Hertz 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

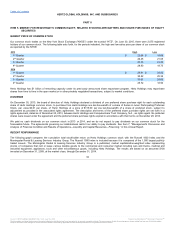

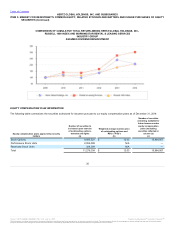

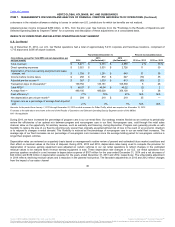

Cash and cash equivalents $ 490

$ 411

$ 541

$ 919

Total assets 23,985

24,423

23,128

17,562

Total debt 15,993

16,309

15,449

11,317

Total equity 2,464

2,567

2,331

2,118

(a) Includes U.S. Car Rental and International Car Rental segments.

(b) Our results from November 19, 2012 include the results of Dollar Thrifty which we acquired in 2012. See Note 5, "Acquisitions and Divestitures" to the Notes to our

consolidated financial statements included in this Annual Report under the caption Item 8, "Financial Statements and Supplementary Data."

(c) Our results from September 1, 2011 include the results of Donlen, our fleet leasing and management services subsidiary which we acquired in 2011.

(d) See Note 19, "Earnings Per Share" for reconciliation of net income used in diluted earnings per share calculation.

(e) For further details regarding the restatement see Note 2, "Restatement" to the Notes to our consolidated financial statements included in this Annual Report under the

caption Item 8, "Financial Statements and Supplementary Data."

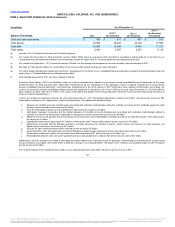

(f) Financial data presented for 2011 has been restated as follows:

During the fourth quarter of 2013, we identified certain out of period misstatements related to our previously issued consolidated financial statements for the years

ended December 31, 2012 and prior years. While these misstatements did not, individually or in the aggregate, result in a material misstatement of our previously

issued consolidated financial statements, correcting these misstatements in the fourth quarter of 2013 would have been material to that quarter. Accordingly, we

revised our previously reported consolidated balance sheets and statements of operations in the Form 10-K/A for the year ended December 31, 2013 filed with the

SEC on March 20, 2014 ("2013 Form 10-K/A"). The column in the table below labeled "As Previously Reported" reflect the revised numbers that include the effects of

these out of period misstatements.

In 2014, we restated our financial results for the year ended December 31, 2011. Restatement adjustments related to fiscal 2011 reduced pre-tax income by $54

million and are reflected in the "Adjustments" column in the table below. The adjustments identified include:

a. Allowance for doubtful accounts misstatements associated with estimation methodologies utilized to estimate recoveries for the worldwide equipment rental

business which reduced pre-tax income by $3 million.

b. Hertz #1 Gold loyalty program accrual misstatement reduced pre-tax income by $3 million.

c. Subrogation (damage) receivables and the related allowance for doubtful accounts misstatements associated with estimation methodologies utilized to

estimate recoveries from third parties responsible for damages to vehicles reduced pre-tax income by $9 million.

d. Adjustments to accounts payable and accrued expenses for previously unrecorded liabilities, including incurred but not reported charges, which reduced pre-

tax income by $1 million.

e. Capitalization and timing of depreciation for certain non-fleet assets and IT assets which reduced pre-tax income by $16 million.

f. Adjustments associated with the Brazilian operations, including allowances for doubtful accounts, certain assets and reserves for legal expenses and

litigation which reduced pre-tax income by $11 million.

g. Accruals for open rental agreements which reduced pre-tax income by $5 million.

h. Asset restoration costs associated with contractual obligations included in lease agreements which reduced pre-tax income by $1 million.

i. Certain other restatement matters not described above which decreased 2011 pre-tax income by $5 million, net.

j. Reclassification between cash and cash equivalents and accounts payable due to right of offset which reduced cash by $12 million.

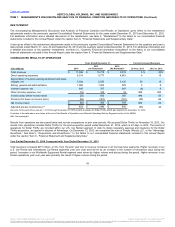

Additionally in 2014, we changed our method of calculating the market-related value of pension assets for purposes of determining the expected return on plan assets

and accounting for asset gains and losses which is deemed a change in accounting principle. The impact of the change in accounting principle for 2011 increased

pre-tax income by $3 million.

The combined impact of the restatement and change in accounting principle was a $51 million reduction to pre-tax income in 2011.

37

Source: HERTZ GLOBAL HOLDINGS INC, 10-K, July 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.