PG&E 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PG&E Corporation and Pacific Gas and Electric Company

2010 Annual Report

Table of contents

-

Page 1

PG&E Corporation and Pacific Gas and Electric Company 2010 Annual Report -

Page 2

-

Page 3

TABLE OF CONTENTS A Letter to our Stakeholders Financial Statements PG&E Corporation and Pacific Gas and Electric Company Boards of Directors Officers of PG&E Corporation and Pacific Gas and Electric Company Shareholder Information 1 6 118 119 120 -

Page 4

-

Page 5

... that any long-lived company inevitably experiences. Even amid last year's challenges, PG&E employees accomplished important goals on behalf of our customers. They re-inspected thousands of miles of natural gas lines in the wake of the San Bruno accident. They restored power following outages more... -

Page 6

... to the San Bruno community, re-inspecting natural gas lines, and other activities. Although we expect that most of the costs the utility incurs for third-party claims relating to the accident will ultimately be recovered through insurance, GAAP required us to record a charge equal to the low end of... -

Page 7

.... Closely linked and equally important to employee safety is our commitment and responsibility to public safety. As noted earlier, we view the San Bruno accident and the findings that have emerged from the investigation thus far as clear signs that we must raise the bar on many of our natural gas... -

Page 8

...evaluates investor risk and value related to sustainability issues, ranked PG&E number one on its 2010 global assessment of environmental attributes of 29 companies in the utility sector. In particular, PG&E was recognized for its low carbon emissions risk, overall sustainability management strategy... -

Page 9

...on concrete action rather than words. On behalf of all 20,000 men and women of PG&E, we look forward to delivering results that will demonstrate our commitment and speak for themselves over the course of this year and beyond. Sincerely, Peter A. Darbee Chairman of the Board, Chief Executive Officer... -

Page 10

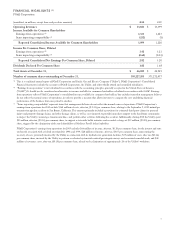

...-Year Cumulative Total Shareholder Return Selected Financial Data Management's Discussion and Analysis PG&E Corporation and Pacific Gas and Electric Company Consolidated Financial Statements Notes to the Consolidated Financial Statements Quarterly Consolidated Financial Data Management's Report on... -

Page 11

...tax, ($ 0.43) per common share, relating to the September 9, 2010 natural gas transmission pipeline accident in San Bruno, California. This amount primarily included a provision for estimated third-party claims for personal injury and property damage claims, and other damage claims, as well as costs... -

Page 12

... is traded on the New York Stock Exchange. The official New York Stock Exchange symbol for PG&E Corporation is "PCG." COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL SHAREHOLDER RETURN (1) This graph compares the cumulative total return on PG&E Corporation common stock (equal to dividends plus stock price... -

Page 13

...-End Common stock price per share Total assets Long-term debt (excluding current portion) Capital lease obligations (excluding current portion) (4) Energy recovery bonds (excluding current portion) (5) Pacific Gas and Electric Company For the Year Operating revenues Operating income Income available... -

Page 14

... Utility has been authorized to pass on to customers, including costs to purchase electricity and natural gas; to fund public purpose, demand response, and customer energy efficiency programs; and to recover certain capital expenditures. The Utility's ability to recover these costs is not dependent... -

Page 15

... costs timely, and earn its authorized rate of return. A number of factors have had, or are expected to have, a significant impact on PG&E Corporation's and the Utility's results of operations and financial condition, including: • The Outcome of Pending Investigations of Natural Gas Explosions... -

Page 16

... "Critical Accounting Policies" below.) • Authorized Capital Structure, Rate of Return, and Financing. The Utility's CPUC-authorized capital structure for its electric and natural gas distribution and electric generation rate base, consisting of 52% common equity and 48% debt and preferred stock... -

Page 17

... facts as of the date of this report. These forward-looking statements relate to, among other matters, estimated capital expenditures; estimated environmental remediation, tax, and other liabilities; estimates and assumptions used in PG&E Corporation's and the Utility's critical accounting policies... -

