PG&E 2010 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

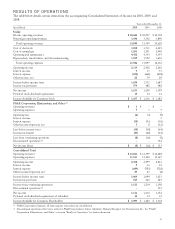

The following table summarizes PG&E Corporation’s

and the Utility’s cash positions:

December 31,

(in millions) 2010 2009

PG&E Corporation $ 240 $ 193

Utility 51 334

Total consolidated cash and cash equivalents 291 527

Utility restricted cash 563 633

$ 854 $ 1,160

Restricted cash primarily consists of cash held in

escrow pending the resolution of the remaining disputed

claims filed in the Utility’s reorganization proceeding

under Chapter 11. PG&E Corporation and the Utility

maintain separate bank accounts and primarily invest

their cash in money market funds.

Credit Facilities

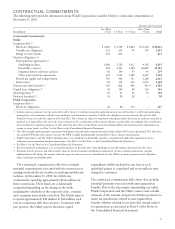

The following table summarizes PG&E Corporation’s and the Utility’s revolving credit facilities at December 31, 2010:

(in millions) Termination Date Facility

Limit

Letters

of Credit

Outstanding Cash

Borrowings

Commercial

Paper

Backup Availability

PG&E Corporation February 2012 $ 187 (1) $ – $ – N/A $ 187

Utility February 2012 1,940 (2) 329 – $ 603 1,008

Utility February 2012 750 (3) N/A – – 750

Total credit facilities $ 2,877 $ 329 $ – $ 603 $ 1,945

(1) Includes an $87 million sublimit for letters of credit and a $100 million commitment for “swingline” loans, defined as loans that are made available

on a same-day basis and are repayable in full within 30 days.

(2) Includes a $921 million sublimit for letters of credit and a $200 million commitment for swingline loans.

(3) Includes a $75 million commitment for swingline loans.

For the year ended December 31, 2010, the average

outstanding cash borrowings and commercial paper

balance were $33 million and $655 million, respectively.

PG&E Corporation’s and the Utility’s credit

agreements contain covenants that are usual and

customary for credit facilities of this type, including

covenants limiting liens, mergers, substantial asset sales,

and other fundamental changes. Both the $750 million

and the $1.9 billion revolving credit facilities require that

the Utility maintain a ratio of total consolidated debt to

total consolidated capitalization of at most 65% as of the

end of each fiscal quarter. In addition, the $187 million

revolving credit facility agreement requires that PG&E

Corporation must own, directly or indirectly, at least 80%

of the common stock and at least 70% of the voting

capital stock of the Utility.

At December 31, 2010, PG&E Corporation and the

Utility were in compliance with all covenants under each

of the revolving credit facilities listed in the table above.

2010 FINANCINGS

PG&E Corporation

On November 4, 2010, PG&E Corporation entered into

an Equity Distribution Agreement pursuant to which

PG&E Corporation’s sales agents may offer and sell, from

time to time, PG&E Corporation common stock having

an aggregate gross offering price of up to $400 million.

Sales of the shares are made by means of ordinary

brokers’ transactions on the New York Stock Exchange,

or in such other transactions as agreed upon by PG&E

Corporation and the sales agents and in conformance

with applicable securities laws. As of December 31, 2010,

PG&E Corporation had issued 2,357,796 shares of

common stock pursuant to the Equity Distribution

Agreement for cash proceeds of $110 million, net of fees

and commissions paid of $1 million.

In addition, during 2010, PG&E Corporation issued

5,105,505 shares of common stock upon the exercise of

employee stock options and under its 401(k) plan and

Dividend Reinvestment and Stock Purchase Plan,

generating $192 million of cash. PG&E Corporation

issued 16,370,779 shares of common stock upon

conversion of the $247 million principal amount of

PG&E Corporation’s Convertible Subordinated Notes at

a conversion price of $15.09 per share between June 23

and June 29, 2010. These notes were no longer

outstanding at December 31, 2010, and the conversion

had no impact on cash.

22