PG&E 2010 Annual Report Download - page 92

Download and view the complete annual report

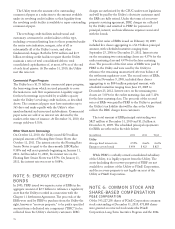

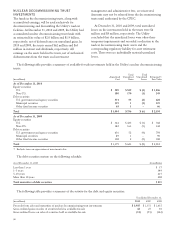

Please find page 92 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Tax Relief, Unemployment Insurance

Reauthorization, and Job Creation Act of 2010 (the “Tax

Relief Act”) Federal legislation that was signed into law on

December 17, 2010, provides for full expensing of qualified

property, plant, and equipment placed in service from

September 9, 2010 to December 31, 2011 for tax purposes.

The Tax Relief Act increased PG&E Corporation’s federal

net operating loss carry forwards. As of December 31, 2010,

PG&E Corporation has approximately $540 million of

federal net operating loss carry forwards and $45 million of

tax credit carry forwards, which will expire between 2029

and 2030. In addition, PG&E Corporation has

approximately $46 million of loss carry forwards related to

charitable contributions, which will expire between 2014

and 2015. PG&E Corporation believes it is more likely

than not the tax benefits associated with the federal

operating loss and tax credit can be realized within the

carry forward periods; therefore, no valuation allowance

was recognized as of December 31, 2010. The amount of

federal net operating loss carry forwards for which a tax

benefit from employee stock plans would be recorded in

additional paid-in capital was approximately $9 million as

of December 31, 2010.

NOTE 10: DERIVATIVES AND

HEDGING ACTIVITIES

USE OF DERIVATIVE INSTRUMENTS

The Utility faces market risk primarily related to electricity

and natural gas commodity prices. All of the Utility’s risk

management activities involving derivatives reduce the

volatility of commodity costs on behalf of its customers.

The CPUC allows the Utility to charge customer rates

designed to recover the Utility’s reasonable costs of

providing services, including the cost to obtain and deliver

electricity and natural gas.

The Utility uses both derivative and non-derivative

contracts in managing its customers’ exposure to

commodity-related price risk, including:

• forward contracts that commit the Utility to purchase a

commodity in the future;

• swap agreements that require payments to or from

counterparties based upon the difference between two

prices for a predetermined contractual quantity;

• option contracts that provide the Utility with the right to

buy a commodity at a predetermined price; and

• futures contracts that are exchange-traded contracts

committing the Utility to make a cash settlement at a

specified price and future date.

These instruments are not held for speculative purposes

and are subject to certain regulatory requirements.

COMMODITY-RELATED PRICE RISK

Commodity-related price risk management activities that

meet the definition of a derivative are recorded at fair value

on the Consolidated Balance Sheets. As long as the

ratemaking mechanisms discussed above remain in place

and the Utility’s risk management activities are carried out

in accordance with CPUC directives, the Utility expects to

fully recover from customers, in rates, all costs related to

commodity-related price risk-related derivative instruments.

Therefore, all unrealized gains and losses associated with

the change in fair value of these derivative instruments are

deferred and recorded within the Utility’s regulatory assets

and liabilities on the Consolidated Balance Sheets. (See

Note 3 above.) Net realized gains or losses on derivative

instruments related to price risk for commodities are

recorded in the cost of electricity or the cost of natural gas

with corresponding increases or decreases to regulatory

balancing accounts for recovery from customers.

The Utility elects the normal purchase and sale

exception for qualifying commodity-related derivative

instruments. Derivative instruments that require physical

delivery, are probable of physical delivery in quantities that

are expected to be used by the Utility over a reasonable

period in the normal course of business, and do not

contain pricing provisions unrelated to the commodity

delivered are eligible for the normal purchase and sale

exception. The fair value of instruments that are eligible for

the normal purchase and sales exception are not reflected

in the Consolidated Balance Sheets.

The following is a discussion of the Utility’s use of

derivative instruments intended to mitigate commodity-

related price risk for its customers.

ELECTRICITY PROCUREMENT

The Utility obtains electricity from a diverse mix of

resources, including third-party power purchase

agreements, amounts allocated under DWR contracts, and

its own electricity generation facilities. The amount of

electricity the Utility needs to meet the demands of

customers and that is not satisfied from the Utility’s own

generation facilities, existing purchase contracts, or DWR

contracts allocated to the Utility’s customers is subject to

change for a number of reasons, including:

• periodic expirations or terminations of existing electricity

purchase contracts, including the DWR’s contracts;

• the execution of new electricity purchase contracts;

• fluctuation in the output of hydroelectric and other

renewable power facilities owned or under contract;

• changes in the Utility’s customers’ electricity demands

due to customer and economic growth or decline,

88