PG&E 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

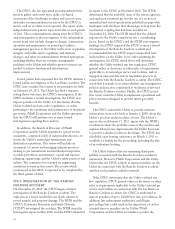

The following reflects the sensitivity of pension costs

and projected benefit obligation to changes in certain

actuarial assumptions:

(in millions)

Increase

(Decrease) in

Assumption

Increase

in 2010

Pension

Costs

Increase in

Projected

Benefit

Obligation at

December 31,

2010

Discount rate (0.5)% $ 78 $ 872

Rate of return on plan

assets (0.5)% 46 –

Rate of increase in

compensation 0.5% 36 206

The following reflects the sensitivity of other

postretirement benefit costs and accumulated benefit

obligation to changes in certain actuarial assumptions:

(in millions)

Increase

(Decrease) in

Assumption

Increase

in 2010

Other

Postretirement

Benefit Costs

Increase in

Accumulated

Benefit

Obligation at

December 31,

2010

Health care cost

trend rate 0.5 % $ 4 $ 41

Discount rate (0.5)% 2 103

Rate of return on

plan assets (0.5)% 6 –

RISK FACTORS

RISKS RELATED TO PG&E CORPORATION

As a holding company, PG&E Corporationdepends oncash

distributionsandreimbursements from the Utility to meet its

debt service and otherfinancial obligationsand to pay

dividends onits commonstock.

PG&E Corporation is a holding company with no revenue

generating operations of its own. PG&E Corporation’s

ability to pay interest on its outstanding debt, the principal

at maturity, pay dividends on its common stock, as well as

satisfy its other financial obligations, primarily depends on

the earnings and cash flows of the Utility and the ability of

the Utility to distribute cash to PG&E Corporation (in the

form of dividends and share repurchases) and reimburse

PG&E Corporation for the Utility’s share of applicable

expenses. Before it can distribute cash to PG&E

Corporation, the Utility must use its resources to satisfy its

own obligations, including its obligation to serve customers,

to pay principal and interest on outstanding debt, to pay

preferred stock dividends, and to meet its obligations to

employees and creditors. If the Utility is not able to make

distributions to PG&E Corporation or to reimburse PG&E

Corporation, PG&E Corporation’s ability to meet its own

obligations could be impaired and its ability to pay

dividends could be restricted.

PG&E Corporationcould be required to contribute

capital to the Utility orbe denied distributionsfrom the

Utility to the extentrequired by the CPUC’s

determinationof the Utility’s financial condition.

The CPUC imposed certain conditions when it approved

the original formation of a holding company for the

Utility, including an obligation by PG&E Corporation’s

Board of Directors to give “first priority” to the capital

requirements of the Utility, as determined to be necessary

and prudent to meet the Utility’s obligation to serve or to

operate the Utility in a prudent and efficient manner. The

CPUC later issued decisions adopting an expansive

interpretation of PG&E Corporation’s obligations under

this condition, including the requirement that PG&E

Corporation “infuse the Utility with all types of capital

necessary for the Utility to fulfill its obligation to serve.”

The CPUC’s interpretation of PG&E Corporation’s

obligation under the first priority condition could require

PG&E Corporation to infuse the Utility with significant

capital in the future or could prevent distributions from the

Utility to PG&E Corporation, either of which could

materially restrict PG&E Corporation’s ability to pay

principal and interest on its outstanding debt or pay or

increase its common stock dividend, meet other

obligations, or execute its business strategy.

RISKS RELATED TO PG&E CORPORATION AND

THE UTILITY

The ultimate amount of loss the Utility bearsinconnection

with the SanBruno accident could have a material adverse

impact onPG&E Corporation’s and the Utility’s financial

conditionandresults of operations.

PG&E Corporation and the Utility recorded a provision of

$220 million in 2010 for estimated third-party claims

related to the San Bruno accident, including personal injury

and property damage claims, damage to infrastructure, and

other damage claims. Various lawsuits have been filed by

residents of San Bruno against PG&E Corporation and the

Utility seeking to recover compensation for personal injury

and property damage and seeking other relief. Both the

NTSB and the CPUC are investigating the San Bruno

accident, but the cause has not yet been determined. The

CPUC has also appointed an independent review panel to

gather facts and make a technical assessment of the San

Bruno accident and its root cause. The Utility estimates

that it may incur as much as $400 million for third-party

claims depending on the final outcome of the NTSB and

CPUC investigations and the number and nature of third-

party claims. Management’s estimates and assumptions

regarding the financial impact of the San Bruno accident

may change as more information becomes known,

including information resulting from the investigations by

the NTSB and the CPUC.

43