PG&E 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

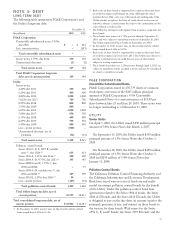

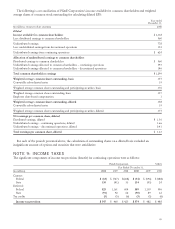

NOTE 8: EARNINGS PER SHARE

PG&E Corporation’s earnings per common share (“EPS”) is calculated utilizing the “two-class” method by dividing the sum of

distributed earnings to common shareholders and undistributed earnings allocated to common shareholders by the weighted

average number of common shares outstanding during the period. In applying the two-class method, undistributed earnings are

allocated to both common shares and participating securities. PG&E Corporation’s Convertible Subordinated Notes met the

criteria of participating securities as the holders were entitled to receive dividends similar to holders of common stock.

As of June 29, 2010, all of PG&E Corporation’s Convertible Subordinated Notes had been converted into common

stock. Therefore, there were no participating securities outstanding at December 31, 2010. (See Note 4 above.)

The following is a reconciliation of PG&E Corporation’s income available for common shareholders and weighted

average shares of common stock outstanding for calculating basic EPS:

Year Ended December 31,

(in millions, except per share amounts) 2010 2009 2008

Basic

Income available for common shareholders $ 1,099 $ 1,220 $ 1,338

Less: distributed earnings to common shareholders 706 621 560

Undistributed earnings 393 599 778

Less: undistributed earnings from discontinued operations –– 154

Undistributed earnings from continuing operations $ 393 $ 599 $ 624

Allocation of undistributed earnings to common shareholders

Distributed earnings to common shareholders $ 706 $ 621 $ 560

Undistributed earnings allocated to common shareholders – continuing operations 385 573 592

Undistributed earnings allocated to common shareholders – discontinued operations –– 146

Total common shareholders earnings $ 1,091 $ 1,194 $ 1,298

Weighted average common shares outstanding, basic 382 368 357

Convertible subordinated notes 817 19

Weighted average common shares outstanding and participating securities 390 385 376

Net earnings per common share, basic

Distributed earnings, basic(1) $ 1.85 $ 1.69 $ 1.57

Undistributed earnings – continuing operations, basic 1.01 1.56 1.66

Undistributed earnings – discontinued operations, basic –– 0.41

Total $ 2.86 $ 3.25 $ 3.64

(1) Distributed earnings, basic may differ from actual per share amounts paid as dividends, as the EPS computation under GAAP requires the use of the

weighted average, rather than the actual, number of shares outstanding.

83