PG&E 2010 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

passed through to customers, decreased by $748 million, or

19%, in 2009 compared to 2008. This reflects a $799

million decrease in the total cost of natural gas that is

passed through to customers and generally does not impact

net income. (See “Cost of Natural Gas” below.) Natural gas

operating revenues, excluding costs passed through to

customers, increased by $51 million, primarily due to an

increase in authorized base revenues.

The Utility’s future natural gas operating revenues will

be impacted by final authorization by the CPUC in the

2011 GRC and the 2011 Gas Transmission and Storage rate

case. Finally, the Utility may earn incentive revenues under

the existing energy efficiency ratemaking mechanism. (See

“Regulatory Matters” below.)

Cost of Natural Gas

The Utility’s cost of natural gas includes the purchase costs

of natural gas, transportation costs on interstate pipelines,

and gas storage costs but excludes the transportation costs

on intrastate pipelines for core and non-core customers,

which are included in operating and maintenance expense

in the Consolidated Statements of Income. The Utility’s

cost of natural gas also includes realized gains and losses on

price risk management activities. (See Notes 10 and 11 of

the Notes to the Consolidated Financial Statements.)

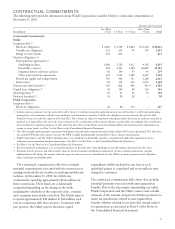

The following table provides a summary of the Utility’s

cost of natural gas:

(in millions) 2010 2009 2008

Cost of natural gas sold $ 1,119 $ 1,130 $ 1,955

Transportation cost of natural gas

sold 172 161 135

Total cost of natural gas $ 1,291 $ 1,291 $ 2,090

Average cost per Mcf (1) of natural

gas sold $ 4.69 $ 4.47 $ 7.43

Total natural gas sold (in millions

of Mcf) 249 253 263

(1) One thousand cubic feet

The Utility’s total cost of natural gas decreased by less

than $1 million in 2010 compared to 2009. The Utility

received $49 million in the first quarter of 2010 to be

refunded to customers as part of a litigation settlement

arising from the manipulation of the natural gas market by

third parties during 1999 through 2002. The decrease

resulting from the settlement was partially offset by an

increase in transportation costs primarily due to attrition

adjustments and an increase in procurement costs due to

increases in the average market price of natural gas

purchased.

The Utility’s total cost of natural gas decreased by $799

million, or 38%, in 2009 compared to 2008, primarily due

to decreases in the average market price of natural gas.

The Utility’s future cost of natural gas will be affected

by the market price of natural gas and changes in customer

demand. In addition, the Utility’s future cost of natural gas

may be affected by federal or state legislation or rules to

regulate the GHG emissions from the Utility’s natural gas

transportation and distribution facilities and from natural

gas consumed by the Utility’s customers.

Operatingand Maintenance

Operating and maintenance expenses consist mainly of the

Utility’s costs to operate and maintain its electricity and

natural gas facilities, customer billing and service expenses,

the cost of public purpose programs, and administrative

and general expenses. Operating and maintenance expenses

are influenced by wage inflation; changes in liabilities for

employee benefits; property taxes; the timing and length of

Diablo Canyon refueling outages; the occurrence of

storms, wildfires, and other events causing outages and

damages in the Utility’s service territory; environmental

remediation costs; legal costs; changes in the accrual for

legal matters; materials costs; the level of uncollectible

customer accounts; and various other factors. Although

some of the Utility’s operating and maintenance expenses,

like the cost of public purpose programs, are passed

through to customers and generally do not impact net

income, many other expenses are less predictable and less

controllable and do impact net income. The Utility’s

ability to earn its authorized rate of return depends in large

part on the success of its ability to manage these expenses

and to achieve operational and cost efficiencies.

The Utility’s operating and maintenance expenses

(including costs passed through to customers) increased by

$89 million, or 2%, in 2010 compared to 2009. During

2010, the change in pass-through operating and

maintenance costs as compared to 2009 was immaterial.

The increase in operating and maintenance expenses was

primarily due to $283 million of costs associated with the

San Bruno accident. This amount includes a provision of

$220 million for estimated third-party claims, including

personal injury and property damage claims, damage to

infrastructure, and other damage claims. (See Note 15 of

the Notes to the Consolidated Financial Statements.) The

additional $63 million of costs associated with the San

Bruno accident were incurred to provide immediate

support to the San Bruno community, re-inspect the

Utility’s natural gas transmission lines, and perform other

activities following the accident. Additionally, operating

and maintenance expenses increased due to a $36 million

provision that was recorded for SmartMeter™related

18