Page 18

... customers due to various forms of bypass and competition, including municipalization of the Utility's electric distribution facilities, increasing levels of "direct access" by which consumers procure electricity from alternative energy providers, and implementation of "community choice aggregation... -

Page 19

... revenues Cost of electricity Cost of natural gas Operating and maintenance Depreciation, amortization, and decommissioning Total operating expenses Operating income Interest income Interest expense Other income, net Income before income taxes Income tax provision Net income Preferred stock dividend... -

Page 20

...of electric procurement, public purpose, energy efficiency, and demand response programs. The Utility provides electricity to residential, industrial, agricultural, and small and large commercial customers through its own generation facilities and through power purchase agreements with third parties... -

Page 21

... Various factors will affect the Utility's future cost of electricity, including the market prices for electricity and natural gas, the level of hydroelectric and nuclear power that the Utility produces, changes in customer demand, and the amount and timing of power purchases needed to replace power... -

Page 22

... electricity and natural gas facilities, customer billing and service expenses, the cost of public purpose programs, and administrative and general expenses. Operating and maintenance expenses are influenced by wage inflation; changes in liabilities for employee benefits; property taxes; the timing... -

Page 23

... that have been issued in connection with the investigation of the San Bruno accident, such as costs to perform an exhaustive review of records related to the Utility's natural gas transmission system and to perform pressure tests on portions of its natural gas transmission system. The... -

Page 24

... balancing accounts and regulatory assets, and changes in the amount of debt outstanding as long-term debt matures and additional long-term debt is issued. (See "Liquidity and Financial Resources" below.) Other Income, Net The Utility's other income, net decreased by $37 million, or 63%, in 2010... -

Page 25

... and access to the capital and credit markets. The levels of the Utility's operating cash and short-term debt fluctuate as a result of seasonal load and natural gas, volatility in energy commodity costs, collateral requirements related to price risk management activity, the timing and amount of tax... -

Page 26

..., during 2010, PG&E Corporation issued 5,105,505 shares of common stock upon the exercise of employee stock options and under its 401(k) plan and Dividend Reinvestment and Stock Purchase Plan, generating $192 million of cash. PG&E Corporation issued 16,370,779 shares of common stock upon conversion... -

Page 27

... capital markets, and other factors. (See Notes 13 and 15 of the Notes to the Consolidated Financial Statements.) PG&E Corporation may issue debt or equity in the future to fund equity contributions to the Utility and to fund tax equity investments to the extent that internally generated funds are... -

Page 28

... and decommissioning Allowance for equity funds used during construction Deferred income taxes and tax credits, net Other Effect of changes in operating assets and liabilities: Accounts receivable Inventories Accounts payable Disputed claims and customer refunds Income taxes receivable/payable Other... -

Page 29

... to the increase in installation of the SmartMeterâ„¢ advanced metering infrastructure, generation facility spending, replacing and expanding gas and electric distribution systems, and improving the electric transmission infrastructure. (See "Capital Expenditures" below.) Future cash flows used in... -

Page 30

... residential and commercial retail solar energy installations. Under these agreements, PG&E Corporation will provide payments of up to $300 million, and in return, receive the benefits of local rebates, federal investment tax credits or grants, and a share of these companies' customer payments. PG... -

Page 31

... Qualifying facilities Renewable contracts Irrigation district and water agencies Other power purchase agreements Natural gas supply and transportation Nuclear fuel Pension and other benefits (3) Capital lease obligations (4) Operating leases (4) Preferred dividends (5) PG&E Corporation Long-term... -

Page 32

... makes various capital investments in its electric generation and electric and natural gas transmission and distribution infrastructure to maintain and improve system reliability, safety, and customer service; to extend the life of or replace existing infrastructure; and to add new infrastructure to... -

Page 33

... The settlement agreement proposes that the Utility's total 2011 revenue requirements be increased by $395 million, including $103 million related to depreciation rate changes. In addition, the settlement agreement proposes to (1) establish a new balancing account for meter reading costs outside of... -

Page 34

... million in 2013. Balancing Accounts The settlement agreement proposes to establish a new "one-way" balancing account for the Utility to recover up to approximately $20 million per year for costs associated with the Utility's natural gas distribution integrity management program. If these costs are... -

