PG&E 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

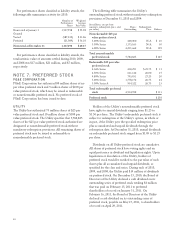

Long-Term Incentive Plan (“2006 LTIP”), and 5,105,505

shares were issued for the accounts of participants in PG&E

Corporation’s 401(k) plan and Dividend Reinvestment and

Stock Purchase Plan (“DRSPP”). In addition, between

June 23 and June 29, 2010, PG&E Corporation issued

16,370,779 shares of common stock upon conversion of

the $247 million principal amount of Convertible

Subordinated Notes. (See Note 4 above.)

On November 4, 2010, PG&E Corporation entered into

an Equity Distribution Agreement pursuant to which

PG&E Corporation’s sales agents may offer and sell, from

time to time, PG&E Corporation common stock having an

aggregate gross offering price of up to $400 million. Sales

of the shares are made by means of ordinary brokers’

transactions on the New York Stock Exchange, or in such

other transactions as agreed upon by PG&E Corporation

and the sales agents and in conformance with applicable

securities laws. As of December 31, 2010, PG&E

Corporation had issued 2,357,796 shares of its common

stock pursuant to the Equity Distribution Agreement for

cash proceeds of $110 million, net of fees and commissions

paid of $1 million.

UTILITY

As of December 31, 2010, PG&E Corporation held all of

the Utility’s outstanding common stock.

DIVIDENDS

The Boards of Directors of PG&E Corporation and the

Utility have each adopted a dividend policy. Under the

Utility’s Articles of Incorporation, the Utility cannot pay

common stock dividends unless all cumulative preferred

dividends on the Utility’s preferred stock have been paid.

PG&E Corporation and the Utility each have revolving

credit facilities that require the company to maintain a

ratio of consolidated total debt to consolidated

capitalization of at most 65%. This covenant, along with

the CPUC’s requirement for the Utility to maintain the

52% equity component of its capital structure, are

considered to be restrictions on the payment of dividends.

Based on the calculation of these ratios for each company,

no amount of PG&E Corporation’s retained earnings and

$5.3 billion of the Utility’s retained earnings were restricted

at December 31, 2010.

In addition, the Utility was required to maintain at least

$9.7 billion of its net assets as equity in order to maintain

the capital structure of at least 52% equity at December 31,

2010. As a result, $9.7 billion of the Utility’s net assets are

restricted and may not be transferred to PG&E Corporation

in the form of cash dividends.

The Boards of Directors of PG&E Corporation and the

Utility declare dividends quarterly. On December 15, 2010,

the Board of Directors of PG&E Corporation declared a

quarterly dividend of $0.455 per share, totaling $183

million, which was paid on January 15, 2011 to

shareholders of record on December 31, 2010.

LONG-TERM INCENTIVE PLAN

The 2006 LTIP permits the award of various forms of

incentive awards, including stock options, stock

appreciation rights, restricted stock awards, restricted stock

units, performance shares, deferred compensation awards,

and other stock-based awards, to eligible employees of

PG&E Corporation and its subsidiaries. Non-employee

directors of PG&E Corporation are also eligible to receive

restricted stock and either stock options or restricted stock

units under the formula grant provisions of the 2006 LTIP.

A maximum of 12 million shares of PG&E Corporation

common stock (subject to adjustment for changes in capital

structure, stock dividends, or other similar events) has been

reserved for issuance under the 2006 LTIP, of which

7,856,348 shares were available for award at December 31,

2010.

Awards made under the PG&E Corporation LTIP before

December 31, 2005 and still outstanding continue to be

governed by the terms and conditions of the PG&E

Corporation LTIP.

PG&E Corporation and the Utility use an estimated

annual forfeiture rate of 2.5% for stock options and

restricted stock and 2% for performance shares, based on

historic forfeiture rates, for purposes of determining

compensation expense for share-based incentive awards.

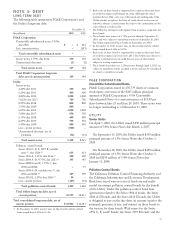

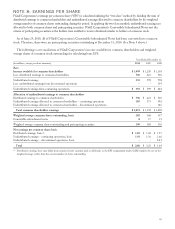

The following table provides a summary of total

compensation expense for PG&E Corporation and the

Utility for share-based incentive awards for 2010, 2009, and

2008:

(in millions) 2010 2009 2008

Stock Options $– $– $2

Restricted Stock 14 922

Restricted Stock Units 911 –

Performance Shares:

Liability Awards 22 37 33

Equity Awards 11 ––

Total Compensation Expense

(pre-tax) $ 56 $57 $57

Total Compensation Expense

(after-tax) $ 33 $34 $34

There were no significant stock-based compensation

costs capitalized during 2010, 2009 and 2008. There was no

material difference between PG&E Corporation and the

Utility for the information disclosed above.

79