PG&E 2010 Annual Report Download - page 23

Download and view the complete annual report

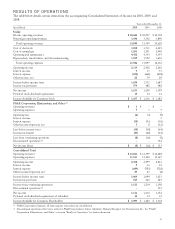

Please find page 23 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.capital costs that are forecasted to exceed the CPUC-

authorized amount for recovery. (See “Regulatory Matters

– Deployment of SmartMeter™Technology” below.) These

increases were partially offset by decreases of approximately

$139 million in labor costs and other costs as compared to

2009, when costs were incurred in connection with an

additional scheduled refueling outage at Diablo Canyon

and accelerated natural gas leak surveys (and associated

remedial work); $67 million in severance costs as compared

to the same period in 2009, when charges were incurred

related to the reduction of approximately 2% of the

Utility’s workforce; and $21 million in uncollectible

customer accounts, as a result of customer outreach and

increased collection efforts.

The Utility’s operating and maintenance expenses

(including costs passed through to customers) increased by

$146 million, or 3%, in 2009 compared to 2008. During

2009, the pass-through costs of public purpose programs

decreased by $111 million as compared to the level of

program spending in 2008. Excluding costs passed through

to customers, operating and maintenance expenses

increased by $257 million, primarily due to approximately

$100 million of costs to perform accelerated natural gas

leak surveys and associated remedial work, $67 million of

employee severance costs incurred due to the reduction of

approximately 2% of the Utility’s workforce, $42 million of

costs related to the SmartMeter™advanced metering

project, and $35 million of costs for the second refueling

outage at Diablo Canyon. The remaining increase consists

primarily of employee wage and benefit costs that were

partially offset by lower storm-related costs as compared to

2008, when costs were incurred in connection with the

January 2008 winter storm.

The Utility currently estimates that it may incur as

much as $180 million for third-party claims related to the

San Bruno accident in future years, in addition to the $220

million provision recorded in 2010. (See Note 15 of the

Notes to the Consolidated Financial Statements.) The

Utility also expects to continue to incur other costs related

to the San Bruno accident, including costs to comply with

CPUC orders and NTSB recommendations that have been

issued in connection with the investigation of the San

Bruno accident, such as costs to perform an exhaustive

review of records related to the Utility’s natural gas

transmission system and to perform pressure tests on

portions of its natural gas transmission system. The Utility

currently estimates that these costs could range from

approximately $200 million to $300 million for 2011.

These estimates could change depending on a number of

factors, including the outcome of the NTSB and CPUC

investigations; the outcome of the “safety phase” of the

Utility’s 2011 Gas Transmission and Storage Rate Case;

and the outcome of future rule-making, ratemaking, or

investigatory proceedings at the CPUC. (See “Regulatory

Matters” and “Pending Investigations” below.) In addition,

current estimates could be affected by state and federal

legislative requirements that may be adopted to establish

operating practice standards for natural gas transmission

operations and safety, to require the use of certain types of

inspection methods and equipment, and to require the

installations of certain types of valves. If this or similar

legislation is enacted, the Utility may incur unforecasted

costs to comply with new statutory requirements. PG&E

Corporation and the Utility are uncertain whether all or a

portion of the costs the Utility may incur to respond to

orders, recommendations, or new legislative requirements

would be recoverable through rates and the timing of any

such recovery. Finally, if the CPUC institutes one or more

formal investigations related to the San Bruno accident or

the Utility’s natural gas operating and maintenance

practices in addition to the formal investigation of the

Rancho Cordova accident, the CPUC may impose fines or

penalties, which may be material, on the Utility if the

CPUC determines that the Utility violated laws, rules,

regulations, or orders.

Depreciation, Amortization,and Decommissioning

The Utility’s depreciation and amortization expense

consists of depreciation and amortization on plant and

regulatory assets, and decommissioning expenses associated

with fossil and nuclear decommissioning. The Utility’s

depreciation, amortization, and decommissioning expenses

increased by $153 million, or 9%, in 2010 compared to

2009, primarily due to an increase in authorized capital

additions.

The Utility’s depreciation, amortization, and

decommissioning expenses increased by $102 million, or

6%, in 2009 compared to 2008, primarily due to an

increase in authorized capital additions and depreciation

rate changes.

The Utility’s depreciation expense for future periods is

expected to increase as a result of an overall increase in

capital expenditures and implementation of depreciation

rates authorized by the CPUC. Depreciation expenses in

subsequent years will be determined based on rates set by

the CPUC in the 2011 GRC and the 2011 Gas

Transmission and Storage rate case, and by the FERC in

future TO rate cases.

Interest Income

The Utility’s interest income decreased by $24 million, or

73%, in 2010 as compared to 2009, primarily due to lower

interest rates affecting various regulatory balancing

accounts and fluctuations in those accounts. In addition,

19