Page 35

... would increase at an annual average rate of 2% for 2012 through 2014. The proposed Gas Accord V maintains a majority of the terms and conditions applicable to the Utility's natural gas transportation and storage services that had been established under previously approved settlement agreements (the... -

Page 36

...'s information system, where the data is stored and used for billing and other Utility business purposes. Advanced electric meters enable the implementation of "dynamic pricing" rates for customers that reflect the higher cost of electricity during periods of high demand. As of December 31, 2010... -

Page 37

... CPUCauthorized cost cap and therefore will not be recoverable through rates. The Utility will update its forecasts as the project continues and may incur additional non-recoverable costs. Following customer complaints that the new metering system led to overcharges, a class action lawsuit was filed... -

Page 38

...or the investigation of the independent review panel may include changes to design, construction, operation and maintenance of natural gas facilities; management practices at the Utility in the areas of pipeline integrity and public safety; regulatory and statutory changes; and other recommendations... -

Page 39

...begin on January 1, 2015 and would expand to include suppliers of natural gas and liquid fossil fuels. Under the proposed cap-and-trade system, some emission allowances would be allocated to the electric sector utilities at no cost for the benefit of their customers. The investor-owned utilities are... -

Page 40

...the Utility, to gradually increase their deliveries of renewable energy to meet specific annual targets. For 2012, 2013, and 2014, the amount of electricity delivered from renewable energy resources must equal at least 20% of total energy deliveries, increasing to 24% in 2015, 2016, and 2017, 28% in... -

Page 41

... include former manufactured gas plant ("MGP") sites; current and former power plant sites; former gas gathering and gas storage sites; sites where natural gas compressor stations are located; current and former substations; service center and general construction yard sites; and sites currently and... -

Page 42

... value-at-risk to measure the shareholders' exposure to price and volumetric risks resulting from variability in the price of, and demand for, natural gas transportation and storage services that could impact revenues due to changes in market prices and customer demand. Value-at-risk measures this... -

Page 43

...rate-sensitive instruments outstanding. CREDIT RISK The Utility conducts business with counterparties mainly in the energy industry, including other California investor-owned electric utilities, municipal utilities, energy trading companies, financial institutions, and oil and natural gas production... -

Page 44

... is in place to recover current expenditures and historical experience indicates that recovery of incurred costs is probable, such as the regulatory assets for pension benefits; deferred income tax; price risk management; and unamortized loss, net of gain, on reacquired debt. The CPUC has not denied... -

Page 45

... purposes), inflation rates, and the estimated date of decommissioning. The estimated future cash flows are discounted using a credit-adjusted risk-free rate that reflects the risk associated with the decommissioning obligation. (See Note 2 of the Notes to the Consolidated Financial Statements... -

Page 46

...pension and other postretirement benefit payments. Consistent with the trusts' investment policies, assets are primarily invested in equity securities and fixed income securities. (See Note 12 of the Notes to the Consolidated Financial Statements.) PG&E Corporation and the Utility review recent cost... -

Page 47

... December 31, 2010 (in millions) Increase (Decrease) in Assumption Health care cost trend rate Discount rate Rate of return on plan assets 0.5 % (0.5)% (0.5)% $4 2 6 $ 41 103 - PG&E Corporation could be required to contribute capital to the Utility or be denied distributions from the Utility... -

Page 48

...-authorized equity ratio depends on the ability of the Utility to pay dividends to PG&E Corporation, and on PG&E Corporation's independent access to the capital and credit markets. PG&E Corporation may also be required to access the capital markets when the Utility is successful in selling long-term... -

Page 49

... assets, employee demographics, discount rates used in determining future benefit obligations, rates of increase in health care costs, levels of assumed interest rates, future government regulation, and prior contributions to the plans. Similarly, funding requirements for the nuclear decommissioning... -

Page 50

... its ability to recover in rates, in a timely manner, the costs of electricity and natural gas purchased for its customers, its operating expenses, and an adequate return of and on the capital invested in its utility assets, including the costs of long-term debt and equity issued to finance their 46 -

Page 51

... the Utility; implementation of new energy efficiency and demand response programs; and the acquisition, retirement, or closure of generation facilities. The amount of electricity the Utility would need to purchase would immediately increase if there were an unexpected outage at Diablo Canyon or any... -

