Hertz 2014 Annual Report Download - page 262

Download and view the complete annual report

Please find page 262 of the 2014 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

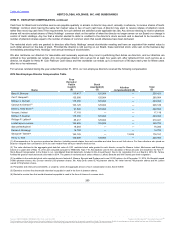

On June 2, 2014, Hertz Holdings entered into an employment agreement with Mr. MacDonald to serve as the CEO of HERC, which was

subsequently modified by a letter agreement with Hertz Holdings dated November 8, 2014, which outlined additional compensation and benefits for

serving as interim CEO of our Company in 2014. Mr. MacDonald’s employment agreement provided that he would receive an annual base salary of

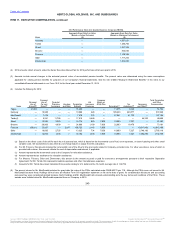

no less than $1,100,000 and a target annual bonus of no less than 130% of base salary. For 2014, Mr. MacDonald was eligible for, and was

awarded, his target bonus, as pro-rated to his date of hire.

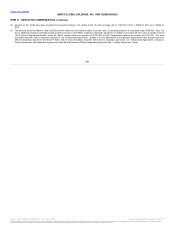

Mr. MacDonald was also eligible under the employment agreement to receive an equity award valued at $2,500,000 to be issued when Hertz

Holdings was current in its Exchange Act reporting requirements (the letter agreement converted this obligation into eligibility to receive 114,000

PSUs). The performance measures for the PSUs consisted of HERC and its consolidated subsidiaries exceeding $350,000,000 of Corporate

EBITDA for a specified 12-month period. In the event that HERC’s equipment rental business became a separate publicly-traded company, Mr.

MacDonald was scheduled to receive an equity grant in the amount of $4,000,000 and was eligible for a matching equity grant equal to 1/3 of the

stock he purchased (up to a $1,500,000 maximum match) within 60 days of the separation. The awards were scheduled to be issued when Hertz

Holdings is current in its Exchange Act reporting requirements (pursuant to accounting and SEC rules, however, the value of the 114,000 PSUs is

reflected in the 2014 Summary Compensation Table and 2014 Grants of Plan-Based Awards Table above).

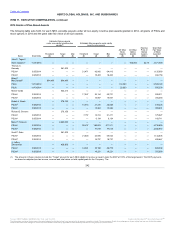

Under this letter agreement, Mr. MacDonald received additional compensation, on an annualized basis, retroactive to the date Mr. MacDonald was

appointed as interim CEO of Hertz Holdings, of $500,000 in recognition of his increased responsibilities as interim CEO in addition to the amounts

he would receive under the Senior Executive Bonus Plan for his service as CEO of HERC. In addition, Mr. MacDonald received an award of an

additional 23,000 PSUs under the 2008 Omnibus Plan. This award was scheduled to vest subject to achievement of a performance goal based on

EBITDA of Hertz Holdings and its consolidated subsidiaries exceeding $20,000,000 during a specified one-year period. The awards were

scheduled to be issued when Hertz Holdings is current in its Exchange Act reporting requirements (pursuant to accounting and SEC rules,

however, the value of the 23,000 PSUs is reflected in the 2014 Summary Compensation Table and 2014 Grants of Plan-Based Awards Table

above).

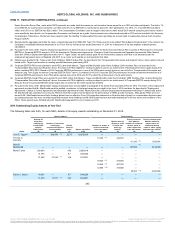

Mr. MacDonald resigned as CEO of HERC effective May 20, 2015 under circumstances that entitled him to the severance benefits provided under

the employment agreement and the letter agreement in the case of a termination without cause. In connection with his separation, he entered into

a Separation Agreement and General Release dated May 26, 2015. As required by the employment and letter agreements, Mr. MacDonald (1) was

paid the product of (a) 2 times (b) the sum of his base salary and his target 2014 bonus, for a total of $5,060,000, on the 30th day following his date

of termination; (2) was paid $3,000,000 on the 30th day following his date of termination (this separation payment represented compensation for the

lost opportunity to earn the equity awards provided for by his employment agreement and the letter agreement); (3) is eligible to be paid a pro rata

portion of his 2015 bonus, based on actual performance and with the individual modifier treated as satisfied at target; and (4) he will be provided

continued health and other certain benefits under Hertz’s benefits plans for the same cost 24 months after his separation. In exchange, Mr.

MacDonald agreed to a waiver and release of claims against us, to cooperate with us for a period of three years with respect to activities that

occurred during his tenure at the Company and not to disparage us. In addition, Mr. MacDonald reaffirmed his commitment to be bound by the

restrictive covenants concerning noncompetition and nonsolicitation of employees and clients contained in his employment agreement. Mr.

MacDonald also made certain representations within his Separation Agreement and General Release stating that he did not: (i) engage in any

conduct that constituted willful gross neglect or willful gross misconduct with respect to his employment duties which resulted or will result in

material economic harm to Hertz Holdings; (ii) knowingly violate Hertz Holdings’ Standards of Business Conduct or similar policy; (iii) facilitate or

engage in, and has no knowledge of, any financial or accounting improprieties or irregularities; and (iv) knowingly make any incorrect or false

statements in any of his certifications relating to filings required under applicable securities laws or management representation letters, and has no

knowledge of any incorrect or false statements in any filings required under applicable securities laws.

Mr. MacDonald’s letter agreement is filed as exhibit 10.1 to the Form 8-K the Company filed on November 14, 2014, and Mr. MacDonald’s

separation agreement is filed as exhibit 10.38 to this Annual Report on Form 10-K.

250

Source: HERTZ GLOBAL HOLDINGS INC, 10-K, July 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.