PG&E 2010 Annual Report Download - page 6

Download and view the complete annual report

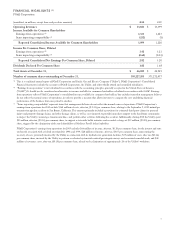

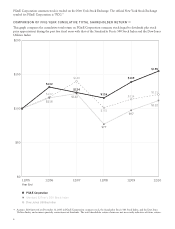

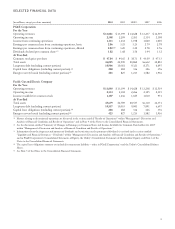

Please find page 6 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.reported in accordance with generally accepted accounting

principles (GAAP).

On a GAAP basis, net income after dividends on

preferred stock (also called “income available for common

shareholders”) was $1.10 billion, or $2.82 per share, for

2010. This compared with $1.22 billion, or $3.20 per share,

for 2009.

The year-over-year decline in net income reflected San

Bruno-related costs totaling $283 million on a pre-tax basis,

or $0.43 per share. These costs included a $220 million

provision for property damage, personal injury, and other

third-party claims, as well as an additional $63 million in

direct costs for providing support to the San Bruno

community, re-inspecting natural gas lines, and other

activities. Although we expect that most of the costs the

utility incurs for third-party claims relating to the accident

will ultimately be recovered through insurance, GAAP

required us to record a charge equal to the low end of the

estimated range for potential liability costs of $220 million

to $400 million.

On an earnings from operations basis, a non-GAAP

measure adjusted to reflect normal operations and exclude

items like the accident-related costs, earnings per share rose

6.5 percent to $3.42, on earnings of $1.33 billion,

compared to $3.21 per share, or $1.22 billion, in 2009.

(The “Financial Highlights” table on page 7 reconciles

GAAP total net income with non-GAAP earnings from

operations.) These results were well within the company’s

2010 guidance range of $3.35 per share to $3.50 per share

for earnings from operations.

STRENGTHENING THE UTILITY’S

INFRASTRUCTURE

We continued to invest substantially in our system last

year, deploying $3.9 billion of new capital to expand and

improve our gas and electric assets, strengthen safety and

reliability, and meet the needs of new customers.

Within our electric distribution and transmission

operations, a major focus was continuing to upgrade

targeted transmission and distribution circuits and install

new equipment to improve reliability. Additionally, we

secured regulatory approval to invest an additional $357

million of capital through 2013 for PG&E’s Cornerstone

Improvement Program. This program aims to create more

capacity and interconnectedness on the power grid,

enabling us to better isolate power outages and redirect

power flows onto neighboring circuits to restore service

more quickly.

We also continued to invest in PG&E’s natural gas

system, with an emphasis on retrofitting or replacing older

transmission and distribution pipe. This work has been a

long-term priority, and in light of the San Bruno accident,

we are accelerating and expanding many plans to reinforce

our gas infrastructure.

The focal point for this work going forward is a

proposed new 10-year pipeline modernization program,

Pipeline 2020. Announced late last year, Pipeline 2020 is

one of the most significant initiatives PG&E has ever

launched, with ambitious goals and a sweeping scope.

Pipeline 2020 will propose to make targeted investments

to test, inspect, and upgrade or replace parts of our

transmission pipeline system, and to add remote-controlled

or automatic shut-off valves in locations in our system

where they can be effective. It will drive advancements in

best practices across the industry and also includes funding

to support new research into next-generation pipeline

inspection technology. In addition, it encompasses efforts

to create a new model for coordinating with local first

responders and community leaders and increasing pipeline

safety awareness.

In the coming months, we plan to share with California

regulators our proposals for the first phase of this gas

infrastructure modernization work that we believe is

important to creating a safer and more reliable energy

future for our customers.

In 2010, we also continued to grow PG&E’s

conventional electric generation portfolio as we began

operations at the new units at our Humboldt Bay

Generating Station and the new state-of-the-art Colusa

Generating Station. We also received CPUC approval to

purchase the Oakley Generating Station, a natural-gas-fired

facility that is forecast to be the most efficient power plant

of its kind in California when PG&E takes ownership,

which is scheduled for 2016.

For the first time in our recent history, we also added

renewable generation to our utility-owned portfolio with

the inauguration of the Vaca-Dixon photovoltaic solar

station. This represents the first major project under our

five-year program to develop up to 500 megawatts of clean

solar photovoltaic power, 250 megawatts of which will be

owned by PG&E. When the entire program is online, we

expect that it will provide enough renewable power each

year to serve roughly 150,000 homes.

Finally, our Diablo Canyon nuclear power plant

continues to provide safe, carbon-free electric power for

our customers. As the regulatory process for relicensing this

essential facility moves forward, our focus remains on

ensuring safe and reliable operations.

Among last year’s most notable accomplishments were

settlements reached in PG&E’s 2011 General Rate Case and

its 2011 Gas Transmission and Storage Rate Case, both of

2