Page 52

... implements "dynamic pricing" rates for customers as required by the CPUC. Dynamic pricing rates are designed to encourage efficient energy consumption and cost-effective demand response by more closely aligning retail rates with the wholesale electricity market. The CPUC has authorized the Utility... -

Page 53

...gas transportation facilities could risk being bypassed by interstate pipeline companies that construct facilities in the Utility's markets, by customers who build pipeline connections that bypass the Utility's natural gas transportation and distribution system, or by customers who use and transport... -

Page 54

... • the price of fuels that are used to produce electricity, including natural gas, crude oil, coal, and nuclear materials; • the transparency, efficiency, integrity, and liquidity of regional energy markets affecting California; • electricity transmission or natural gas transportation capacity... -

Page 55

... employees covered by collective bargaining agreements with three unions. The terms of these agreements impact the Utility's labor costs. While these contracts are re-negotiated, it is possible that labor disruptions could A report issued on June 16, 2009 by the U.S. Global Change Research Program... -

Page 56

... licensing and safety-related requirements that could require the Utility to incur significant capital expenditures in connection with the re-licensing process. The NRC also has issued a license for the Utility to construct a dry cask storage facility to store spent nuclear fuel on site at Diablo... -

Page 57

... orders or decisions, or other rules or requirements applicable to its natural gas service and facilities. The CPUC has authority to impose penalties of up to $20,000 per day, per violation. (See "Pending Investigations" above.) Under the Energy Policy Act of 2005, the FERC can impose penalties (up... -

Page 58

...or capacity at the facility. If the Utility cannot obtain, renew, or comply with necessary governmental permits, authorizations, or licenses, or if the Utility cannot recover any increased costs of complying with additional license requirements or any other associated costs in its rates in a timely... -

Page 59

CONSOLIDATED STATEMENTS OF INCOME PG&E Corporation Year ended December 31, 2010 2009 2008 (in millions, except per share amounts) Operating Revenues Electric Natural gas Total operating revenues Operating Expenses Cost of electricity Cost of natural gas Operating and maintenance Depreciation, ... -

Page 60

...Equipment Electric Gas Construction work in progress Other Total property, plant, and equipment Accumulated depreciation Net property, plant, and equipment Other Noncurrent Assets Regulatory assets ($735 and $1,124 related to energy recovery bonds at December 31, 2010 and 2009, respectively) Nuclear... -

Page 61

... Disputed claims and customer refunds Regulatory balancing accounts Other Interest payable Income taxes payable Deferred income taxes Other Total current liabilities Noncurrent Liabilities Long-term debt Energy recovery bonds Regulatory liabilities Pension and other postretirement benefits Asset... -

Page 62

...net of premium, discount, and issuance costs of $23 in 2010, $29 in 2009, and $19 in 2008 Short-term debt matured Long-term debt matured or repurchased Energy recovery bonds matured Common stock issued Common stock dividends paid Other Net cash provided by financing activities Net change in cash and... -

Page 63

...) Equity of Subsidiary Balance at December 31, 2007 Income available for common shareholders Employee benefit plan adjustment (net of income tax benefit of $156) Comprehensive income Common stock issued, net Common stock cancelled Stock-based compensation amortization Common stock dividends declared... -

Page 64

... Expenses Cost of electricity Cost of natural gas Operating and maintenance Depreciation, amortization, and decommissioning Total operating expenses Operating Income Interest income Interest expense Other income, net Income Before Income Taxes Income tax provision Net Income Preferred stock dividend... -

Page 65

CONSOLIDATED BALANCE SHEETS Pacific Gas and Electric Company Balance at December 31, 2010 2009 (in millions) ASSETS Current Assets Cash and cash equivalents Restricted cash ($38 and $39 related to energy recovery bonds at December 31, 2010 and 2009, respectively) Accounts receivable Customers (net... -

Page 66

... Pacific Gas and Electric Company Balance at December 31, 2010 2009 (in millions, except share amounts) LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities Short-term borrowings Long-term debt, classified as current Energy recovery bonds, classified as current Accounts payable Trade creditors... -

