PG&E 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

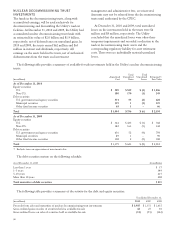

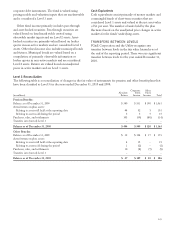

NUCLEAR DECOMMISSIONING TRUST

INVESTMENTS

The funds in the decommissioning trusts, along with

accumulated earnings, will be used exclusively for

decommissioning and dismantling the Utility’s nuclear

facilities. At December 31, 2010 and 2009, the Utility had

accumulated nuclear decommissioning trust funds with

an estimated fair value of $2.0 billion and $1.9 billion,

respectively, net of deferred taxes on unrealized gains. In

2010 and 2009, the trusts earned $62 million and $63

million in interest and dividends, respectively. All

earnings on the assets held in the trusts, net of authorized

disbursements from the trusts and investment

management and administrative fees, are reinvested.

Amounts may not be released from the decommissioning

trusts until authorized by the CPUC.

At December 31, 2010 and 2009, total unrealized

losses on the investments held in the trusts were $6

million and $8 million, respectively. The Utility

concluded that the unrealized losses were other-than-

temporary impairments and recorded a reduction to the

nuclear decommissioning trusts assets and the

corresponding regulatory liability for asset retirement

costs. There were no individually material unrealized

losses.

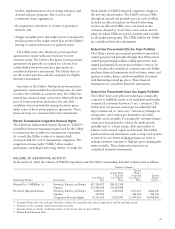

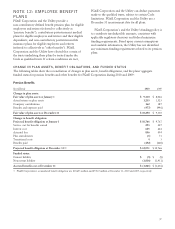

The following table provides a summary of available-for-sale investments held in the Utility’s nuclear decommissioning

trusts:

(in millions) Amortized

Cost

Total

Unrealized

Gains

Total

Unrealized

Losses Estimated (1)

Fair Value

As of December 31, 2010

Equity securities

U.S. $ 509 $ 529 $ (2) $ 1,036

Non-U.S. 180 170 (1) 349

Debt securities

U.S. government and agency securities 571 55 (2) 624

Municipal securities 119 1 (1) 119

Other fixed income securities 65 1 – 66

Total $ 1,444 $ 756 $ (6) $ 2,194

As of December 31, 2009

Equity securities

U.S. $ 344 $ 425 $ (1) $ 768

Non-U.S. 182 163 (1) 344

Debt securities

U.S. government and agency securities 656 52 (4) 704

Municipal securities 89 1 – 90

Other fixed income securities 108 2 (2) 108

Total $ 1,379 $ 643 $ (8) $ 2,014

(1) Excludes taxes on appreciation of investment value.

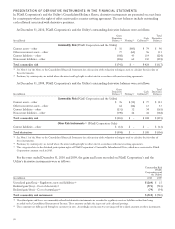

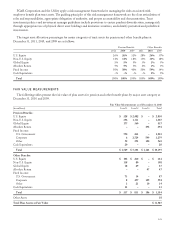

The debt securities mature on the following schedule:

As of December 31, 2010 (in millions)

Less than 1 year $37

1–5 years 349

5–10 years 215

More than 10 years 208

Total maturities of debt securities $ 809

The following table provides a summary of the activity for the debt and equity securities:

Year Ended December 31,

(in millions) 2010 2009 2008

Proceeds from sales and maturities of nuclear decommissioning trust investments $ 1,405 $ 1,351 $ 1,635

Gross realized gains on sales of securities held as available-for-sale 42 27 30

Gross realized losses on sales of securities held as available-for-sale (11) (55) (142)

96