PG&E 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

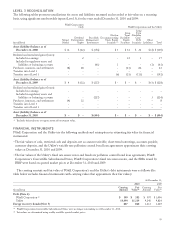

corporate debt instruments. The fund is valued using

pricing models and valuation inputs that are unobservable

and is considered a Level 3 asset.

Other fixed income primarily includes pass-through

and asset-backed securities. Pass-through securities are

valued based on benchmark yields created using

observable market inputs and are Level 2 assets. Asset-

backed securities are primarily valued based on broker

quotes in non-active markets and are considered Level 3

assets. Other fixed income also includes municipal bonds

and futures. Municipal bonds are valued based on a

compilation of primarily observable information or

broker quotes in non-active markets and are considered

Level 2 assets. Futures are valued based on unadjusted

prices in active markets and are Level 1 assets.

Cash Equivalents

Cash equivalents consist primarily of money markets and

commingled funds of short-term securities that are

considered Level 1 assets and valued at the net asset value

of $1 per unit. The number of units held by the plan

fluctuates based on the unadjusted price changes in active

markets for the funds’ underlying assets.

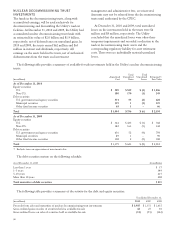

TRANSFERS BETWEEN LEVELS

PG&E Corporation and the Utility recognize any

transfers between levels in the fair value hierarchy as of

the end of the reporting period. There were no significant

transfers between levels for the year ended December 31,

2010.

Level 3 Reconciliation

The following table is a reconciliation of changes in the fair value of instruments for pension and other benefit plans that

have been classified as Level 3 for the years ended December 31, 2010 and 2009:

(in millions) Absolute

Return

Corporate

Fixed

Income

Other

Fixed

Income Total

Pension Benefits:

Balance as of December 31, 2009 $ 340 $ 531 $ 190 $ 1,061

Actual return on plan assets:

Relating to assets still held at the reporting date 44 52 5 101

Relating to assets sold during the period 5 5 5 15

Purchases, sales, and settlements 105 (39) (80) (14)

Transfers into (out of) Level 3 – – – –

Balance as of December 31, 2010 $ 494 $ 549 $ 120 $ 1,163

Other Benefits:

Balance as of December 31, 2009 $ 32 $ 124 $ 17 $ 173

Actual return on plan assets:

Relating to assets still held at the reporting date 4 15 – 19

Relating to assets sold during the period 1 (2) – (1)

Purchases, sales, and settlements 10 (8) (7) (5)

Transfers into (out of) Level 3 – – – –

Balance as of December 31, 2010 $ 47 $ 129 $ 10 $ 186

103