PG&E 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FAIR VALUE MEASUREMENTS

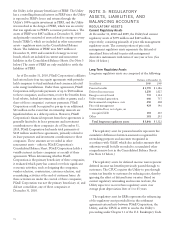

PG&E Corporation and the Utility determine the fair value

of certain assets and liabilities based on assumptions that

market participants would use in pricing the assets or

liabilities. Fair value is defined as the price that would be

received to sell an asset or paid to transfer a liability in an

orderly transaction between market participants at the

measurement date, or the “exit price.” PG&E Corporation

and the Utility utilize a fair value hierarchy that prioritizes

the inputs to valuation techniques used to measure fair

value and give precedence to observable inputs in

determining fair value. An instrument’s level within the

hierarchy is based on the lowest level of any significant

input to the fair value measurement. The hierarchy gives

the highest priority to unadjusted quoted prices in active

markets for identical assets or liabilities (Level 1

measurements) and the lowest priority to unobservable

inputs (Level 3 measurements). (See Note 11 below.)

ADOPTION OF NEW ACCOUNTING

PRONOUNCEMENTS

Improvements to Financial ReportingbyEnterprises

Involved with Variable Interest Entities

On January 1, 2010, PG&E Corporation and the Utility

adopted an accounting standards update that changes when

and how to determine, or re-determine, whether an entity

is a variable interest entity (“VIE”), which could require

consolidation. In addition, the accounting standards

update replaces the quantitative approach for determining

who has a controlling financial interest in a VIE with a

qualitative approach and requires ongoing assessments of

whether an entity is the primary beneficiary of a VIE. The

adoption of the accounting standards update did not have

a material impact on PG&E Corporation’s or the Utility’s

Consolidated Financial Statements.

PG&E Corporation and the Utility are required to

consolidate any entities that they control. In most cases,

control can be determined based on majority ownership or

voting interests. However, for certain entities, control is

difficult to discern based on ownership or voting interests

alone. These entities are referred to as VIEs. A VIE is an

entity that does not have sufficient equity at risk to finance

its activities without additional subordinated financial

support from other parties, or whose equity investors lack

any characteristics of a controlling financial interest. An

enterprise has a controlling financial interest if it has the

obligation to absorb expected losses or receive expected

gains that could potentially be significant to a VIE and the

power to direct the activities that are most significant to a

VIE’s economic performance. An enterprise that has a

controlling financial interest is known as the VIE’s primary

beneficiary and is required to consolidate the VIE.

Some of the counterparties to the Utility’s power

purchase agreements are considered VIEs. In determining

whether the Utility has a controlling financial interest in a

VIE, the Utility must first assess whether it absorbs any of

the VIE’s expected losses or receives any portion of the

VIE’s expected residual returns, as a result of power

purchase agreements. This assessment includes an

evaluation of how the risks and rewards associated with the

power plant’s activities are absorbed by variable interest

holders. These VIEs are typically exposed to credit risk,

production risk, commodity price risk, and any applicable

tax incentive risks, among others. The Utility analyzes the

variability in the VIE’s gross margin and the impact of

power purchase agreements on the gross margin to

determine whether the Utility absorbs variability, resulting

in a variable interest. Factors that may be considered when

assessing the impact of a power purchase agreement on the

VIE’s gross margin include the pricing structure of the

power purchase agreement and the cost of inputs and

production, which depend on the technology of the power

plant.

For each variable interest, the Utility must also assess

whether it has the power to direct the activities of the

power plant that most directly impact the VIE’s economic

performance. This assessment considers any decision-

making rights associated with designing the VIE, any

dispatch rights, any operating and maintenance activities,

and any re-marketing activities of the power plant after the

end of the power purchase agreement with the Utility.

The Utility held a variable interest in several entities that

own power plants that generate electricity for sale to the

Utility under power purchase agreements. Each of these

VIEs was designed to own a power plant that would

generate electricity for sale to the Utility utilizing various

technologies such as natural gas, wind, solar photovoltaic,

solar thermal, and hydroelectric. Under each of these

power purchase agreements, the Utility is obligated to

purchase electricity or capacity, or both, from the VIE. The

Utility did not provide any other support to these VIEs,

and the Utility’s financial exposure is limited to the

amount it pays for delivered electricity and capacity. (See

Note 15 below.) The Utility does not have the power to

direct the activities that are most significant to these VIE’s

economic performance. As a result, the Utility does not

have a controlling financial interest in any of these VIEs.

Therefore, at December 31, 2010, the Utility was not the

primary beneficiary of, and did not consolidate, any of

these VIEs.

The Utility continued to consolidate PG&E Energy

Recovery Funding LLC (“PERF”) at December 31, 2010, as

71