PG&E 2010 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

weather, implementation of new energy efficiency and

demand response programs, direct access, and

community choice aggregation;

• the acquisition, retirement, or closure of generation

facilities; and

• changes in market prices that make it more economical to

purchase power in the market rather than use the Utility’s

existing or contracted resources to generate power.

The Utility enters into third-party power purchase

agreements to ensure sufficient electricity to meet

customer needs. The Utility’s third-party power purchase

agreements are generally accounted for as leases, but

certain third-party power purchase agreements are

considered derivative instruments. The Utility elects to

use the normal purchase and sale exception for eligible

derivative instruments.

A portion of the Utility’s third-party power purchase

agreements contain market-based pricing terms. In order

to reduce the volatility in customer rates, the Utility has

entered into financial swap contracts to effectively fix the

price of future purchases and reduce the cash flow

variability associated with fluctuating electricity prices

under some of those power purchase agreements. These

financial swaps are considered derivative instruments.

Electric TransmissionCongestionRevenue Rights

The California Independent System Operator (“CAISO”)

controlled electricity transmission grid used by the Utility

to transmit power is subject to transmission constraints.

As a result, the Utility is subject to financial risk

associated with the cost of transmission congestion. The

congestion revenue rights (“CRRs”) allow market

participants, including load-serving entities, to hedge the

financial risk of CAISO-imposed congestion charges in

the new day-ahead market. The CAISO releases CRRs

through an annual and monthly process, each of which

includes an allocation phase (in which load-serving

entities are allocated CRRs at no cost based on the

customer demand or “load” they serve) and an auction

phase (in which CRRs are priced at market and available

to all market participants). The CRRs held by the Utility

are considered derivative instruments.

Natural Gas Procurement (Electric Fuels Portfolio)

The Utility’s electric procurement portfolio is exposed to

natural gas price risk primarily through the Utility-owned

natural gas generating facilities, tolling agreements, and

natural gas-indexed electricity procurement contracts. In

order to reduce the volatility in customer rates, the Utility

purchases financial instruments such as futures, swaps, and

options to reduce future cash flow variability associated

with fluctuating natural gas prices. These financial

instruments are considered derivative instruments.

Natural Gas Procurement (Core Gas Supply Portfolio)

The Utility enters into physical natural gas commodity

contracts to fulfill the needs of its residential and smaller

commercial customers known as “core” customers. (The

Utility does not procure natural gas for industrial and

large commercial, or “non-core,” customers.) Changes in

temperature cause natural gas demand to vary daily,

monthly, and seasonally. Consequently, varying volumes

of gas may be purchased or sold in the multi-month,

monthly and, to a lesser extent, daily spot market to

balance such seasonal supply and demand. The Utility

purchases financial instruments such as swaps and options

as part of its core winter hedging program in order to

manage customer exposure to high gas prices during peak

winter months. These financial instruments are

considered derivative instruments.

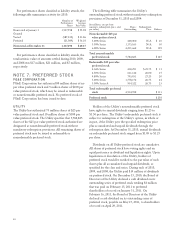

VOLUME OF DERIVATIVE ACTIVITY

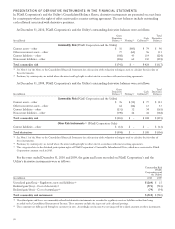

At December 31, 2010, the volumes of PG&E Corporation’s and the Utility’s outstanding derivative contracts were as follows:

Contract Volume (1)

Underlying Product Instruments Less Than 1

Year

Greater Than

1 Year but

Less Than 3

Years

Greater

Than 3

Years but

Less Than 5

Years

Greater

Than 5

Years (2)

Natural Gas (3) (MMBtus (4)) Forwards, Futures, and Swaps 427,176,587 308,712,558 – –

Options 270,509,308 176,150,000 – –

Electricity (Megawatt-hours) Forwards, Futures, and Swaps 5,690,441 6,969,024 3,673,512 4,826,640

Options 415,450 – 264,096 396,396

Congestion Revenue Rights 74,313,524 72,070,789 71,997,921 96,986,809

(1) Amounts shown reflect the total gross derivative volumes by commodity type that are expected to settle in each time period.

(2) Derivatives in this category expire between 2016 and 2022.

(3) Amounts shown are for the combined positions of the electric and core gas portfolios.

(4) Million British Thermal Units.

89