Page 67

... from issuance of long-term debt, net of premium, discount, and issuance costs of $23 in 2010, $25 in 2009, and $19 in 2008 Short-term debt matured Long-term debt matured or repurchased Energy recovery bonds matured Preferred stock dividends paid Common stock dividends paid Equity contribution Other... -

Page 68

... Electric Company Additional Paid-in Capital Common Stock Held by Subsidiary Accumulated Other Comprehensive Income (Loss) Total Shareholders' Equity Comprehensive Income (in millions) Preferred Stock Common Stock Reinvested Earnings Balance at December 31, 2007 Net income Employee benefit plan... -

Page 69

...when purchased and then expensed or capitalized to plant, as appropriate, when consumed or installed. Natural gas stored underground represents purchases that are injected into inventory and then expensed at average cost when withdrawn and distributed to customers or used in electric generation. 65 -

Page 70

... distribution facilities Natural gas transportation and storage Construction work in progress Total (1) $ 4,777 19,924 5,780 7,069 $ (1,279) (6,924) (1,751) (2,667) $ 3,498 13,000 4,029 4,402 The useful lives of the Utility's property, plant, and equipment are authorized by the CPUC and the FERC... -

Page 71

... condition. Additionally, the Utility has recorded AROs related to gas distribution, gas transmission, electric distribution, and electric transmission system assets. Detailed studies of the cost to decommission the Utility's nuclear power plants are conducted every three years in conjunction with... -

Page 72

... of the changes in the ARO liability is as follows: (in millions) the Utility's hydroelectric facilities is currently, and for the foreseeable future, economically beneficial. Therefore, the settlement date cannot be determined at this time. IMPAIRMENT OF LONG-LIVED ASSETS PG&E Corporation and the... -

Page 73

... requirements to recover certain costs that the Utility has been authorized to pass on to customers, including costs to purchase electricity and natural gas; to fund public purpose, demand response, and customer energy efficiency programs; and to recover certain capital expenditures. Generally, the... -

Page 74

... files a combined state income tax return in California. PG&E Corporation and the Utility are parties to a tax-sharing agreement under which the Utility determines its income tax provision (benefit) on a standalone basis. NUCLEAR DECOMMISSIONING TRUSTS The Utility's nuclear power facilities... -

Page 75

... returns, as a result of power purchase agreements. This assessment includes an evaluation of how the risks and rewards associated with the power plant's activities are absorbed by variable interest holders. These VIEs are typically exposed to credit risk, production risk, commodity price risk... -

Page 76

...: Balance at December 31, 2010 2009 (in millions) Pension benefits Deferred income taxes Energy recovery bonds Utility retained generation Environmental compliance costs Price risk management Unamortized loss, net of gain, on reacquired debt Other Total long-term regulatory assets $ 1,759... -

Page 77

... under energy efficiency programs designed to encourage the manufacture, design, distribution, and customer use of energy efficient appliances and other energy-using products; under the California Solar Initiative program to promote the use of solar energy in residential homes and commercial, 73 -

Page 78

... implementing customer energy efficiency programs. The public purpose programs primarily consist of the energy efficiency programs; low-income energy efficiency programs; research, development, and demonstration programs; and renewable energy programs. The gas fixed cost balancing account is used to... -

Page 79

... (309) (95) Bank have issued various series of fixed rate and multiTotal pollution control bonds 1,209 1,468 modal tax-exempt pollution control bonds for the benefit of the Utility. Under the pollution control bond loan Total Utility long-term debt, net of agreements related to the Series 1996... -

Page 80

... SCHEDULE PG&E Corporation's and the Utility's combined aggregate principal repayment amounts of long-term debt at December 31, 2010 are reflected in the table below: (in millions, except interest rates) 2011 2012 2013 2014 2015 Thereafter Total Long-term debt: PG&E Corporation Average fixed... -

Page 81

... for natural gas and energy procurement transactions. On June 8, 2010, the Utility entered into a $750 million unsecured revolving credit agreement with a syndicate of lenders. Of the total credit capacity, $500 million was used to replace the $500 million Floating Rate Senior Notes that... -

