PG&E 2010 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

payments under these renewable energy agreements are

expected to grow significantly, assuming that the facilities

are developed timely. No single supplier accounted for

more than 5% of the Utility’s 2010, 2009, or 2008

electricity sources.

OtherPowerPurchase Agreements — In accordance with

the Utility’s CPUC-approved long-term procurement

plans, the Utility has entered into several power purchase

agreements with third parties. The Utility’s obligations

under a portion of these agreements are contingent on the

third party’s development of a new generation facility to

provide the power to be purchased by the Utility under

the agreements.

IrrigationDistrict and WaterAgency PowerPurchase

Agreements – The Utility has contracts with various

irrigation districts and water agencies to purchase

hydroelectric power. Under these contracts, the Utility

must make specified semi-annual minimum payments

based on the irrigation districts’ and water agencies’ debt

service requirements, whether or not any hydroelectric

power is supplied, and variable payments for operation

and maintenance costs incurred by the suppliers. These

contracts expire on various dates from 2011 to 2031.

Irrigation districts and water agencies consist of small and

large hydro plants. No single irrigation district or water

agency accounted for more than 5% of the Utility’s 2010,

2009, or 2008 electricity sources.

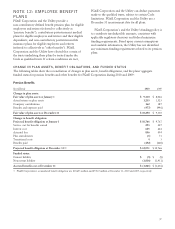

At December 31, 2010, the undiscounted future expected power purchase agreement payments were as follows:

Qualifying Facility Renewable

(Other than QF) Irrigation District &

Water Agency Other

(in millions) Energy Capacity Energy Capacity Operations &

Maintenance Debt

Service Energy Capacity Total

Payments

2011 $ 720 $ 366 $ 796 $ 8 $ 59 $ 21 $ 3 $ 691 $ 2,664

2012 545 321 944 9 45 21 3 684 2,572

2013 542 312 1,261 9 28 15 3 822 2,992

2014 548 301 1,647 – 13 12 1 605 3,127

2015 509 259 1,942 – 11 11 – 583 3,315

Thereafter 3,129 1,263 40,882 5 27 16 – 4,227 49,549

Total $ 5,993 $ 2,822 $ 47,472 $ 31 $ 183 $ 96 $ 10 $ 7,612 $ 64,219

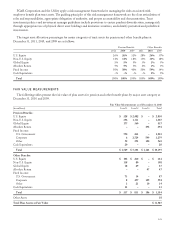

Some of the power purchase agreements that the

Utility entered into with independent power producers

that are QFs are treated as capital leases. The following

table shows the future fixed capacity payments due under

the QF contracts that are treated as capital leases. (These

amounts are also included in the table above.) The fixed

capacity payments are discounted to their present value in

the table below using the Utility’s incremental borrowing

rate at the inception of the leases. The amount of this

discount is shown in the table below as the amount

representing interest.

(in millions)

2011 $ 50

2012 50

2013 50

2014 42

2015 38

Thereafter 124

Total fixed capacity payments 354

Less: amount representing interest 72

Present value of fixed capacity payments $ 282

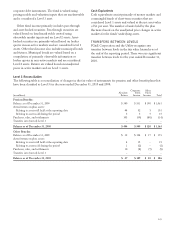

Minimum lease payments associated with the lease

obligation are included in cost of electricity on PG&E

Corporation’s and the Utility’s Consolidated Statements

of Income. The timing of the recognition of the lease

expense conforms to the ratemaking treatment for the

Utility’s recovery of the cost of electricity. The QF

contracts that are treated as capital leases expire between

April 2014 and September 2021.

The present value of the fixed capacity payments due

under these contracts is recorded on PG&E Corporation’s

and the Utility’s Consolidated Balance Sheets. At

December 31, 2010 and December 31, 2009, current

liabilities – other included $34 million and $32 million,

respectively, and noncurrent liabilities – other included

$248 million and $282 million, respectively. The

corresponding assets at December 31, 2010 and

December 31, 2009 of $282 million and $314 million

including accumulated amortization of $126 million and

$94 million, respectively are included in property, plant,

and equipment on PG&E Corporation’s and the Utility’s

Consolidated Balance Sheets.

107