PG&E 2010 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

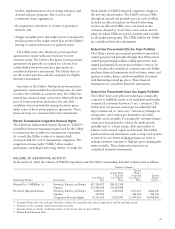

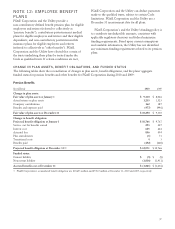

OtherBenefits

December 31,

(in millions) 2010 2009 2008

Service cost for benefits earned $36 $30 $29

Interest cost 88 87 81

Expected return on plan assets (74) (68) (93)

Amortization of transition obligation 26 26 26

Amortization of prior service cost 25 16 16

Amortization of unrecognized loss (gain) 33 (15)

Net periodic benefit cost $ 104 $94 $44

There was no material difference between PG&E

Corporation and the Utility for the information disclosed

above.

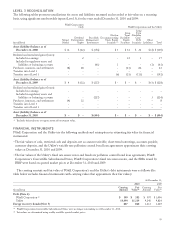

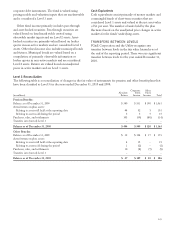

COMPONENTS OF ACCUMULATED OTHER

COMPREHENSIVE INCOME (LOSS)

PG&E Corporation and the Utility record the net periodic

benefit cost for pension benefits and other benefits as a

component of accumulated other comprehensive income

(loss), net of tax. Net periodic benefit cost is composed of

unrecognized prior service costs, unrecognized gains and

losses, and unrecognized net transition obligations as

components of accumulated other comprehensive income,

net of tax. (See Note 2 above.)

Regulatory adjustments are recorded in the

Consolidated Statements of Income and Consolidated

Balance Sheets to reflect the difference between pension

expense or income for accounting purposes and pension

expense or income for ratemaking, which is based on a

funding approach. A regulatory adjustment is also recorded

for the amounts that would otherwise be charged to

accumulated other comprehensive income for the pension

benefits related to the Utility’s defined benefit pension

plan. The Utility would record a regulatory liability for a

portion of the credit balance in accumulated other

comprehensive income, should the other benefits be in an

overfunded position. However, this recovery mechanism

does not allow the Utility to record a regulatory asset for an

underfunded position related to other benefits. Therefore,

the charge remains in accumulated other comprehensive

income (loss) for other benefits.

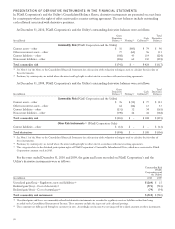

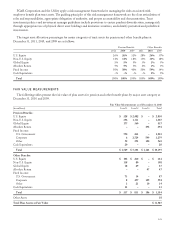

The estimated amounts that will be amortized into net

periodic benefit cost for PG&E Corporation in 2011 are as

follows:

PensionBenefits

(in millions)

Unrecognized prior service cost $ 35

Unrecognized net loss 48

Total $83

OtherBenefits

(in millions)

Unrecognized prior service cost $ 26

Unrecognized net loss 4

Unrecognized net transition obligation 26

Total $56

There were no material differences between the

estimated amounts that will be amortized into net period

benefit costs for PG&E Corporation and the Utility.

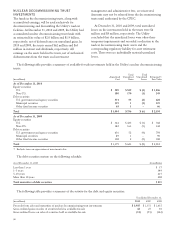

MEDICARE PRESCRIPTION DRUG,

IMPROVEMENT, AND MODERNIZATION ACT OF

2003

The Medicare Prescription Drug, Improvement, and

Modernization Act of 2003 establishes a prescription drug

benefit under Medicare (“Medicare Part D”) and a

tax-exempt federal subsidy to sponsors of retiree health care

benefit plans that provide a benefit that actuarially is at

least equivalent to Medicare Part D. PG&E Corporation

and the Utility determined that benefits provided to certain

participants actuarially will be at least equivalent to

Medicare Part D. Therefore, PG&E Corporation and the

Utility are entitled to a tax-exempt subsidy that reduced the

accumulated postretirement benefit obligation under the

defined benefit medical plan at December 31, 2010 and

2009 and reduced the net periodic cost for 2010 and 2009

by the following amounts:

(in millions) 2010 2009

Accumulated postretirement benefit obligation

reduction $ 72 $ 71

Net periodic benefit cost reduction 1 7

On March 30, 2010, federal health care legislation was

signed eliminating the deduction for subsidy contributions

after 2012. (See Note 9 above.)

There was no material difference between PG&E

Corporation’s and the Utility’s Medicare Part D subsidy

during 2010.

99