PG&E 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

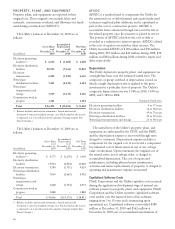

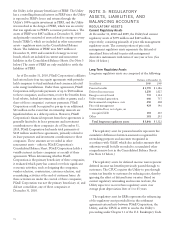

ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

Accumulated other comprehensive income (loss) reports a measure for accumulated changes in equity of an enterprise

that result from transactions and other economic events, other than transactions with shareholders. The following table

sets forth the after-tax changes in each component of accumulated other comprehensive income (loss):

Employee Benefit Plans – Accumulated Other Comprehensive

Income (Loss)

(in millions) 2010 2009 2008

Balance at beginning of year $ (160) $ (221) $ 10

Period change in pension benefits and other benefits:

Unrecognized prior service cost (1) (29) (1) 37

Unrecognized net gain (loss) (2) (110) 363 (1,583)

Unrecognized net transition obligation (3) 15 15 15

Transfer to regulatory account (4) (5) 82 (316) 1,300

Balance at end of year $ (202) $ (160) $ (221)

(1) Net of income tax benefit (expense) of $20 million, $1 million, and $(27) million for December 31, 2010, 2009, and 2008, respectively.

(2) Net of income tax benefit (expense) of $73 million, $(216) million, and $1,088 million for December 31, 2010, 2009, and 2008, respectively.

(3) Net of income tax benefit (expense) of $(11) million for December 31, 2010, 2009, and 2008.

(4) Net of income tax benefit (expense) of $(57) million, $218 million, and $(894) million for December 31, 2010, 2009, and 2008, respectively.

(5) Amounts transferred to the pension regulatory asset are probable of recovery from customers in future rates.

There was no material difference between PG&E

Corporation’s and the Utility’s accumulated other

comprehensive income (loss) for the periods presented

above.

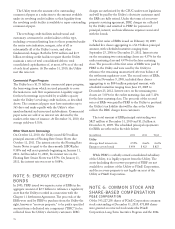

REVENUE RECOGNITION

The Utility recognizes revenues after persuasive evidence

of an arrangement exists, delivery has occurred, or

services have been rendered; the price to the customer is

fixed or determinable; and collectability is reasonably

assured. Revenues meet these criteria as the electricity and

natural gas services are delivered, and include amounts for

services rendered but not yet billed at the end of the

period.

The Utility recognizes revenues after the CPUC or the

FERC has authorized rate recovery, amounts are

objectively determinable and probable of recovery, and

amounts will be collected within 24 months. (See Note 3

below.)

The CPUC authorizes most of the Utility’s revenue

requirements in its general rate case (“GRC”), which

generally occurs every three years. The Utility’s ability to

recover revenue requirements authorized by the CPUC in

the GRC does not depend on the volume of the Utility’s

sales of electricity and natural gas services. Generally, the

revenue recognition criteria are met ratably over the year.

The CPUC also has authorized the Utility to collect

additional revenue requirements to recover certain costs

that the Utility has been authorized to pass on to

customers, including costs to purchase electricity and

natural gas; to fund public purpose, demand response,

and customer energy efficiency programs; and to recover

certain capital expenditures. Generally, the revenue

recognition criteria for pass-through costs billed to

customers are met at the time the costs are incurred.

The Utility’s revenues and earnings also are affected by

incentive ratemaking mechanisms that adjust rates

depending on the extent the Utility meets certain

performance criteria. (See Note 15 below.)

The FERC authorizes the Utility’s revenue

requirements in annual transmission owner rate cases.

The Utility’s ability to recover revenue requirements

authorized by the FERC is dependent on the volume of

the Utility’s electricity sales, and revenue is recognized

only for amounts billed and unbilled.

In determining whether revenue transactions should be

presented net of the related expenses, the Utility considers

various factors, including whether the Utility takes title to

the product being delivered, has latitude in establishing

price for the product, and is subject to the customer

credit risk. In January 2001, the California Department of

Water Resources (“DWR”) began purchasing electricity to

meet the portion of demand of the California investor-

owned electric utilities that was not being satisfied from

the utilities’ own generation facilities and existing

electricity contracts. The Utility acts as a billing and

collection agent on behalf of the DWR and does not have

any authority to set prices for the energy delivered. The

69