PG&E 2010 Annual Report Download - page 91

Download and view the complete annual report

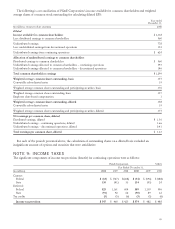

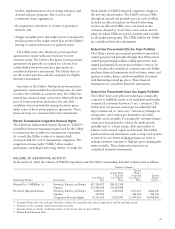

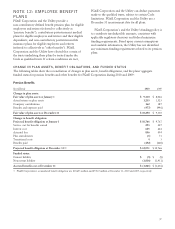

Please find page 91 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The component of unrecognized tax benefits that, if

recognized, would affect the effective tax rate at

December 31, 2010 for PG&E Corporation and the Utility

is $39 million, with the remaining balance representing the

probable deferral of taxes to later years. PG&E Corporation

and the Utility do not expect that the total unrecognized

tax benefits would significantly change within the next 12

months.

PG&E Corporation and the Utility recognize accrued

interest and penalties related to unrecognized tax benefits

as income tax expense in the Consolidated Statements of

Income. Interest income net of penalties recognized in

income tax expense by PG&E Corporation in 2010, 2009,

and 2008 was $3 million, $19 million, and $24 million,

respectively. Interest income net of penalties recognized in

income tax expense by the Utility in 2010, 2009, and 2008

was $3 million, $14 million, and $11 million, respectively.

As of December 31, 2010, PG&E Corporation and the

Utility had accrued interest income of $8 million. As of

December 31, 2009, PG&E Corporation and the Utility

had accrued interest expense and penalties of $11 million

and $12 million, respectively.

Federal subsidy forMedicarePartD

PG&E Corporation and the Utility receive a federal subsidy

for maintaining a retiree medical benefit plan with

prescription drug benefits that is actuarially equivalent to

Medicare Part D. For federal income tax purposes, the

subsidy was deductible when contributed to the benefit

plan maintained for these benefits. On March 30, 2010,

federal health care legislation was signed eliminating the

deduction for subsidy contributions after 2012. As a result,

PG&E Corporation and the Utility recognized an expense

of $19 million in 2010 to reverse previously recognized

federal tax benefits (recorded as an increase to income tax

provision and a reduction to deferred income tax assets for

subsidy amounts included in the calculation of accrued

retiree medical benefit obligation).

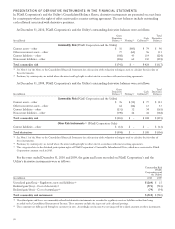

Tax settlements and years that remainsubject to

examination

On September 29, 2010, PG&E Corporation received the

Internal Revenue Service (“IRS”) examination report for the

2005 to 2007 audit years and resolved all matters except for

a few items that will be discussed with the IRS Appeals

office. Included in the 2005 to 2007 audit was the

resolution of the change in accounting method related to

the capitalization of indirect service costs for those years.

As a result, PG&E Corporation recorded a $25 million

reduction to income tax expense during 2010.

In tax year 2008, PG&E Corporation began participating

in the Compliance Assurance Process (“CAP”), a real-time

IRS audit intended to expedite resolution of tax matters.

The CAP audit culminates with a letter from the IRS

indicating their acceptance of the return. The IRS partially

accepted the 2008 return, withholding two issues for

further review. The most significant of these relates to a tax

accounting method change filed by PG&E Corporation to

accelerate the amount of deductible repairs. While the IRS

approved PG&E Corporation’s request for a change in

method, the IRS will audit the methodology to determine

the proper deduction. This audit has not progressed

significantly because the IRS is working with the utility

industry to resolve this matter in a consistent manner for

all utilities before auditing individual companies. On

December 14, 2010 the IRS accepted PG&E Corporation’s

2009 tax return without change.

In 2009, PG&E Corporation recognized an income tax

benefit of $56 million from settling a claim with the IRS

related to 1998 and 1999. Additionally during 2009, PG&E

Corporation recognized $12 million in California benefits,

of which $10 million was attributable to this settlement

and $2 million was attributable to the 2001–2004 IRS

settlement. (The 2001–2004 IRS settlement resulted in a

$154 million tax benefit related to National Energy & Gas

Transmission, Inc. (“NEGT”) and was recorded as

discontinued operations in 2008.) PG&E Corporation

received total cash refunds of $605 million in 2009 related

to these settlements.

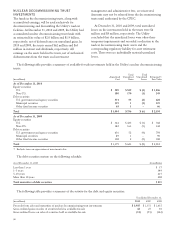

The California Franchise Tax Board is auditing PG&E

Corporation’s 2004 and 2005 combined California income

tax returns, as well as the 1997-2007 amended income tax

returns reflecting IRS settlements for these years and claim

filings that apply only to California. It is uncertain when

the California Franchise Tax Board will complete the

audits.

PG&E Corporation believes that the final resolution of

the federal and California audits will not have a material

adverse impact on its financial condition or results of

operations. PG&E Corporation is neither under audit nor

subject to any material risk in any other jurisdiction.

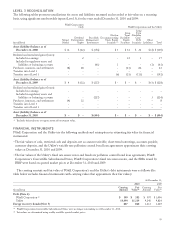

Loss carryforwards

As of December 31, 2010 and 2009, PG&E Corporation

has $24 million and $25 million, respectively, of federal

and California capital loss carry forwards based on filed tax

returns, of which approximately $9 million will expire if

not used by December 31, 2011. For all periods presented,

PG&E Corporation has provided a full valuation allowance

against its deferred income tax assets for capital loss carry

forwards.

87