets. The liabilities of PERF were $827 million at

December 31, 2010 and consisted of energy recovery

bonds, which are included in current and noncurrent

liabilities in the Consolidated Balance Sheets. (See Note 5

below.) The assets of PERF are only available to settle the

liabilities of PERF.

As of December 31, 2010, PG&E Corporation’s affiliates

had entered into four tax equity agreements with privately

held companies to fund residential and commercial retail

solar energy installations. Under these agreements, PG&E

Corporation will provide payments of up to $300 million

to these companies, and in return, receive the benefits from

local rebates, federal investment tax credits or grants, and a

share of these companies’ customer payments. PG&E

Corporation could be required to pay up to an additional

$41 million in the event that its ownership interests are

liquidated when in a deficit position. However, PG&E

Corporation’s financial exposure from these agreements is

generally limited to its lease payments and investment

contributions to these companies. As of December 31,

2010, PG&E Corporation had made total payments of

$149 million under these agreements, primarily related to

its lease payments and investment contributions to these

companies. These amounts are recorded in other

noncurrent assets – other in PG&E Corporation’s

Consolidated Balance Sheet. PG&E Corporation holds a

variable interest in these companies as a result of these

agreements. When determining whether PG&E

Corporation is the primary beneficiary of these companies,

it evaluated which party has control over their significant

economic activities, such as designing the companies,

vendor selection, construction, customer selection, and

re-marketing activities at the end of customer leases. As

these activities are under the control of these companies,

PG&E Corporation was not the primary beneficiary of, and

did not consolidate, any of these companies at

December 31, 2010.

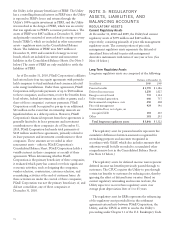

NOTE 3: REGULATORY

ASSETS, LIABILITIES, AND

BALANCING ACCOUNTS

REGULATORY ASSETS

Current Regulatory Assets

At December 31, 2010 and 2009, the Utility had current

regulatory assets of $599 million and $427 million,

respectively, consisting primarily of price risk management

regulatory assets. The current portion of price risk

management regulatory assets represents the deferral of

unrealized losses related to price risk management

derivative instruments with terms of one year or less. (See

Note 10 below.)

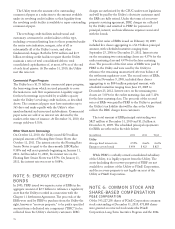

Long-Term Regulatory Assets

Long-term regulatory assets are composed of the following:

Balance at December 31,

(in millions) 2010 2009

Pension benefits $ 1,759 $ 1,386

Deferred income taxes 1,250 1,027

Energy recovery bonds 735 1,124

Utility retained generation 666 737

Environmental compliance costs 450 408

Price risk management 424 346

Unamortized loss, net of gain, on

reacquired debt 181 203

Other 381 291

Total long-term regulatory assets $ 5,846 $ 5,522

The regulatory asset for pension benefits represents the

cumulative differences between amounts recognized for

ratemaking purposes and amounts recognized in

accordance with GAAP, which also includes amounts that

otherwise would be fully recorded to accumulated other

comprehensive loss in the Consolidated Balance Sheets.

(See Note 12 below.)

The regulatory assets for deferred income taxes represent

deferred income tax benefits previously passed through to

customers. The CPUC requires the Utility to pass through

certain tax benefits to customers by reducing rates, thereby

ignoring the effect of deferred taxes on rates. Based on

current regulatory ratemaking and income tax laws, the

Utility expects to recover these regulatory assets over

average plant depreciation lives of 1 to 45 years.

The regulatory asset for ERBs represents the refinancing

of the regulatory asset provided for in the settlement

agreement entered into between PG&E Corporation, the

Utility, and the CPUC in 2003 to resolve the Utility’s

proceeding under Chapter 11 of the U.S. Bankruptcy Code

72