PG&E 2010 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTE 12: EMPLOYEE BENEFIT

PLANS

PG&E Corporation and the Utility provide a

non-contributory defined benefit pension plan for eligible

employees and retirees (referred to collectively as

“pension benefits”), contributory postretirement medical

plans for eligible employees and retirees and their eligible

dependents, and non-contributory postretirement life

insurance plans for eligible employees and retirees

(referred to collectively as “other benefits”). PG&E

Corporation and the Utility have elected that certain of

the trusts underlying these plans be treated under the

Code as qualified trusts. If certain conditions are met,

PG&E Corporation and the Utility can deduct payments

made to the qualified trusts, subject to certain Code

limitations. PG&E Corporation and the Utility use a

December 31 measurement date for all plans.

PG&E Corporation’s and the Utility’s funding policy is

to contribute tax-deductible amounts, consistent with

applicable regulatory decisions and federal minimum

funding requirements. Based upon current assumptions

and available information, the Utility has not identified

any minimum funding requirements related to its pension

plans.

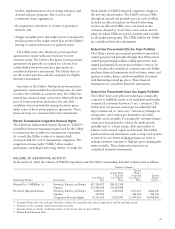

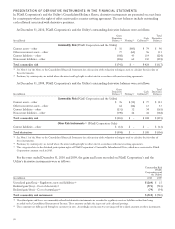

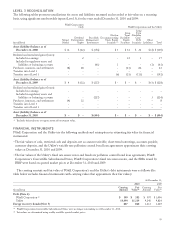

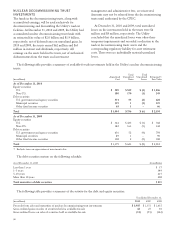

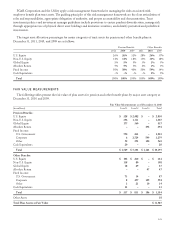

CHANGE IN PLAN ASSETS, BENEFIT OBLIGATIONS, AND FUNDED STATUS

The following tables show the reconciliation of changes in plan assets, benefit obligations, and the plans’ aggregate

funded status for pension benefits and other benefits for PG&E Corporation during 2010 and 2009:

PensionBenefits

(in millions) 2010 2009

Change in plan assets:

Fair value of plan assets at January 1 $ 9,330 $ 8,066

Actual return on plan assets 1,235 1,523

Company contributions 162 187

Benefits and expenses paid (477) (446)

Fair value of plan assets at December 31 $ 10,250 $ 9,330

Change in benefit obligation:

Projected benefit obligation at January 1 $ 10,766 $ 9,767

Service cost for benefits earned 253 227

Interest cost 645 624

Actuarial loss 856 494

Plan amendments (1) 71

Transitional costs 43

Benefits paid (452) (420)

Projected benefit obligation at December 31 (1) $ 12,071 $ 10,766

Funded status:

Current liability $ (5) $ (5)

Noncurrent liability (1,816) (1,431)

Accrued benefit cost at December 31 $ (1,821) $ (1,436)

(1) PG&E Corporation’s accumulated benefit obligation was $10,653 million and $9,527 million at December 31, 2010 and 2009, respectively.

97