Hertz 2014 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2014 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

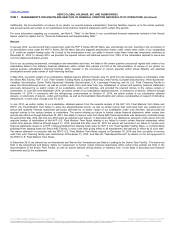

We participate in several "multiemployer" pension plans. In the event that we withdraw from participation in one of these plans, then applicable law

could require us to make an additional lump-sum contribution to the plan, and we would have to reflect that as an expense in our consolidated

statement of operations and as a liability on our consolidated balance sheet. Our withdrawal liability for any multiemployer plan would depend on

the extent of the plan's funding of vested benefits. Our multiemployer plans could have significant underfunded liabilities. Such underfunding may

increase in the event other employers become insolvent or withdraw from the applicable plan or upon the inability or failure of withdrawing

employers to pay their withdrawal liability. In addition, such underfunding may increase as a result of lower than expected returns on pension fund

assets or other funding deficiencies. The occurrence of any of these events could have a material adverse effect on our consolidated financial

position, results of operations or cash flows. For a discussion of the risks associated with our pension plans, see Item 1A, "Risk Factors” in this

Annual Report.

During 2012, Hertz completely withdrew from an existing multi-employer pension plan with the Central States Pension Fund, or the "Pension

Fund," and entered into a new agreement with the Pension Fund. In connection with the complete withdrawal from the Pension Fund, Hertz was

subject to a withdrawal liability of approximately $24 million, substantially all of which was paid in December 2012.

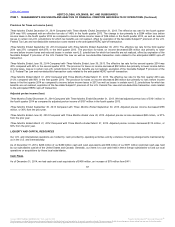

Our discussion and analysis of financial condition and results of operations are based upon our consolidated financial statements, which have

been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of the consolidated

financial statements requires management to make estimates and judgments that affect the reported amounts in our consolidated financial

statements and accompanying notes.

Certain of our accounting policies involve a higher degree of judgment and complexity in their application, and therefore, represent the critical

accounting policies used in the preparation of our financial statements. If different assumptions or conditions were to prevail, the results could be

materially different from our reported results. We believe the following accounting policies may involve a higher degree of judgment and complexity

in their application and represent the critical accounting policies used in the preparation of our financial statements. If different assumptions or

conditions were to prevail, the results could be materially different from our reported results. For additional discussion of our critical accounting

policies, as well as our significant accounting policies, see Note 3, "Summary of Critical and Significant Accounting Policies" to the Notes to our

consolidated financial statements included in this Annual Report under the caption Item 8, "Financial Statements and Supplementary Data."

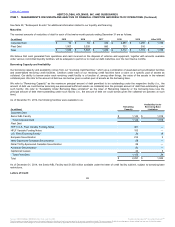

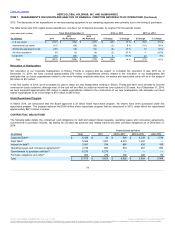

We record acquisitions resulting in the consolidation of an enterprise using the acquisition method of accounting. Under this method, the acquiring

company records the assets acquired, including intangible assets that can be identified and named, and liabilities assumed based on their

estimated fair values at the date of acquisition. The purchase price in excess of the fair value of the assets acquired and liabilities assumed is

recorded as goodwill. If the assets acquired, net of liabilities assumed, are greater than the purchase price paid then a bargain purchase has

occurred and we will recognize the gain immediately in earnings. Among other sources of relevant information, we may use independent appraisals

and actuarial or other valuations to assist in determining the estimated fair values of the assets and liabilities. Various assumptions are used in the

determination of these estimated fair values including discount rates, market and volume growth rates, expected royalty rates, EBITDA margins

and other prospective financial information. Transaction costs associated with acquisitions are expensed as incurred.

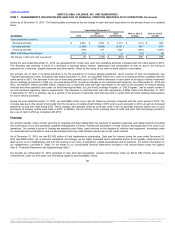

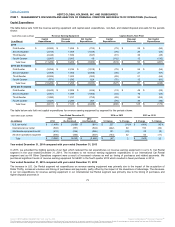

Our principal assets are revenue earning equipment, which represented approximately 57% of our total assets as of December 31, 2014. Revenue

earning equipment consists of vehicles utilized in our car rental operations and equipment utilized in our equipment rental operations. For the year

ended December 31, 2014, 53% of the vehicles purchased for our combined U.S. and International car rental fleets were subject to repurchase by

automobile manufacturers under contractual repurchase and guaranteed depreciation programs, subject to certain manufacturers' car condition and

mileage requirements, at a specific price during a specified time period. These programs limit our residual risk with respect to vehicles purchased

under these programs. For all other vehicles, as well as equipment acquired by our equipment rental business, we use historical experience,

industry residual value guidebooks and the monitoring

77

Source: HERTZ GLOBAL HOLDINGS INC, 10-K, July 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.