Hertz 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

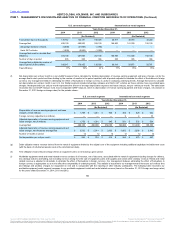

• Increased computers and field systems expenses of $22 million driven by growth in the number of off airport transactions and

integration of our on airport field back-office and maintenance operations.

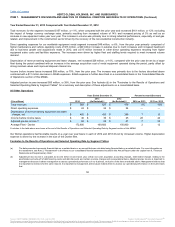

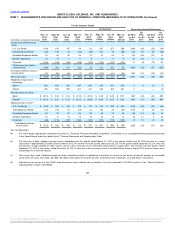

Depreciation of revenue earning equipment and lease charges, net increased $477 million, or 37%, from the prior year. Net depreciation per unit per

month for our U.S. Car Rental segment increased 35% to $294 from $218 year over year. This increase was primarily due to declining residual

values, a change in estimate of channel shift benefit and a reduction in the planned hold period as we implemented our new fleet strategy.

Additionally, 2013 included $79 million of Dollar Thrifty acquisition accounting adjustments that reduced this expense.

Income before income taxes decreased $614 million, or 70%, from the prior year. This decrease in income before income taxes was primarily due

to increased operating costs in the U.S. Car Rental segment due to damage, maintenance expenditures associated with higher mileage cars in the

fleet and increased personnel costs to support the higher mileage fleet, and increased net depreciation per unit per month of 35% to $294 from

$218 year over year. This increase was primarily due to declining residual values, a change in estimate of channel shift benefit and a reduction in

the planned hold period as we implemented our new fleet strategy. Additionally, 2013 depreciation expense was favorably impacted by $79 million

of Dollar Thrifty acquisition adjustments and an assumed longer fleet holding period. The change was partially offset by a $49 million decrease in

SG&A expenses resulting from reduced marketing, co-branding and promotional activity. Additionally, there was other income of $18 million in

2014 compared to other expense of $31 million in the prior year, resulting in a $49 million favorable impact. Other income in 2014 was primarily

comprised of a $19 million litigation settlement received in relation to a class action lawsuit filed against an original equipment manufacturer

stemming from recalls of their vehicles in previous years. Other expense in 2013 is primarily comprised of $40 million of impairment charges and

asset write-downs related to vehicles subleased to FSNA, the parent of Simply Wheelz, LLC, the owner and operator of our divested Advantage

brand, as further described in Note 5, "Acquisitions and Divestitures," to the Notes to our consolidated financial statements included in this Annual

Report under the caption Item 8, "Financial Statements and Supplementary Data."

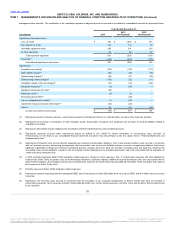

Adjusted pre-tax income decreased $646 million, or 63%, from the prior year. See footnote (b) in the "Footnotes to the Results of Operations and

Selected Operating Data by Segment Tables" for a summary and description of these adjustments on a consolidated basis.

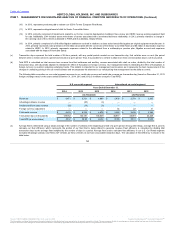

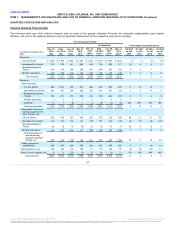

Total revenues for our U.S. Car Rental segment increased $1,443 million, or 30%, from the prior year. The increase in the size of our fleet resulting

from the late 2012 acquisition of Dollar Thrifty drove a 26% increase in transaction days, however, Total RPD increased only slightly as a result of

the expanded price mix of our business post acquisition. Off airport revenues comprised 24% of total revenues for the segment in 2013 compared

to 24% in 2012.

Direct operating expenses for our U.S. Car Rental segment increased $805 million, or 30%, from the prior year due to the full year impact of our

acquisition of Dollar Thrifty in late 2012, the expansion of our off-airport and leisure businesses and the impact of recalls. The following are the

components of the increases:

• Fleet related expenses increased $153 million, or 27%, from 2012 primarily comprised of increases in vehicle damage expenses of $38

million, self-insurance expenses of $40 million, gasoline costs of $38 million, and vehicle maintenance costs of $27 million.

• Personnel related expenses increased $210 million, or 23%, from 2012 primarily driven by increases in salaries and wages of $170 million

and taxes and benefits of $39 million as a result of additional headcount post acquisition.

• Other direct operating expenses increased $441 million, or 36%, from 2012 and is primarily comprised of increases in concession fees of

$120 million, facilities expenses of $75 million, commissions of $37 million, field administration of $40 million, amortization of intangibles

of $35 million, guaranteed charge card expenses of $35 million, supplemental liability and personal accident insurance products of $16

million, field systems of $15 million, service vehicles of $11 million and customer service expenses of $8 million.

48

Source: HERTZ GLOBAL HOLDINGS INC, 10-K, July 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.