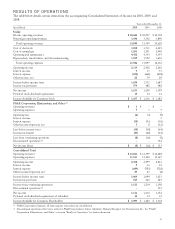

PG&E 2010 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Utility

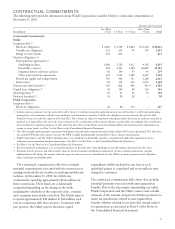

The following table summarizes debt issuances in 2010.

(See Note 4 of the Notes to the Consolidated Financial

Statements.)

(in millions) Issue Date Amount

Senior Notes

5.8%, due 2037 April 1 $ 250

3.5%, due 2020 September 15 550

Floating rate, due 2011 October 12 250

3.5%, due 2020 November 18 250

5.4%, due 2040 November 18 250

Total senior notes 1,550

Pollution control bonds

Series 2010E, 2.25%, due 2026 (1) April 8 50

Total debt issuances in 2010 $ 1,600

(1) These bonds bear interest at 2.25% per year through April 1, 2012; are

subject to mandatory tender on April 2, 2012; and may be remarketed

in a fixed or variable rate mode.

The net proceeds from the issuance of Utility senior

notes in 2010 were used to repay outstanding commercial

paper and for general corporate purposes. The net proceeds

from the issuance of the pollution control bonds by the

California Infrastructure and Economic Development

Bank for the benefit of the Utility were used to fund capital

investments and general working capital needs.

The Utility also received a contribution of $190 million

of cash from PG&E Corporation during 2010 to ensure that

the Utility had adequate capital to fund its capital

expenditures and to maintain the 52% common equity

ratio authorized by the CPUC.

FUTURE FINANCING NEEDS

The amount and timing of the Utility’s future financings

will depend on various factors, including:

• the amount of cash internally generated through normal

business operations;

• the timing and amount of forecasted capital expenditures

authorized in GRC or TO rate cases, or whether the

CPUC approves the Utility’s requests for specific capital

projects outside of the GRC (discussed below under

“Capital Expenditures”);

• the timing of the resolution of the Chapter 11 disputed

claims and the amount of interest on these claims that the

Utility will be required to pay;

• the timing and amount of payments made to third parties

in connection with the San Bruno accident, and the

timing and amount of related insurance recoveries;

• the reduction in future tax payments as a result of

legislation in December 2010 that allows for bonus

depreciation on qualified property (discussed below under

“Utility – Operating Activities”); and

• the conditions in the capital markets, and other factors.

(See Notes 13 and 15 of the Notes to the Consolidated

Financial Statements.)

PG&E Corporation may issue debt or equity in the future

to fund equity contributions to the Utility and to fund tax

equity investments to the extent that internally generated

funds are not sufficient. PG&E Corporation’s financing needs

depend primarily on the timing and amount of contributions

made to the Utility to maintain the Utility’s 52% common

equity ratio authorized by the CPUC. Further, at

December 31, 2010, PG&E Corporation made certain tax

equity investments (see “PG&E Corporation” below) and may

fund similar investments in the future, resulting in additional

financing needs.

PG&E Corporation and the Utility have had continued

access to the capital markets on reasonable terms and

continue to believe that the Utility’s cash flows from

operations, existing sources of liquidity, and future

financings will provide adequate resources to fund

operating activities, meet anticipated obligations, make

payments to third parties related to the San Bruno

accident, and finance future capital expenditures and

investments.

DIVIDENDS

The dividend policies of PG&E Corporation and the

Utility are designed to meet the following three objectives:

•Comparability: Pay a dividend competitive with the

securities of comparable companies based on payout ratio

(the proportion of earnings paid out as dividends) and,

with respect to PG&E Corporation, yield (i.e., dividend

divided by share price);

•Flexibility: Allow sufficient cash to pay a dividend and to

fund investments while avoiding having to issue new

equity unless PG&E Corporation’s or the Utility’s capital

expenditure requirements are growing rapidly and PG&E

Corporation or the Utility can issue equity at reasonable

cost and terms; and

•Sustainability: Avoid reduction or suspension of the

dividend despite fluctuations in financial performance

except in extreme and unforeseen circumstances.

The Boards of Directors of PG&E Corporation and the

Utility have each adopted a target dividend payout ratio

range of 50% to 70% of earnings. Dividends paid by PG&E

Corporation and the Utility are expected to remain in the

lower end of the target payout ratio range so that more

internal funds are readily available to support each

23