PG&E 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

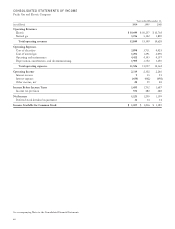

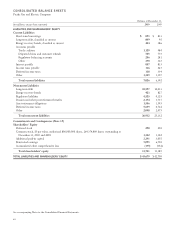

CONSOLIDATED STATEMENTS OF CASH FLOWS

Pacific Gas and Electric Company

Year ended December 31,

(in millions) 2010 2009 2008

Cash Flows from Operating Activities

Net income $ 1,121 $ 1,250 $ 1,199

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation, amortization, and decommissioning 2,116 1,927 1,838

Allowance for equity funds used during construction (110) (94) (70)

Deferred income taxes and tax credits, net 762 787 593

Other 46 (27) (6)

Effect of changes in operating assets and liabilities:

Accounts receivable (105) 157 (83)

Inventories (43) 109 (59)

Accounts payable 109 (33) (137)

Disputed claims and customer refunds – (700) –

Income taxes receivable/payable (58) 21 43

Other current assets (7) 122 (187)

Other current liabilities 130 183 60

Regulatory assets, liabilities, and balancing accounts, net (394) (516) (374)

Other changes in noncurrent assets and liabilities (331) (282) (51)

Net cash provided by operating activities 3,236 2,904 2,766

Cash Flows from Investing Activities

Capital expenditures (3,802) (3,958) (3,628)

Decrease in restricted cash 66 666 36

Proceeds from sales and maturities of nuclear decommissioning trust investments 1,405 1,351 1,635

Purchases of nuclear decommissioning trust investments (1,456) (1,414) (1,684)

Other 19 11 1

Net cash used in investing activities (3,768) (3,344) (3,640)

Cash Flows from Financing Activities

Borrowings under revolving credit facilities 400 300 533

Repayments under revolving credit facilities (400) (300) (783)

Net issuances of commercial paper, net of discount of $3 in 2010 and 2009, and $11 in 2008 267 43 6

Proceeds from issuance of short-term debt, net of issuance costs of $1 in 2010 and 2009 249 499 –

Proceeds from issuance of long-term debt, net of premium, discount, and issuance costs of $23 in

2010, $25 in 2009, and $19 in 2008 1,327 1,384 2,185

Short-term debt matured (500) ––

Long-term debt matured or repurchased (95) (909) (454)

Energy recovery bonds matured (386) (370) (354)

Preferred stock dividends paid (14) (14) (14)

Common stock dividends paid (716) (624) (568)

Equity contribution 190 718 270

Other (73) (5) (36)

Net cash provided by financing activities 249 722 785

Net change in cash and cash equivalents (283) 282 (89)

Cash and cash equivalents at January 1 334 52 141

Cash and cash equivalents at December 31 $ 51 $ 334 $ 52

Supplemental disclosures of cash flow information

Cash received (paid) for:

Interest, net of amounts capitalized $ (595) $ (578) $ (496)

Income taxes, net (171) 170 95

Supplemental disclosures of noncash investing and financing activities

Capital expenditures financed through accounts payable $ 364 $ 273 $ 348

See accompanying Notes to the Consolidated Financial Statements.

63