Hertz 2014 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2014 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

may have contributed to this restatement matter. The resulting increase to pre-tax earnings was $1 million in 2013 and there was no impact in

2012. The adjustments related to Brazil impacting periods prior to 2012 have been reflected in the opening adjustment to retained earnings. The

cumulative pre-tax misstatement (including the correction recorded in the Form 10-K/A in 2013 of $14 million) was a decrease in pre-tax income of

$54 million.

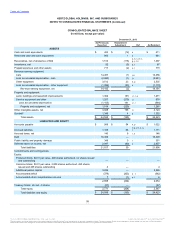

(k) Cash reclassifications (All Segments) - The Company reclassified negative cash balances representing outstanding checks to accounts

payable at period end despite, in some cases, the existence of bank agreements with legal right of offset against cash balances with the same

banks. The resulting correction had no impact to pre-tax earnings for 2013 and 2012 but reduced cash balances and accounts payable by $19

million for 2013 and $9 million for 2012.

(l) Internal Use Software reclassification (All Segments) - The Company reclassified all internal use software asset balances, including

accumulated depreciation on these assets, to intangible assets. Previously, these assets were reported in property and equipment. The resulting

correction had no impact to pre-tax earnings for 2013 and 2012, but reduced gross property and equipment and accumulated depreciation balances

and increased intangible asset and accumulated amortization balances by $197 million for 2013 and $151 million for 2012, on a net basis.

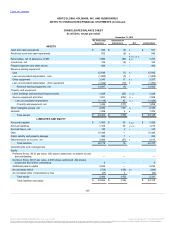

(m) Accrued Unbilled Accounts Receivable (U.S. Car Rental) - The Company over accrued revenue on open rental agreements related to the U.S.

Car Rental business at period end because its calculation methodology was based on too limited a sample of open rental agreements. Also,

vehicles that had been returned before period end, but that had not been processed as returned until after the look back period used in the

calculation methodology, were treated as rented to customers at period end. Further, the rates utilized for certain types of transactions in the

computation for the unbilled receivables were erroneous. The resulting reduction to pre-tax earnings was $1 million in 2013 and $6 million in 2012,

respectively. The cumulative pre-tax misstatement was a decrease of $13 million.

(n) Vehicle License Fees (U.S. Car Rental) - This restatement matter relates to vehicle registration cost amortization in the U.S. Car Rental

business. The Company inappropriately changed its amortization period for vehicle registration cost to the life of the vehicle instead of the life of

the registration or license. Inappropriate tone at the top, among other factors, may have contributed to this restatement matter. The resulting

reduction to pre-tax earnings was $13 million in 2013 and cumulatively.

(o) Hertz #1 Gold Points Liability (U.S. Car Rental) - The Company has made adjustments to the reserves established for the liability associated

with the redemption of points earned by customers enrolled in the Hertz Gold Plus Rewards Program. The Company determined that these

reserves were understated in 2011, 2012, and 2013 for a variety of reasons. These reasons included: (1) a miscalculation of the rate at which

customers would redeem points, (2) the use of incorrect income statement accounts in calculating the incremental costs associated with

customers’ use of points, (3) the failure to reconcile the account from 2011 through 2013 and (4) a systems issue that prevented certain customer

points from expiring as they should have when the Company modified its Gold Points expiration policy in 2011. The resulting reduction to pre-tax

earnings was $1 million for 2013 and $3 million for 2012. The cumulative pre-tax misstatement was a decrease of $9 million.

(p) Accounts payable (All Segments) - The accruals for expenses paid utilizing credit cards did not include amounts which have been incurred and

are in the process of being billed to the Company. In addition, the manual process and lack of automated interface controls with legacy systems

and the failure to complete sufficient personnel training on the accounts payable Oracle ERP system module, among other factors, resulted in

erroneous accruals including purchase orders, marketing and consulting spending. The resulting reduction to pre-tax earnings was $19 million for

2013 and $2 million for 2012. The cumulative pre-tax misstatement was a decrease of $33 million.

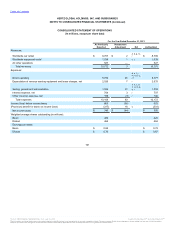

(q) Asset Retirement Obligation (All Segments) - This restatement matter relates to asset restoration costs associated with contractual obligations

included in lease agreements. The Company failed to account for global contractual restoration costs on certain of its leased facilities, including its

European headquarters at Uxbridge, United Kingdom. Inappropriate tone at the top, among other factors, may have contributed to this restatement

matter. The resulting

97

Source: HERTZ GLOBAL HOLDINGS INC, 10-K, July 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.