PG&E 2010 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Differences in the amount or timing of forecasted or

authorized costs and actual costs can affect the Utility’s

ability to earn its authorized rate of return and the

amount of PG&E Corporation’s income available for

common shareholders. (See “Capital Expenditures”

below.) To the extent the Utility is unable to conclude

that costs are probable of recovery through rates, the

Utility will incur a charge to income. (See “Critical

Accounting Policies” below.)

•Authorized Capital Structure, Rate of Return,andFinancing.

The Utility’s CPUC-authorized capital structure for its

electric and natural gas distribution and electric

generation rate base, consisting of 52% common equity

and 48% debt and preferred stock, will remain in effect

through 2012. The Utility’s CPUC-authorized ROE of

11.35% will remain in effect through 2011 but is subject

to change based on an annual adjustment mechanism

described below under “Liquidity and Financial

Resources.” The timing and amount of the Utility’s future

debt financing will depend on the timing and amount of

capital expenditures and other factors. PG&E Corporation

contributes equity to the Utility as needed by the Utility

to maintain its CPUC-authorized capital structure. PG&E

Corporation may issue debt or equity to fund these

equity contributions. (See “Liquidity and Financial

Resources” below.)

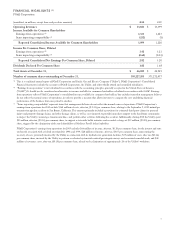

SUMMARY OF CHANGES IN EARNINGS PER

COMMON SHARE AND INCOME AVAILABLE FOR

COMMON SHAREHOLDERS FOR 2010

PG&E Corporation’s income available for common

shareholders decreased by $121 million, or 10%, from

$1,220 million in 2009 to $1,099 million in 2010. The

following table is a summary reconciliation of the key

changes in income available for common shareholders

and earnings per common share for the year ended

December 31, 2010:

Earnings

Earnings Per

Common Share

(Diluted)

Income Available for Common

Shareholders – 2009 $ 1,220 $ 3.20

San Bruno accident (1) (168) (0.43)

Tax refund (2) (66) (0.18)

Statewide ballot initiative (3) (45) (0.12)

Recovery of hydroelectric

generation-related costs (4) (28) (0.07)

Federal health care law (5) (19) (0.05)

Rate base earnings (6) 88 0.23

Accelerated work on gas system (7) 59 0.16

Severance costs (8) 38 0.10

Other (9) 20 0.05

Increase in shares outstanding (10) – (0.07)

Income Available for Common

Shareholders – 2010 $ 1,099 $ 2.82

(1) During 2010, the Utility recorded charges of $168 million, after-tax,

for the San Bruno accident. These charges primarily included a

provision for estimated third-party claims for personal injury and

property damage claims, and other damage claims, as well as costs

incurred to provide immediate support to the San Bruno

community, re-inspect the Utility’s natural gas transmission lines,

and perform other activities following the accident.

(2) During 2009, PG&E Corporation recognized $66 million for the

interest benefit associated with a federal tax refund.

(3) During 2010, the Utility contributed $45 million to support

Proposition 16 – The Taxpayers Right to Vote Act.

(4) During 2009, the Utility recognized income of $28 million, after-tax,

for the recovery of costs previously incurred in connection with its

hydroelectric generation facilities.

(5) During 2010, the Utility recorded a charge of $19 million triggered

by the elimination of the tax deductibility of Medicare Part D federal

subsidies.

(6) During 2010, the Utility recognized earnings of $88 million, after-tax,

attributable to the ROE on higher authorized capital investments.

(7) During 2009, the Utility incurred $59 million, after-tax, for costs to

perform accelerated system-wide natural gas integrity surveys and

associated remedial work.

(8) During 2009, the Utility accrued $38 million, after-tax, of severance

costs related to the elimination of approximately 2% of its workforce.

(9) During 2010, the Utility incurred lower expenses for nuclear refueling

outages, uncollectible customer accounts and disability costs,

partially offset by a charge for SmartMeter™related capital costs and

higher storm and outage expenses.

(10) Represents the impact of a lower number of shares outstanding in

2009 compared to 2010; this has no dollar impact on earnings.

12