Hertz 2014 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2014 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

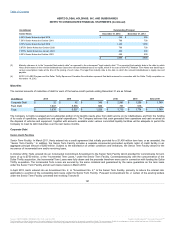

CAR, Inc.

In 2013, Hertz entered into definitive agreements with CAR, Inc. formerly operating as China Auto Rental Holdings, Inc., and related parties

pursuant to which Hertz made a strategic investment in CAR, Inc., the largest car rental company in China. Pursuant to the transaction, Hertz

invested cash and contributed its China Rent-a-Car entities to CAR, Inc. In return for its investment, Hertz received common stock in CAR, Inc.

and convertible debt securities in the amount of $236 million.

In April 2014, the Company converted the debt securities into common stock of CAR, Inc. In September 2014, CAR, Inc. launched its initial public

offering ("IPO") on the Hong Kong stock exchange and in conjunction with the IPO, Hertz invested an additional $30 million to purchase equity

shares. As a result of the IPO and its additional investment, Hertz owns approximately 16% of CAR, Inc. Hertz accounts for this investment under

the equity method based on its ability to exercise significant influence over CAR, Inc. and presents this investment within "Prepaid expenses and

other assets."

Dollar and Thrifty Franchises

In August 2014, the Company acquired substantially all of the assets of certain Dollar and Thrifty franchisees including existing fleets and contract

and concession rights for $62 million. The acquisition was part of a strategic decision to increase its Hertz-owned locations and capitalize on

certain benefits of ownership not available to the Company under a franchise agreement. The acquisition was accounted for utilizing the acquisition

method of accounting where the purchase price of the franchises was allocated based on estimated fair values of the assets acquired and

liabilities assumed. The excess of the purchase price over the estimated fair value of the net tangible and intangible assets acquired was recorded

as goodwill.

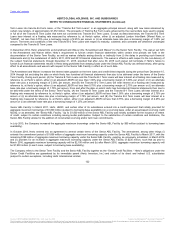

Dollar Thrifty Acquisition

On November 19, 2012, Hertz Holdings completed the Dollar Thrifty acquisition pursuant to the terms of the Merger Agreement with Dollar Thrifty

and HDTMS, Inc., or "Merger Sub," a wholly owned Hertz subsidiary. In accordance with the terms of the Merger Agreement, Merger Sub

completed a tender offer in which it purchased a majority of the shares of Dollar Thrifty common stock then outstanding at a price equal to $87.50

per share in cash. Merger Sub subsequently acquired the remaining shares of Dollar Thrifty common stock by means of a short-form merger in

which such shares were converted into the right to receive the same $87.50 per share in cash paid in the tender offer. The total purchase price

was approximately $2,592 million, which was comprised of $2,551 million of cash, including the Company's use of approximately $404 million of

cash and cash equivalents available from Dollar Thrifty, and the fair value of its previously held equity interest in Dollar Thrifty of $41 million. As a

result of re-measuring to fair value the Company's equity interest previously held in Dollar Thrifty immediately before the acquisition date, the

Company recognized a gain of approximately $8 million in its consolidated statements of operations within "Other (income) expense, net." As a

condition of the Merger Agreement, and pursuant to a divestiture agreement reached with the Federal Trade Commission, Hertz divested its

Simply Wheelz subsidiary, which owned and operated the Advantage brand, and secured for the buyer of Advantage certain Dollar Thrifty on-

airport car rental concessions. Dollar Thrifty is now a wholly-owned subsidiary of Hertz.

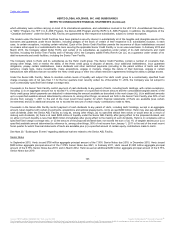

The Dollar Thrifty acquisition has been accounted for utilizing the acquisition method, which requires an allocation of the purchase price of the

acquired entity to the assets acquired and liabilities assumed based on their estimated fair values from a market-participant perspective at the

date of acquisition. During the measurement period (which was not to exceed one year from the acquisition date), the Company was required to

retrospectively adjust the preliminary amounts recognized to reflect new information obtained about facts and circumstances that existed as of the

acquisition date that, if known, would have affected the measurement of the amounts recognized as of that date. Adjustments to the preliminary

purchase price allocation were made to reflect finalized estimates of the fair value of the assets acquired and liabilities assumed at November 19,

2012. These revisions primarily related to the valuation of certain contracts, accrued liabilities and income taxes, and the resulting changes to

goodwill. Prior period financial statements were not

116

Source: HERTZ GLOBAL HOLDINGS INC, 10-K, July 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.