Hertz 2014 Annual Report Download - page 255

Download and view the complete annual report

Please find page 255 of the 2014 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

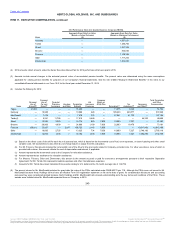

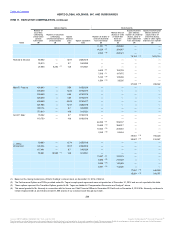

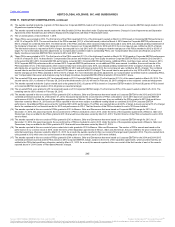

Senior Executive Bonus Plan, under which EICP payments are made, limits the maximum cash incentive bonus payout for our CEO and other participants. The limit is 1%

of our EBITDA for a performance period for our CEO and 0.5% of our EBITDA for a performance period for other participants. For 2014, 1% of our EBITDA was $40.4

million and 0.5% of our EBITDA was $20.2 million. The Compensation Committee uses its negative discretion to make actual EICP awards using the performance metrics

more specifically described in our Compensation Discussion and Analysis as a guide. Actual amounts were determined and paid in 2015 and are included in the Summary

Compensation Table above. We discuss these awards under the heading “Compensation Discussion and Analysis-Annual Cash Compensation-Annual Cash Incentive

Program (EICP).”

(2) Represents the aggregate grant date fair value, computed pursuant to FASB ASC Topic 718. Please see the note entitled "Stock-Based Compensation" in the notes to the

Company's consolidated financial statements in our Form 10-K for the fiscal year ended December 31, 2014 for a discussion of the assumptions underlying these

calculations.

(3) Pursuant to the terms of Mr. Tague's employment agreement, he did not receive an award under the Senior Executive Bonus Plan or grants of PSUs based on Corporate

EBITDA or Corporate EDITDA margin in 2014. As described in “Employment Agreements, Change in Control Agreements and Separation Agreements-Other Named

Executive Officers-Employment Agreement with John P. Tague” below, the performance goals for the Performance Options and PSUs to be awarded under his

employment agreement were not finalized until 2015. As a result, such awards are not reported in this table.

(4) Options were granted to Mr. Tague under Hertz Holdings’ 2008 Omnibus Plan. As described in the "Compensation Discussion and Analysis" above, these options will vest

based on Mr. Tague's performance in meeting specified business goals during 2015.

(5) Corporate EBITDA PSUs were granted to each NEO (other than Messrs. Tague and MacDonald) under Hertz Holdings’ 2008 Omnibus Plan. As described in the

"Compensation Discussion and Analysis" above, the amount of PSUs eligible for vesting is subject in part to our achievement of financial performance goals during 2014

and/or combined 2014‑2015. Based on 2014 Corporate EBITDA performance, none of the PSUs were earned. However, as set forth in “Compensation Discussion and

Analysis-Long Term Equity Incentives-Corporate EBITDA PSUs” above, if combined 2014‑2015 Corporate EBITDA performance exceeds at least the threshold level of

Corporate EBITDA performance, then PSUs will be earned and vest in 2016 and 2017 to reflect the achievement of such performance.

(6) Corporate EBITDA margin PSUs were granted to each NEO (other than Messrs. Tague and MacDonald) under Hertz Holdings’ 2008 Omnibus Plan. As described in the

"Compensation Discussion and Analysis" above, the amount of PSUs eligible for vesting is subject in part to our achievement of Corporate EBITDA margin during 2014.

Because the 2014 Corporate EBITDA margin target was not achieved, the entire award was forfeited.

(7) Pursuant to the terms of Mr. MacDonald’s employment agreement, he was eligible to participate in the Senior Executive Bonus Plan for 2014. The terms of the employment

agreement provided that Mr. MacDonald would be entitled, at minimum, to his target award as pro-rated for his June 2, 2014 start date. As described in “Employment

Agreements, Change in Control Agreements and Separation Agreements-Other Named Executive Officers-Employment Arrangements with Brian P. MacDonald” below,

Mr. MacDonald was awarded, but not issued, PSUs in 2014 that could be earned based on the performance of HERC and the Company. Although the PSUs were not

issued to Mr. MacDonald because Hertz Holdings did not have an effective Form S-8 registration statement on file at the date of grant, for compensation disclosure and

accounting purposes they were considered granted because Hertz Holdings and Mr. MacDonald had a mutual understanding as to the key terms and conditions of the

PSUs. These awards were forfeited when Mr. MacDonald separated from our Company in 2015.

‑

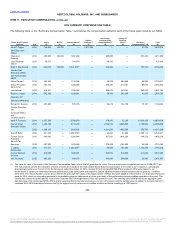

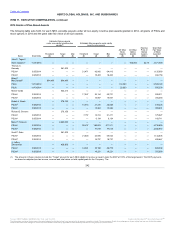

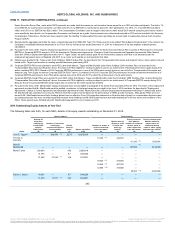

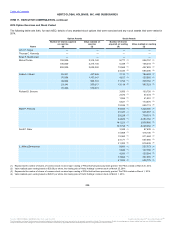

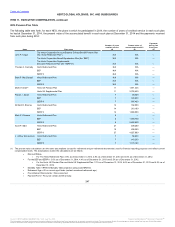

The following table sets forth, for each NEO, details of all equity awards outstanding on December 31, 2014.

John P. Tague(2) — 500,000 (3) 22.75 12/31/2019

—

— —

—

Thomas C.

Kennedy

13,740 (4) 342,676 —

—

61,345 (5) 1,529,944

Brian P.

MacDonald — —

— —

—

— 137,000

(6)

3,416,780

Michel Taride 200,000 —

4.56 2/28/2018

—

— —

—

31,766 —

9.7 3/4/2020

—

— —

—

21,558 21,559 (7) 14.6 3/1/2021

—

— —

—

15,060 (8) 375,596 —

—

19,556 (9) 487,726 —

—

12.698 (10) 316,688 —

—

90.605 (11) 2,259,689

Robert J. Stuart 16,654 —

9.7 3/4/2020

—

— —

—

11,570 11.571 (7) 14.6 3/1/2021

—

— —

—

243

Source: HERTZ GLOBAL HOLDINGS INC, 10-K, July 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.