Page 82

... NOTE 5: ENERGY RECOVERY BONDS In 2005, PERF issued two separate series of ERBs in the aggregate amount of $2.7 billion to refinance a regulatory asset that the Utility recorded in connection with the Chapter 11 Settlement Agreement. The proceeds of the ERBs were used by PERF to purchase from the... -

Page 83

Long-Term Incentive Plan ("2006 LTIP"), and 5,105,505 shares were issued for the accounts of participants in PG&E Corporation's 401(k) plan and Dividend Reinvestment and Stock Purchase Plan ("DRSPP"). In addition, between June 23 and June 29, 2010, PG&E Corporation issued 16,370,779 shares of common... -

Page 84

... also awarded restricted stock to eligible employees under the 2006 LTIP. The terms of these restricted stock award agreements provide that 60% of the shares will vest over a period of three years at the rate of 20% per year. If PG&E Corporation's annual total shareholder return ("TSR") is in... -

Page 85

... for 2010: Number of Performance Shares Weighted Average Grant-Date Fair Value Nonvested at January 1 Granted Vested Forfeited Nonvested at December 31 - 616,990 - (7,020) 609,970 $ 35.60 $ 35.60 $ 35.60 As of December 31, 2010, $10 million of total unrecognized compensation costs related to... -

Page 86

... price plus accumulated and unpaid dividends through the redemption date. At December 31, 2010, annual dividends on redeemable preferred stock ranged from $1.09 to $1.25 per share. Dividends on all Utility preferred stock are cumulative. All shares of preferred stock have voting rights and an equal... -

Page 87

... PG&E Corporation's income available for common shareholders and weighted average shares of common stock outstanding for calculating basic EPS: (in millions, except per share amounts) Year Ended December 31, 2010 2009 2008 Basic Income available for common shareholders Less: distributed earnings to... -

Page 88

... of PG&E Corporation's income available for common shareholders and weighted average shares of common stock outstanding for calculating diluted EPS: Year ended December 31, 2010 2009 (in millions, except per share amounts) Diluted Income available for common shareholders Add earnings impact of... -

Page 89

... of PG&E Corporation's income available for common shareholders and weighted average shares of common stock outstanding for calculating diluted EPS: Year ended December 31, 2008 (in millions, except per share amounts) Diluted Income available for common shareholders Less: distributed earnings to... -

Page 90

...&E Corporation Year Ended December 31, 2010 2009 2008 2010 2009 Utility 2008 Federal statutory income tax rate Increase (decrease) in income tax rate resulting from: State income tax (net of federal benefit) Effect of regulatory treatment of fixed asset differences Tax credits IRS audit settlements... -

Page 91

... IRS Appeals office. Included in the 2005 to 2007 audit was the resolution of the change in accounting method related to the capitalization of indirect service costs for those years. As a result, PG&E Corporation recorded a $25 million reduction to income tax expense during 2010. In tax year 2008... -

Page 92

... Balance Sheets. The following is a discussion of the Utility's use of derivative instruments intended to mitigate commodityrelated price risk for its customers. ELECTRICITY PROCUREMENT The Utility obtains electricity from a diverse mix of resources, including third-party power purchase agreements... -

Page 93

... of new energy efficiency and demand response programs, direct access, and community choice aggregation; • the acquisition, retirement, or closure of generation facilities; and • changes in market prices that make it more economical to purchase power in the market rather than use the... -

Page 94

...were as follows: Commodity Risk (PG&E Corporation and the Utility) 2010 2009 (in millions) Unrealized gain/(loss) - Regulatory assets and liabilities (1) Realized gain/(loss) - Cost of electricity (2) Realized gain/(loss) - Cost of natural gas (2) Total commodity risk instruments (1) $ (260) $ 15... -

Page 95

... and for inputs used in the valuation methodologies in measuring fair value: Level 1-Observable inputs that reflect quoted prices Derivatives in a liability position with credit risk-related contingencies that are not fully collateralized Related derivatives in an asset position Collateral posting... -

Page 96

... 10) Electric (3) Gas (4) Total price risk management instruments Rabbi trusts Fixed income securities Life insurance contracts Total rabbi trusts Long-term disability trust U.S. equity securities (1) Corporate debt securities (1) Total long-term disability trust Total assets Liabilities: Price risk... -

