PG&E 2010 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

company’s capital investment needs. Each Board of

Directors retains authority to change the respective common

stock dividend policy and dividend payout ratio at any time,

especially if unexpected events occur that would change its

view as to the prudent level of cash conservation. No

dividend is payable unless and until declared by the

applicable Board of Directors.

In addition, the CPUC requires that the PG&E

Corporation Board of Directors give first priority to the

Utility’s capital requirements, as determined to be

necessary and prudent to meet the Utility’s obligation to

serve or to operate the Utility in a prudent and efficient

manner, in setting the amount of dividends.

The Boards of Directors must also consider the CPUC

requirement that the Utility maintain, on average, its

CPUC-authorized capital structure, including a 52% equity

component.

The following table summarizes PG&E Corporation’s

and the Utility’s dividends paid:

(in millions) 2010 2009 2008

PG&E Corporation:

Common stock dividends paid $ 662 $ 590 $ 546

Common stock dividends reinvested

in Dividend Reinvestment and

Stock Purchase Plan 18 17 20

Utility:

Common stock dividends paid $ 716 $ 624 $ 568

Preferred stock dividends paid 14 14 14

On December 15, 2010, the Board of Directors of

PG&E Corporation declared a quarterly dividend of $0.455

per share, totaling $183 million, which was paid on

January 15, 2011 to shareholders of record on

December 31, 2010. On February 16, 2011, the Board of

Directors of PG&E Corporation declared a dividend of

$0.455 per share, payable on April 15, 2011 to shareholders

of record on March 31, 2011.

On December 15, 2010, the Board of Directors of the

Utility declared a cash dividend on its outstanding series of

preferred stock totaling $4 million that was paid on

February 15, 2011 to preferred shareholders of record on

January 31, 2011. On February 16, 2011, the Board of

Directors of the Utility declared a cash dividend on its

outstanding series of preferred stock, payable on May 15,

2011 to shareholders of record on April 29, 2011.

PG&E Corporation and the Utility each have revolving

credit facilities that require the company to maintain a

ratio of consolidated total debt to consolidated

capitalization of at most 65%. This covenant, along with

the CPUC’s requirement for the Utility to maintain the

52% equity component of its capital structure, are

considered to be restrictions on the payment of dividends.

Based on the calculation of these ratios for each company,

no amount of PG&E Corporation’s retained earnings and

$5.3 billion of the Utility’s retained earnings were restricted

at December 31, 2010.

In addition, the Utility was required to maintain at least

$9.7 billion of its net assets as equity in order to maintain

the capital structure of at least 52% equity at December 31,

2010. As a result, $9.7 billion of the Utility’s net assets are

restricted and may not be transferred to PG&E Corporation

in the form of cash dividends.

UTILITY

Operating Activities

The Utility’s cash flows from operating activities primarily

consist of receipts from customers less payments of

operating expenses, other than expenses such as

depreciation that do not require the use of cash.

The Utility’s cash flows from operating activities for

2010, 2009, and 2008 were as follows:

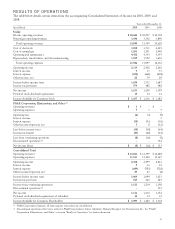

(in millions) 2010 2009 2008

Net income $ 1,121 $ 1,250 $ 1,199

Adjustments to reconcile net

income to net cash provided by

operating activities:

Depreciation, amortization, and

decommissioning 2,116 1,927 1,838

Allowance for equity funds used

during construction (110) (94) (70)

Deferred income taxes and tax

credits, net 762 787 593

Other 46 (27) (6)

Effect of changes in operating assets

and liabilities:

Accounts receivable (105) 157 (83)

Inventories (43) 109 (59)

Accounts payable 109 (33) (137)

Disputed claims and customer

refunds –(700) –

Income taxes receivable/payable (58) 21 43

Other current assets (7) 122 (187)

Other current liabilities 130 183 60

Regulatory assets, liabilities, and

balancing accounts, net (394) (516) (374)

Other changes in noncurrent

assets and liabilities (331) (282) (51)

Net cash provided by operating

activities $ 3,236 $ 2,904 $ 2,766

During 2010, net cash provided by operating activities

increased $332 million compared to 2009. This increase

24