PG&E 2010 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

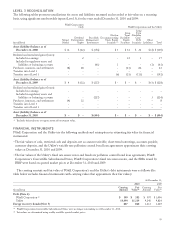

PG&E Corporation and the Utility apply a risk management framework for managing the risks associated with

employee benefit plan trust assets. The guiding principles of this risk management framework are the clear articulation of

roles and responsibilities, appropriate delegation of authority, and proper accountability and documentation. Trust

investment policies and investment manager guidelines include provisions to ensure prudent diversification, manage risk

through appropriate use of physical direct asset holdings and derivative securities, and identify permitted and prohibited

investments.

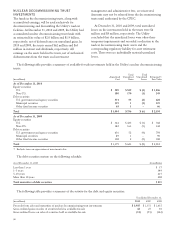

The target asset allocation percentages for major categories of trust assets for pension and other benefit plans at

December 31, 2011, 2010, and 2009 are as follows:

Pension Benefits Other Benefits

2011 2010 2009 2011 2010 2009

U.S. Equity 26% 26% 32% 28% 26% 37%

Non-U.S. Equity 14% 14% 18% 15% 13% 18%

Global Equity 5% 5% 5% 3% 3% 3%

Absolute Return 5% 5% 5% 4% 3% 3%

Fixed Income 50% 50% 40% 50% 54% 34%

Cash Equivalents –% –% –% –% 1% 5%

Total 100% 100% 100% 100% 100% 100%

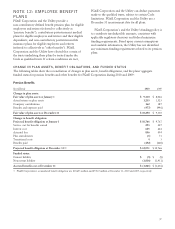

FAIR VALUE MEASUREMENTS

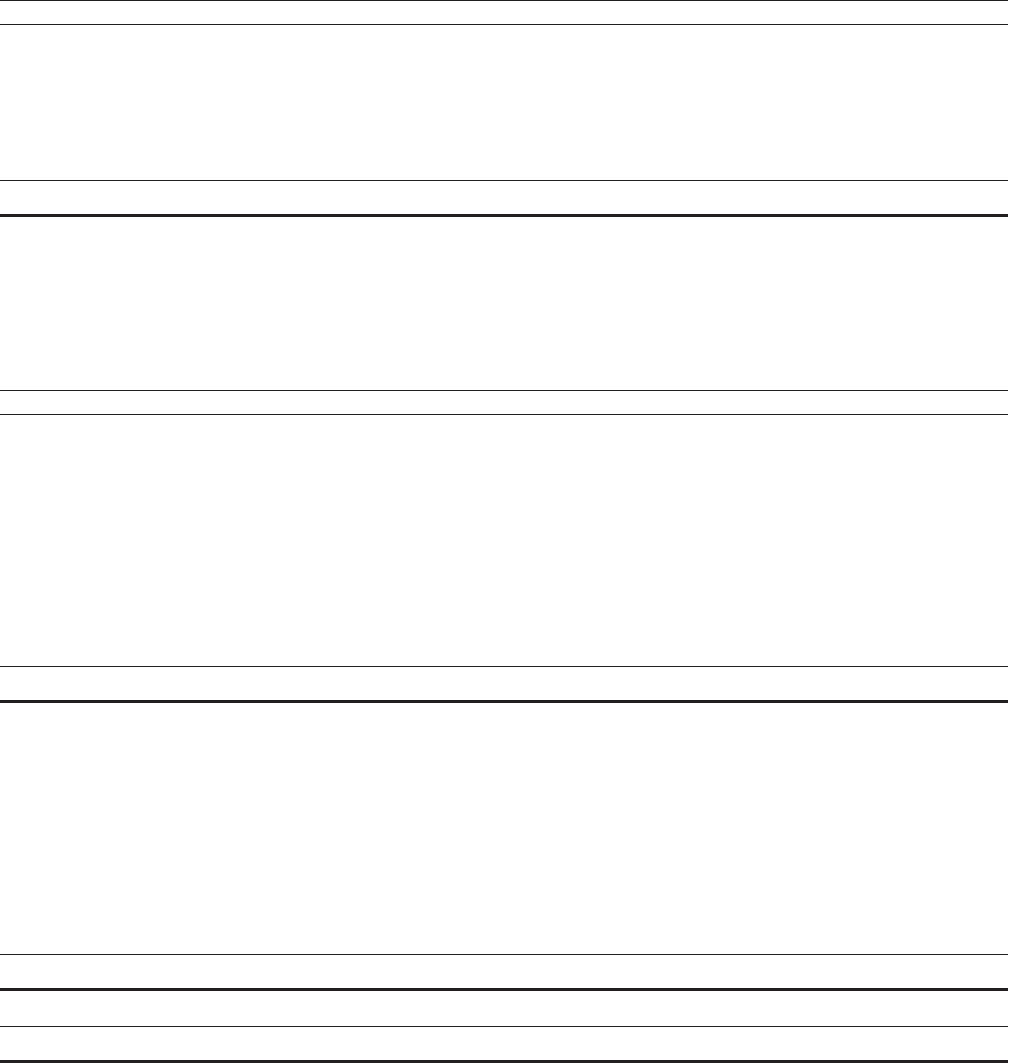

The following tables present the fair value of plan assets for pension and other benefit plans by major asset category at

December 31, 2010 and 2009.

Fair Value Measurements as of December 31, 2010

(in millions) Level 1 Level 2 Level 3 Total

Pension Benefits:

U.S. Equity $ 328 $ 2,482 $ – $ 2,810

Non-U.S. Equity 356 1,111 – 1,467

Global Equity 177 360 – 537

Absolute Return – – 494 494

Fixed Income:

U.S. Government 790 233 – 1,023

Corporate 6 2,724 549 3,279

Other 52 393 120 565

Cash Equivalents 20 – – 20

Total $ 1,729 $ 7,303 $ 1,163 $ 10,195

Other Benefits:

U.S. Equity $ 104 $ 230 $ – $ 334

Non-U.S. Equity 118 80 – 198

Global Equity 18 29 – 47

Absolute Return – – 47 47

Fixed Income:

U.S. Government 73 14 – 87

Corporate 8 457 129 594

Other 32110 34

Cash Equivalents 13 – – 13

Total $ 337 $ 831 $ 186 $ 1,354

Other Assets 38

Total Plan Assets at Fair Value $ 11,587

101