PG&E 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

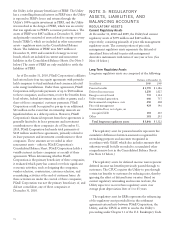

CREDIT FACILITIES AND SHORT-TERM BORROWINGS

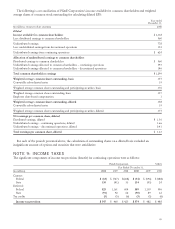

The following table summarizes PG&E Corporation’s and the Utility’s borrowings on outstanding credit facilities at

December 31, 2010:

(in millions) Termination

Date Facility

Limit

Letters

of Credit

Outstanding Cash

Borrowings

Commercial

Paper

Backup Availability

PG&E Corporation February 2012 $ 187 (1) $ – $ – N/A $ 187

Utility February 2012 1,940 (2) 329 – $ 603 1,008

Utility February 2012 750 (3) N/A – – 750

Total credit facilities $ 2,877 $ 329 $ – $ 603 $ 1,945

(1) Includes a $87 million sublimit for letters of credit and a $100 million commitment for “swingline” loans, defined as loans that are made available

on a same-day basis and are repayable in full within 30 days.

(2) Includes a $921 million sublimit for letters of credit and a $200 million commitment for swingline loans.

(3) Includes a $75 million commitment for swingline loans.

PG&E CORPORATION

Revolvingcredit facility

PG&E Corporation has a $187 million revolving credit

facility with a syndicate of lenders that expires on

February 26, 2012. Borrowings under the revolving credit

facility and letters of credit may be used for working

capital and other corporate purposes. PG&E Corporation

can, at any time, repay amounts outstanding in whole or

in part. At PG&E Corporation’s request and at the sole

discretion of each lender, the revolving credit facility may

be extended for additional periods. PG&E Corporation

has the right to increase, in one or more requests given no

more than once a year, the aggregate facility by up to

$100 million, provided that certain conditions are met.

The fees and interest rates that PG&E Corporation pays

under the revolving credit facility vary depending on the

Utility’s unsecured debt ratings issued by Standard &

Poor’s (“S&P”) ratings service and Moody’s Investors

Service (“Moody’s”).

The revolving credit facility includes usual and

customary covenants for credit facilities of this type,

including covenants limiting liens, mergers, sales of all or

substantially all of PG&E Corporation’s assets, and other

fundamental changes. In general, the covenants,

representations, and events of default mirror those in the

Utility’s revolving credit facility, discussed below. In

addition, the revolving credit facility requires that PG&E

Corporation maintain a ratio of total consolidated debt to

total consolidated capitalization of at most 65% and that

PG&E Corporation own, directly or indirectly, at least

80% of the common stock and at least 70% of the voting

securities of the Utility. At December 31, 2010, PG&E

Corporation met both of these tests.

UTILITY

Revolvingcredit facilities

The Utility has a $1.9 billion revolving credit facility with

a syndicate of lenders that expires on February 26, 2012.

Borrowings under the revolving credit facility and letters

of credit are used primarily for liquidity and to provide

credit enhancements to counterparties for natural gas and

energy procurement transactions.

On June 8, 2010, the Utility entered into a $750

million unsecured revolving credit agreement with a

syndicate of lenders. Of the total credit capacity, $500

million was used to replace the $500 million Floating

Rate Senior Notes that matured on June 10, 2010. The

aggregate facility of $750 million includes a $75 million

commitment for swingline loans, or loans that are made

available on a same-day basis and are repayable in full

within 30 days. The Utility can, at any time, repay

amounts outstanding in whole or in part. The credit

agreement expires on February 26, 2012, unless extended

for additional periods at the Utility’s request and at the

sole discretion of each lender.

Borrowings under the credit agreement (other than

swingline loans) will bear interest based, at the Utility’s

election, at (1) London Interbank Offered Rate (“LIBOR”)

plus an applicable margin or (2) the base rate, which will

equal the higher of the (i) administrative agent’s

announced base rate, (ii) 0.5% above the federal funds

rate, or (iii) the one-month LIBOR plus an applicable

margin. Interest is payable quarterly in arrears, or earlier

for loans with shorter interest periods. The Utility also

will pay a facility fee on the total commitments of the

lenders under the credit agreement. The applicable

margin for LIBOR loans and the facility fee will be based

on the Utility’s senior unsecured, non-credit enhanced

debt ratings issued by S&P and Moody’s. Facility fees are

payable quarterly in arrears.

77