Hertz 2014 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2014 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

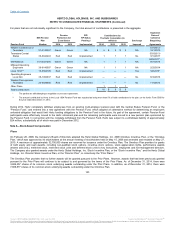

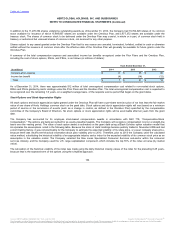

As of December 31, 2014, there were outstanding standby letters of credit totaling $629 million. Of this amount, $613 million was issued under the

Senior Credit Facilities. As of December 31, 2014, none of these letters of credit have been drawn upon.

Substantially all of the Company's revenue earning equipment and certain related assets are owned by special purpose entities, or are encumbered

in favor of its lenders under its various credit facilities, other secured financings and asset-backed securities programs. None of such assets

(including the assets owned by each of HVF II, HVF II GP Corp., HVF, RCFC, DNRS II LLC, HFLF, Donlen Trust and various international

subsidiaries that facilitate its international securitizations) are available to satisfy the claims of its general creditors.

The Company consolidates all special purpose entities for which it is the primary beneficiary, some of which are variable interest entities whose

sole purpose is to provide commitments to lend in various currencies subject to borrowing bases comprised of rental vehicles and related assets

of certain of Hertz International, Ltd.'s subsidiaries. As of December 31, 2014 and 2013, its International Fleet Financing No. 1 B.V., International

Fleet Financing No. 2 B.V. and HA Funding Pty, Ltd. variable interest entities had total assets of $427 million and $461 million, respectively,

primarily comprised of loans receivable and revenue earning equipment, and total liabilities of $426 million and $460 million, respectively, primarily

comprised of debt.

As of December 31, 2014 and 2013, accrued interest was $95 million and $74 million, respectively, which is reflected in the Company's

consolidated balance sheets in “Accrued liabilities.”

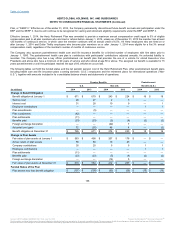

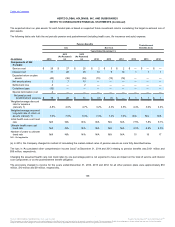

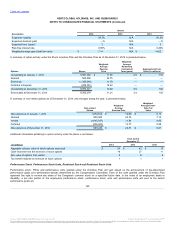

Qualified U.S. employees, after completion of specified periods of service, are eligible to participate in The Hertz Corporation Account Balance

Defined Benefit Pension Plan, or the “Hertz Retirement Plan,” a cash balance plan. Under this qualified Hertz Retirement Plan, the Company pays

the entire cost and employees are not required to contribute. Some of its international subsidiaries have defined benefit retirement plans or

participate in various insured or multiemployer plans. In certain countries, when the subsidiaries make the required funding payments, they have

no further obligations under such plans. Company plans are generally funded, except for certain nonqualified U.S. defined benefit plans and in

Germany and France, where unfunded liabilities are recorded. The Company also sponsors defined contribution plans for certain eligible U.S. and

non-U.S. employees, where contributions are matched based on specific guidelines in the plans.

Effective December 31, 2014, the Company amended the Hertz Retirement Plan to permanently discontinue future benefit accruals and

participation under the plan for non-union employees. The Company anticipates that, while compensation credits will no longer be provided under

the Hertz Retirement Plan after 2014 for affected participants, interest credits will continue to be credited on existing participant account balances

under the plan until benefits are distributed and service will continue to be recognized for vesting and retirement eligibility requirements.

In connection with the freezing of the Hertz Retirement Plan, the Company plans to increase employer contributions under the Company’s qualified

401(k) savings plan (the “401(k) Plan”). Effective January 1, 2015, eligible participants under the 401(k) Plan will receive a matching employer

contribution to their 401(k) Plan account equal to (i) 100% of the first 3% of employee contributions made by such participant and (ii) 50% of the

next 2% of employee contributions, with the total amount of such matching employer contribution to be completely vested, subject to applicable

limits under the United States Internal Revenue Code. Certain eligible participants under the 401(k) Plan will also receive additional employer

contribution amounts to their 401(k) Plan account depending on their years of service and age. The Company reserves the right to change its

benefit offerings, at any time, in its discretion.

On October 22, 2014, the Company amended two non-qualified, unfunded pension plans. These two plans are The Hertz Corporation Benefit

Equalization Plan, or “BEP,” and The Hertz Corporation Supplemental Executive Retirement

135

Source: HERTZ GLOBAL HOLDINGS INC, 10-K, July 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.