PG&E 2010 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

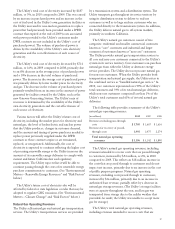

Financing Activities

The Utility’s cash flows from financing activities for 2010,

2009, and 2008 were as follows:

(in millions) 2010 2009 2008

Borrowings under revolving credit

facilities $ 400 $ 300 $ 533

Repayments under revolving credit

facilities (400) (300) (783)

Net issuances of commercial paper,

net of discount of $3 in 2010 and

2009, and $11 in 2008 267 43 6

Proceeds from issuance of short-term

debt, net of issuance costs of $1 in

2010 and 2009 249 499 –

Proceeds from issuance of long-term

debt, net of premium, discount,

and issuance costs of $23 in 2010,

$25 in 2009, and $19 in 2008 1,327 1,384 2,185

Short-term debt matured (500) ––

Long-term debt matured or

repurchased (95) (909) (454)

Energy recovery bonds matured (386) (370) (354)

Preferred stock dividends paid (14) (14) (14)

Common stock dividends paid (716) (624) (568)

Equity contribution 190 718 270

Other (73) (5) (36)

Net cash provided by financing

activities $ 249 $ 722 $ 785

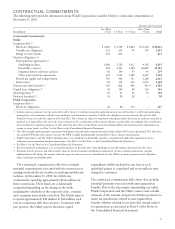

In 2010, net cash provided by financing activities

decreased by $473 million compared to 2009. In 2009, net

cash provided by financing activities decreased by $63

million compared to 2008. Cash provided by or used in

financing activities is driven by the Utility’s financing

needs, which depend on the level of cash provided by or

used in operating activities and the level of cash provided

by or used in investing activities. The Utility generally

utilizes long-term senior unsecured debt issuances and

equity contributions from PG&E Corporation to fund debt

maturities and capital expenditures and to maintain its

CPUC-authorized capital structure, and relies on short-

term debt to fund temporary financing needs.

PG&E CORPORATION

As of December 31, 2010, PG&E Corporation’s affiliates

had entered into four tax equity agreements with two

privately held companies to fund residential and

commercial retail solar energy installations. Under these

agreements, PG&E Corporation will provide payments of

up to $300 million, and in return, receive the benefits of

local rebates, federal investment tax credits or grants, and a

share of these companies’ customer payments. PG&E

Corporation could be required to pay up to an additional

$41 million in the event that its ownership interests are

liquidated when in a deficit position. (See Note 2 of the

Notes to the Consolidated Financial Statements.) However,

PG&E Corporation’s financial exposure for these

arrangements is generally limited to its lease payments and

investment contributions to these companies. As of

December 31, 2010, PG&E Corporation had made total

payments of $149 million under these tax equity

agreements. Lease payments and investment contributions

are included in cash flows from operating and investing

activities, respectively, within the Consolidated Statements

of Cash Flows.

In addition to the investments above, PG&E

Corporation had the following material cash flows on a

stand-alone basis for the years ended December 31, 2010,

2009, and 2008: dividend payments, interest payments,

common stock issuance, the senior note issuance of $350

million in March 2009, net tax refunds of $189 million in

2009, and transactions between PG&E Corporation and the

Utility.

26