PG&E 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Stock Options

The exercise price of stock options granted under the

2006 LTIP and all other outstanding stock options is

equal to the market price of PG&E Corporation’s

common stock on the date of grant. Stock options

generally have a 10-year term and vest over four years of

continuous service, subject to accelerated vesting in

certain circumstances.

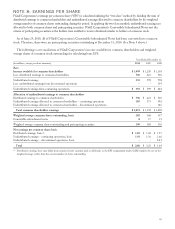

The following table summarizes total intrinsic value

(fair market value of PG&E Corporation’s common stock

less exercise price) of options exercised:

PG&E Corporation

(in millions) 2010 2009 2008

Intrinsic value of options exercised $ 15 $ 18 $ 13

The tax benefit from stock options exercised totaled

$0.5 million, $6 million, and $4 million for 2010, 2009,

and 2008 respectively.

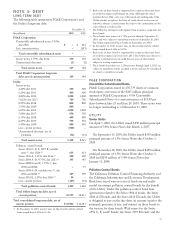

The following table summarizes stock option activity for 2010:

Options Shares Weighted Average

Exercise Price

Weighted

Average

Remaining

Contractual

Term Aggregate

Intrinsic Value

Outstanding at January 1 1,975,341 $ 23.99

Granted 1,742 42.97

Exercised (605,585) 22.67

Forfeited or expired (1,587) 30.13

Outstanding at December 31 1,369,911 25.16 2.76 $ 31,068,628

Expected to vest at December 31 21,401 37.77 7.89 $ 215,584

Exercisable at December 31 1,348,510 $ 24.96 2.68 $ 30,853,045

As of December 31, 2010, there was less than $1

million of total unrecognized compensation cost related

to outstanding stock options.

Restricted Stock

During 2010, PG&E Corporation awarded 10,540 shares

of restricted common stock to eligible participants under

the 2006 LTIP. The terms of the restricted stock award

agreements provide that the shares will vest over a five-

year period. Although the recipients of restricted stock

possess voting rights, they may not sell or transfer their

shares until the shares vest.

Prior to 2010, PG&E Corporation also awarded

restricted stock to eligible employees under the 2006

LTIP. The terms of these restricted stock award

agreements provide that 60% of the shares will vest over a

period of three years at the rate of 20% per year. If PG&E

Corporation’s annual total shareholder return (“TSR”) is

in the top quartile of its comparator group, as measured

for the three immediately preceding calendar years, the

restrictions on the remaining 40% of the shares will lapse

in the third year. If PG&E Corporation’s TSR is not in

the top quartile for that period, then the restrictions on

the remaining 40% of the shares will lapse in the fifth

year. Compensation expense related to the portion of the

restricted stock award that is subject to conditions based

on TSR is recognized over the shorter of the requisite

service period and three years. Dividends declared on

restricted stock are paid to recipients only when the

restricted stock vests.

The weighted average grant-date fair value per-share of

restricted stock granted during 2010, 2009, and 2008 was

$42.97, $35.53, and $37.91, respectively. The total fair

value of restricted stock that vested during 2010, 2009,

and 2008 was $8 million, $24 million, and $19 million,

respectively. The tax benefit from restricted stock that

vested during 2010, 2009, and 2008 was not material.

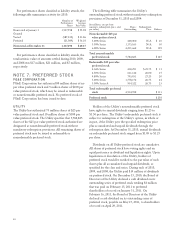

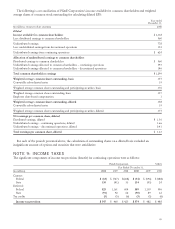

The following table summarizes restricted stock

activity for 2010:

Number of

Shares of

Restricted

Stock

Weighted

Average

Grant-Date

Fair Value

Nonvested at January 1 670,552 $ 41.11

Granted 10,540 $ 42.97

Vested (189,976) $ 41.70

Forfeited (15,236) $ 42.52

Nonvested at December 31 475,880 $ 40.87

80