PG&E 2010 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REGULATORY MATTERS

The Utility is subject to substantial regulation. Set forth

below are matters pending before the CPUC, FERC, and

the NRC. The resolutions of these and other proceedings

may affect PG&E Corporation’s and the Utility’s results of

operations or financial condition.

2011 GENERAL RATE CASE APPLICATION

On October 15, 2010, the Utility, together with the CPUC’s

Division of Ratepayer Advocates (“DRA”), The Utility

Reform Network (“TURN”), Aglet Consumer Alliance, and

nearly all other intervening parties, filed a motion with the

CPUC seeking approval of a settlement agreement to resolve

almost all of the issues raised by the parties in the Utility’s

2011 GRC. Although the CPUC has not yet issued a final

decision in the GRC proceeding, on November 19, 2010, the

CPUC authorized the revenues to be approved in the

CPUC’s final decision to become effective as of January 1,

2011. PG&E Corporation and the Utility are unable to predict

whether the CPUC will approve the settlement agreement.

Revenue Requirements

The settlement agreement proposes that the Utility’s total

2011 revenue requirements be increased by $395 million,

including $103 million related to depreciation rate changes.

In addition, the settlement agreement proposes to

(1) establish a new balancing account for meter reading

costs outside of the GRC that offsets $113 million

requested in the GRC application and (2) remove $30

million of requested revenue requirements from the GRC

for consideration in other ratemaking proceedings.

Furthermore, approximately $44 million of the revenue

requirement the Utility requested in the GRC application

remains subject to litigation in the GRC.

The following table shows the differences, based on cost

category, between the revenue requirements requested in

the GRC application and the amount proposed in the

settlement agreement:

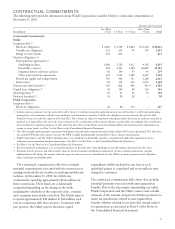

(in millions)

Amounts

Requested

in the GRC

Application

Amounts

Proposed

in the

Settlement

Agreement Difference

Operations and maintenance $ 1,437 $ 1,308 $ (129)

Customer services 498 329 (169)

Administrative and general 857 768 (89)

Less: Revenue credits (151) (149) 2

Franchise fees and uncollectible

customer accounts, taxes

(other than income taxes),

and other adjustments 188 120 (68)

Depreciation, return, and

income taxes 3,817 3,601 (216)

Total Revenue

Requirements $ 6,646 $ 5,977 $ (669)

The following paragraphs describe the revenue

requirement reductions proposed in the settlement

agreement compared to the amounts requested in the GRC

application:

• The $129 million reduction in revenue requirements for

operations and maintenance costs reflects a lower forecast

of costs for, among other items, customer assistance

services related to new customer connections, vegetation

management, and development of utility-owned

renewable generation.

• The $169 million reduction in revenue requirements for

customer services costs reflects the reduction of costs

related to such items as customer retention and economic

development efforts, dynamic pricing, and meter reading.

While the Utility’s GRC application requested recovery

of $113 million for meter reading costs in 2011, the

settlement agreement proposes that these costs will

instead be recovered via a new balancing account. The

balancing account would track and recover incurred

meter reading costs, subject to a cap of $76 million, and

the Utility also would retain the cost savings attributable

to decreased meter reading costs due to the installation of

SmartMeter™devices. The total of the balancing account

recovery plus retained cost savings is estimated to

approximate the $113 million originally requested.

• The $89 million reduction in administrative and general

costs reflects lower funding for various PG&E

Corporation and Utility corporate service functions and

lower funding for employee incentive compensation. The

Utility also agreed to seek recovery of $5 million of costs

incurred in connection with the sale of property in

another proceeding rather than the GRC.

• The $68 million reduction in revenue requirements

relating to franchise fees and uncollectible customer

accounts, taxes (other than income), and other

adjustments includes $44 million related to return and

income taxes on the Utility’s unrecovered investment in

conventional electric meters that have been replaced by

SmartMeter™devices. The parties have agreed that this

part of the Utility’s request will be litigated as part of the

GRC proceeding. If the Utility is successful, the $44

million will be added back to the Utility’s 2011 electric

distribution revenue requirement. The settlement

agreement also would adopt a higher uncollectible

revenue factor that would be used in another CPUC

proceeding to determine the amount of revenue the

Utility can collect to offset uncollectible customer

accounts. This is expected to result in additional revenues

of approximately $4 million.

• The $216 million reduction in revenue requirements for

depreciation, return, and income taxes consists of a

29