PG&E 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

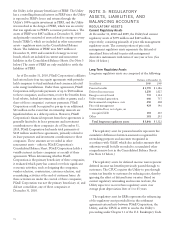

(“Chapter 11 Settlement Agreement”). (See Note 5 below.)

The regulatory asset is amortized over the life of the bonds,

consistent with the period over which the related revenues

and bond-related expenses are recognized. The Utility

expects to fully recover this asset by the end of 2012 when

the ERBs mature.

In connection with the Chapter 11 Settlement

Agreement, the CPUC authorized the Utility to recover

$1.2 billion of costs related to the Utility’s retained

generation assets. The individual components of these

regulatory assets are being amortized over the respective

lives of the underlying generation facilities, consistent with

the period over which the related revenues are recognized.

The weighted average remaining life of the assets is 13

years.

The regulatory assets for environmental compliance

costs represent the portion of estimated environmental

remediation costs that the Utility expects to recover in

future rates as actual remediation costs are incurred. The

Utility expects to recover these costs over the next 32 years.

(See Note 15 below.)

Price risk management regulatory assets represent the

deferral of unrealized losses related to price risk

management derivative instruments with terms in excess of

one year. (See Note 10 below.)

The regulatory assets for unamortized loss, net of gain,

on reacquired debt represent costs related to debt

reacquired or redeemed prior to maturity with associated

discount and debt issuance costs. These costs are expected

to be recovered over the next 16 years, which is the

remaining amortization period of the reacquired debt. The

Utility expects to fully recover these costs by 2026.

At December 31, 2010 and 2009, “other” primarily

consisted of regulatory assets relating to ARO expenses for

decommissioning of the Utility’s fossil-fuel generation

facilities that are probable of future recovery through the

ratemaking process; costs that the Utility incurred in

terminating a 30-year power purchase agreement, which are

being amortized and collected in rates through September

2014; and costs incurred in relation to the Utility’s plan of

reorganization under Chapter 11, which became effective

in April 2004. Additionally, at December 31, 2010, “other”

included removal costs associated with the replacement of

old electromechanical meters with SmartMeter™ devices.

In general, the Utility does not earn a return on

regulatory assets if the related costs do not accrue interest.

Accordingly, the Utility earns a return only on its retained

generation regulatory assets and regulatory assets for

unamortized loss, net of gain, on reacquired debt.

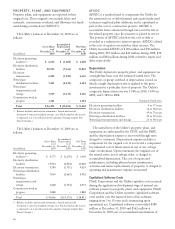

REGULATORY LIABILITIES

Current Regulatory Liabilities

At December 31, 2010 and 2009, the Utility had current

regulatory liabilities of $81 million and $163 million,

respectively, primarily consisting of amounts that the

Utility expects to refund to customers for over-collected

electric transmission rates and amounts that the Utility

expects to refund to electric transmission customers for

their portion of settlements the Utility entered into with

various electricity suppliers to resolve certain remaining

Chapter 11 disputed claims. Current regulatory liabilities

are included in current liabilities – other in the

Consolidated Balance Sheets.

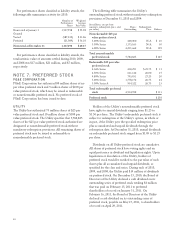

Long-Term Regulatory Liabilities

Long-term regulatory liabilities are composed of the

following:

Balance at December 31,

(in millions) 2010 2009

Cost of removal obligation $ 3,229 $ 2,933

Recoveries in excess of ARO 600 488

Public purpose programs 573 508

Other 123 196

Total long-term regulatory liabilities $ 4,525 $ 4,125

The regulatory liability for the Utility’s cost of removal

obligations represents differences between amounts

collected in rates for asset removal costs and the asset

removal costs recorded in accordance with GAAP.

The regulatory liability for recoveries in excess of ARO

represents differences between amounts collected in rates

for decommissioning the Utility’s nuclear power facilities

and the ARO expenses recorded in accordance with GAAP.

Decommissioning costs recovered in rates are placed in

nuclear decommissioning trusts. The regulatory liability for

recoveries in excess of ARO also represents the deferral of

realized and unrealized gains and losses on those nuclear

decommissioning trust assets.

The regulatory liability for public purpose programs

represents amounts received from customers designated for

public purpose program costs that are expected to be

incurred in the future. The public purpose programs

regulatory liabilities primarily consist of revenues collected

from customers to pay for costs that the Utility expects to

incur in the future under energy efficiency programs

designed to encourage the manufacture, design,

distribution, and customer use of energy efficient

appliances and other energy-using products; under the

California Solar Initiative program to promote the use of

solar energy in residential homes and commercial,

73