PG&E 2010 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

reflects the Utility’s payment to the California Power

Exchange (“PX”) in 2009, partially offset by net tax refunds

that the Utility received in 2009 that were higher than the

amount received in 2010. (The Utility’s payment to the PX

decreased the Utility’s liability for the remaining net

disputed claims that had been made in the Utility’s

Chapter 11 proceeding. See Note 13 of the Notes to the

Consolidated Financial Statements.) The remaining

changes in cash flows from operating activities consisted of

fluctuations in activities within the normal course of

business such as collateral, power purchases, and customer

billings.

During 2009, net cash provided by operating activities

increased $138 million compared to 2008. This increase

reflects significantly lower commodity market prices in

2009 compared to 2008, which resulted in fewer cash

outflows related to the timing of inventory and

procurement activities. These net inflows were partially

offset by the payment to the PX.

On December 17, 2010, the Tax Relief Act was signed

into law, allowing qualified property placed into service

after September 8, 2010, and before January 1, 2012, to be

eligible for 100% bonus depreciation for tax purposes and

qualified property placed into service in 2012 to be eligible

for 50% bonus depreciation for tax purposes. (See Note 9

of the Notes to the Consolidated Financial Statements.) As

a result, the Utility expects to make no federal tax payment

in 2011. A reduction in the 2012 federal tax payment is

expected; however, the amount cannot be reasonably

estimated at this time. (See “Regulatory Matters – CPUC

Resolution Regarding the Tax Relief Act” below.)

Additionally, there is uncertainty around the timing and

amount of payments to be made to third parties in

connection with the San Bruno accident, the timing and

amount of related insurance recoveries, any penalties that

may be assessed, costs associated with related

investigations, and costs associated with changes to

pipeline management and operations.

Investing Activities

The Utility’s investing activities consist of construction of

new and replacement facilities necessary to deliver safe and

reliable electricity and natural gas services to its customers.

Cash used in investing activities depends primarily upon

the amount and timing of the Utility’s capital expenditures,

which can be affected by many factors, including the

timing of regulatory approvals and the occurrence of

storms and other events causing outages or damages to the

Utility’s infrastructure. Cash used in investing activities

also includes the proceeds from sales of nuclear

decommissioning trust investments, largely offset by the

amount of cash used to purchase new nuclear

decommissioning trust investments. (See Note 11 of the

Notes to the Consolidated Financial Statements.)

The Utility’s cash flows from investing activities for

2010, 2009, and 2008 were as follows:

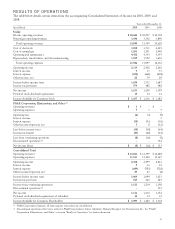

(in millions) 2010 2009 2008

Capital expenditures $ (3,802) $ (3,958) $ (3,628)

Decrease in restricted cash 66 666 36

Proceeds from sales and

maturities of nuclear

decommissioning trust

investments 1,405 1,351 1,635

Purchases of nuclear

decommissioning trust

investments (1,456) (1,414) (1,684)

Other 19 11 1

Net cash used in investing

activities $ (3,768) $ (3,344) $ (3,640)

Net cash used in investing activities increased by $424

million in 2010 compared to 2009, primarily due to the

Utility’s $700 million payment to the PX, which decreased

the restricted cash balance in 2009. (See Note 13 of the

Notes to the Consolidated Financial Statements.) This

increase was partially offset by a decrease in capital

expenditures of $156 million as compared to 2009. Capital

expenditures decreased in 2010 due to permitting delays,

the postponement of purchases of materials that would

otherwise have been capitalized earlier in the year, and

poor weather conditions in the first half of 2010, which

delayed construction activities as resources were re-directed

to emergency response activities.

Net cash used in investing decreased by $296 million in

2009 compared to 2008, primarily due to a $700 million

decrease in the restricted cash balance that resulted from

the Utility’s payment to the PX, partially offset by an

increase of $330 million in capital expenditures. The

increase in capital expenditures in 2009 compared to 2008

was due to the increase in installation of the SmartMeter™

advanced metering infrastructure, generation facility

spending, replacing and expanding gas and electric

distribution systems, and improving the electric

transmission infrastructure. (See “Capital Expenditures”

below.)

Future cash flows used in investing activities are largely

dependent on the timing and amount of capital

expenditures. (See “Capital Expenditures” below for further

discussion of expected spending and significant capital

projects.)

25