PG&E 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

calculation is based on a 95% confidence level, which

means that there is a 5% probability that the impact to

revenues on a pre-tax basis, over the rolling 12-month

forward period, will be at least as large as the reported

value-at-risk. Value-at-risk uses market data to quantify the

Utility’s price exposure. When market data is not

available, the Utility uses historical data or market proxies

to extrapolate the required market data. Value-at-risk as a

measure of portfolio risk has several limitations,

including, but not limited to, inadequate indication of

the exposure to extreme price movements and the use of

historical data or market proxies that may not adequately

capture portfolio risk.

The Utility’s value-at-risk calculated under the

methodology described above was approximately $11

million at December 31, 2010. The Utility’s high, low,

and average values-at-risk during the 12 months ended

December 31, 2010 were approximately $20 million, $10

million, and $14 million, respectively. (See Note 10 of the

Notes to the Consolidated Financial Statements for

further discussion of price risk management activities.)

INTEREST RATE RISK

Interest rate risk sensitivity analysis is used to measure

interest rate risk by computing estimated changes in cash

flows as a result of assumed changes in market interest

rates. At December 31, 2010, if interest rates changed by

1% for all current PG&E Corporation and the Utility

variable rate and short-term debt and investments, the

change would affect net income for the next 12 months

by $6 million, based on net variable rate debt and other

interest rate-sensitive instruments outstanding.

CREDIT RISK

The Utility conducts business with counterparties mainly

in the energy industry, including other California

investor-owned electric utilities, municipal utilities,

energy trading companies, financial institutions, and oil

and natural gas production companies located in the

United States and Canada. If a counterparty fails to

perform on its contractual obligation to deliver electricity

or gas, then the Utility may find it necessary to procure

electricity or gas at current market prices, which may be

higher than the contract prices.

The Utility manages credit risk associated with its

counterparties by assigning credit limits based on

evaluations of their financial conditions, net worth, credit

ratings, and other credit criteria as deemed appropriate.

Credit limits and credit quality are monitored periodically.

The Utility ties many energy contracts to master

commodity enabling agreements that may require security

(referred to as “Credit Collateral” in the table below).

Credit Collateral may be in the form of cash or letters of

credit. The Utility may accept other forms of performance

assurance in the form of corporate guarantees of acceptable

credit quality or other eligible securities (as deemed

appropriate by the Utility). Credit Collateral or

performance assurance may be required from counterparties

when current net receivables and replacement cost exposure

exceed contractually specified limits.

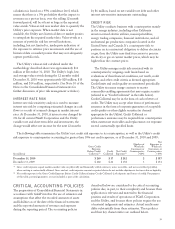

The following table summarizes the Utility’s net credit risk exposure to its counterparties, as well as the Utility’s credit

risk exposure to counterparties accounting for greater than 10% net credit exposure, as of December 31, 2010 and 2009:

(in millions)

Gross Credit

Exposure

Before Credit

Collateral (1)

Credit

Collateral Net Credit

Exposure(2)

Number of

Wholesale

Customers or

Counterparties

>10%

Net

Exposure to

Wholesale

Customers or

Counterparties

>10%

December 31, 2010 $ 269 $ 17 $ 252 2 $ 187

December 31, 2009 $ 202 $ 24 $ 178 3 $ 154

(1) Gross credit exposure equals mark-to-market value on physically and financially settled contracts, notes receivable, and net receivables (payables)

where netting is contractually allowed. Gross and net credit exposure amounts reported above do not include adjustments for time value or liquidity.

(2) Net credit exposure is the Gross Credit Exposure Before Credit Collateral minus Credit Collateral (cash deposits and letters of credit). For purposes

of this table, parental guarantees are not included as part of the calculation.

CRITICAL ACCOUNTING POLICIES

The preparation of Consolidated Financial Statements in

accordance with GAAP involves the use of estimates and

assumptions that affect the recorded amounts of assets

and liabilities as of the date of the financial statements

and the reported amounts of revenues and expenses

during the reporting period. The accounting policies

described below are considered to be critical accounting

policies due, in part, to their complexity and because their

application is relevant and material to the financial

position and results of operations of PG&E Corporation

and the Utility, and because these policies require the use

of material judgments and estimates. Actual results may

differ substantially from these estimates. These policies

and their key characteristics are outlined below.

39