Page 97

.... Money market funds are recorded as cash and cash equivalents in PG&E Corporation's Consolidated Balance Sheets. TRUST ASSETS The assets held by the nuclear decommissioning trusts, the rabbi trusts related to the non-qualified deferred compensation plans, and the long-term disability trust are... -

Page 98

... the purchase of electricity to meet the demand of its customers. (See Note 10 above.) The Utility uses internal models to determine the fair value of these power purchase agreements. These power purchase agreements include contract terms that extend beyond a period for which an active market exists... -

Page 99

...3), for the years ended December 31, 2010 and 2009: PG&E Corporation and the Utility LongLongTerm Nuclear Term Disability Dividend Price Risk Decommissioning Disability Corp. Money Participation Management Trusts Equity Equity Debt Other Market Rights Instruments Securities (1) Securities Securities... -

Page 100

...'s nuclear decommissioning trusts: Amortized Cost Total Unrealized Gains Total Unrealized Losses Estimated (1) Fair Value (in millions) As of December 31, 2010 Equity securities U.S. Non-U.S. Debt securities U.S. government and agency securities Municipal securities Other fixed income securities... -

Page 101

... in plan assets, benefit obligations, and the plans' aggregate funded status for pension benefits and other benefits for PG&E Corporation during 2010 and 2009: Pension Benefits (in millions) 2010 2009 Change in plan assets: Fair value of plan assets at January 1 Actual return on plan assets Company... -

Page 102

... Benefit Cost Net periodic benefit cost as reflected in PG&E Corporation's Consolidated Statements of Income for 2010, 2009, and 2008 is as follows: Pension Benefits (in millions) 2010 December 31, 2009 2008 Service cost for benefits earned Interest cost Expected return on plan assets Amortization... -

Page 103

... that would otherwise be charged to accumulated other comprehensive income for the pension benefits related to the Utility's defined benefit pension plan. The Utility would record a regulatory liability for a portion of the credit balance in accumulated other comprehensive income, should the other... -

Page 104

... of PG&E Corporation's and the Utility's funded status volatility. In addition to affecting the trust's fixed income portfolio market values, interest rate changes also influence liability valuations as discount rates move with current bond yields. To manage this risk, PG&E Corporation's and the... -

Page 105

... and other benefit plans by major asset category at December 31, 2010 and 2009. (in millions) Fair Value Measurements as of December 31, 2010 Level 1 Level 2 Level 3 Total Pension Benefits: U.S. Equity Non-U.S. Equity Global Equity Absolute Return Fixed Income: U.S. Government Corporate Other Cash... -

Page 106

... markets for identical securities. Commingled funds are maintained by investment companies for large institutional investors and are not publicly traded. Commingled funds are composed primarily of underlying equity securities that are publicly traded on exchanges, and price quotes for the assets... -

Page 107

... and 2009: Absolute Return Corporate Fixed Income Other Fixed Income (in millions) Total Pension Benefits: Balance as of December 31, 2009 Actual return on plan assets: Relating to assets still held at the reporting date Relating to assets sold during the period Purchases, sales, and settlements... -

Page 108

(in millions) Absolute Return Corporate Fixed Income Other Fixed Income Total Pension Benefits: Balance as of December 31, 2008 Actual return on plan assets: Relating to assets still held at the reporting date Relating to assets sold during the period Purchases, sales, and settlements Transfers... -

Page 109

... Interest accrued 30 allocation factors, including the number of employees, Less: supplier settlements (42) operating and maintenance expenses, total assets, and other Balance at December 31, 2010 $ 934 cost allocation methodologies. Management believes that the methods used to allocate expenses are... -

Page 110

... market price of either gas or electricity at the date of purchase. The table below shows the costs incurred for each type of third-party power purchase agreement at December 31, 2010: (in millions) 2010 2009 Payments 2008 Qualifying Facility Power Purchase Agreements - Under the Public Utility... -

