PG&E 2010 Annual Report Download - page 34

Download and view the complete annual report

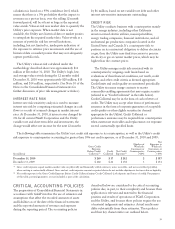

Please find page 34 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$105 million decrease driven by lower depreciation rates

and a $110 million decrease related to lower capital

expenditures and other rate base adjustments. About $49

million of the $110 million reduction is related to the

treatment of nuclear fuel and fuel oil inventory balances.

Under the settlement agreement, the Utility agreed to

continue recovering carrying costs on these balances at

short-term interest rates (estimated to be $1 million per

year based on current rates) through the energy resource

recovery balancing account (“ERRA”), in accordance with

the current regulatory treatment of these costs, rather

than as part of the authorized GRC rate base. Another

$20 million of the reduction relates to costs to implement

the California Independent System Operator’s Market

Redesign and Technology Update (“MRTU”). Consistent

with the settlement agreement, the Utility plans to seek

recovery of MRTU-related costs through the ERRA or

other proceedings.

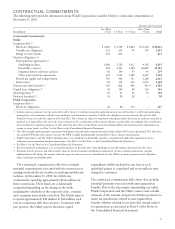

In summary, the settlement agreement proposes revenue

requirements of $3.2 billion for electric distribution (as

compared to $3.5 billion included in the GRC

application), $1.1 billion for natural gas distribution (as

compared to $1.3 billion included in the GRC

application), and $1.7 billion for electric generation

operations (as compared to $1.8 billion included in the

GRC application).

AttritionYearRevenues

The settlement agreement proposes an attrition increase of

$180 million to the authorized 2011 revenues in 2012 and

an additional increase of $185 million in 2013. On a

comparable basis, the Utility had requested an attrition

mechanism estimated to provide increases of

approximately $262 million in 2012 and approximately

$334 million in 2013.

Balancing Accounts

The settlement agreement proposes to establish a new

“one-way” balancing account for the Utility to recover up

to approximately $20 million per year for costs associated

with the Utility’s natural gas distribution integrity

management program. If these costs are not spent during

the GRC period, the unspent funds must be refunded to

customers. However, customers would not be required to

pay for costs in excess of the annual $20 million cost cap.

The proposed decision also would allow the Utility to

remove $113 million in forecast meter reading costs from

the requested GRC revenue requirements. Instead, the

Utility would record actual meter reading costs up to an

annual cap of $76 million in a new “one-way” meter

reading balancing account. With the exception of this

proposed new “one-way” balancing account and the

proposed meter reading balancing account discussed above,

the settlement agreement proposes to retain the existing

balancing account structure without any substantial

changes.

Capital Additionsand Rate Base

The settlement agreement is consistent with capital

expenditures for 2011 through 2013 averaging $2.2 billion

to $2.3 billion per year for the portions of the Utility’s

business addressed in the GRC. Proposed capital

expenditures are lower than the amount included in the

Utility’s GRC application, which averaged $2.7 billion per

year, based on a lower forecast for new customer

connections and lower capital expenditures for

hydroelectric generation facilities, information technology

systems, and fleet replacement. The ultimate amounts of

capital expenditures will depend on a number of factors,

including the level of operations and maintenance,

administrative and general, and other costs.

The settlement agreement proposes a 2011 annual

average rate base of $16.6 billion for the portions of the

Utility’s business reviewed in the GRC compared with the

Utility’s request of $17.2 billion. The $0.6 billion

difference is based on the capital expenditure reductions

described above, the removal of MRTU-related capital

expenditures, the continued funding of nuclear fuel and

fuel oil inventory through the ERRA proceeding rather

than through rate base, and the adjustment of deferred

taxes to reflect the Utility’s updated estimate of the impact

of 2009 bonus depreciation.

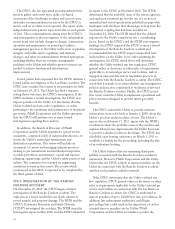

Electric TransmissionOwnerRate Cases

On July 28, 2010, the Utility filed an application with the

FERC requesting an annual retail transmission revenue

requirement of $1.0 billion. The proposed rates represent

an increase of $150 million over current authorized

revenue requirements. On September 30, 2010, the FERC

accepted the Utility’s filing and permitted the proposed

rates to become effective on March 1, 2011, subject to

refund based on a final decision to be issued by the FERC.

Hearings in the case have been halted while the Utility and

other parties engage in settlement negotiations. Any

settlement agreement that the parties may reach will be

subject to the FERC’s approval. If a settlement is not

reached, the FERC will hold hearings and issue a decision

after the conclusion of hearings. The Utility will begin

collecting the proposed rates on March 1, 2011, and record

a reserve for the amount the Utility estimates will be

subject to refund.

30