Page 111

... power purchase agreement payments were as follows: Qualifying Facility (in millions) Energy Capacity Renewable (Other than QF) Energy Capacity Irrigation District & Water Agency Operations & Debt Maintenance Service Other Energy Capacity Total Payments 2011 2012 2013 2014 2015 Thereafter Total... -

Page 112

... obligations for natural gas purchases, natural gas transportation services, and natural gas storage were as follows: (in millions) At December 31, 2010, the undiscounted obligations under nuclear fuel agreements were as follows: (in millions) 2011 2012 2013 2014 2015 Thereafter Total $ 84 69... -

Page 113

...'s two nuclear generating units at Diablo Canyon Power Plant ("Diablo Canyon") and its retired nuclear facility at Humboldt Bay. Because the DOE failed to develop a permanent storage site, the Utility obtained a permit from the NRC to build an on-site dry cask storage facility to store spent fuel... -

Page 114

... December 31, 2010. Explosion and Fires in San Bruno, California On September 9, 2010, an underground 30-inch natural gas transmission pipeline (line 132) owned and operated by the Utility ruptured in a residential area located in the City of San Bruno, California ("San Bruno accident"). The ensuing... -

Page 115

... to do so. A hearing is scheduled for February 24, 2011. The Utility recorded a provision of $220 million in 2010 for estimated third-party claims related to the San Bruno accident, including personal injury and property damage claims, damage to infrastructure, and other damage claims. The Utility... -

Page 116

... a potentially responsible party under federal and state environmental laws. These sites include former 112 manufactured gas plant ("MGP") sites, power plant sites, gas gathering sites, sites where natural gas compressor stations are located, and sites used by the Utility for the storage, recycling... -

Page 117

... waste remediation costs without a reasonableness review (excluding any remediation associated with the Hinkley natural gas compressor site) and $131 million through the ratemaking mechanism that authorizes the Utility to recover 100% of remediation costs for decommissioning fossil-fueled sites and... -

Page 118

...31 2010 PG&E Corporation Operating revenues Operating income Net income Income available for common shareholders Net earnings per common share, basic Net earnings per common share, diluted Common stock price per share: High Low Utility Operating revenues Operating income Net income Income available... -

Page 119

... of December 31, 2010. Deloitte & Touche LLP, an independent registered public accounting firm, has audited the Consolidated Balance Sheets of PG&E Corporation and the Utility, as of December 31, 2010 and 2009; and PG&E Corporation's related consolidated statements of income, equity, and cash flows... -

Page 120

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of PG&E Corporation and Pacific Gas and Electric Company San Francisco, California We have audited the accompanying consolidated balance sheets of PG&E Corporation and subsidiaries (the "Company") and... -

Page 121

... the policies or procedures may deteriorate. In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of PG&E Corporation and subsidiaries and of Pacific Gas and Electric Company and subsidiaries as of December 31, 2010... -

Page 122

... OF DIRECTORS OF PG&E CORPORATION AND PACIFIC GAS AND ELECTRIC COMPANY David R. Andrews Senior Vice President, Government Affairs, General Counsel, and Secretary, Retired, PepsiCo, Inc. Lewis Chew Senior Vice President, Finance and Chief Financial Officer, National Semiconductor Corporation C. Lee... -

Page 123

...Integrated Demand Side Management PLACIDO J. MARTINEZ Vice President, Corporate Development ANIL K. SURI Senior Vice President, Energy Delivery WILLIAM D. ARNDT Vice President, Electric Distribution Planning and Engineering DINYAR B. MISTRY Vice President and Chief Risk and Audit Officer GABRIEL... -

Page 124

...Suite 2400 San Francisco, CA 94105-1126 415-267-7070 Fax 415-267-7268 Securities analysts, portfolio managers, or other representatives of the investment community should contact the Investor Relations Office. PG&E Corporation General Information 415-267-7000 Pacific Gas and Electric Company General... -

Page 125

... Market, Spear Tower, Suite 2400 San Francisco, CA 94105-1126 415-267-7070 Fax 415-267-7268 You may also view the Form 10-K, and all other reports submitted by PG&E Corporation and Pacific Gas and Electric Company to the Securities and Exchange Commission on our website at: www.pgecorp.com/investors... -

Page 126

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 127

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 128