Hertz 2014 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2014 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

which ultimately owns entities carrying on most of its international operations, and subsidiaries involved in the HVF U.S. Asset-Backed Securities,

or "ABS," Program, the HVF II U.S. ABS Program, the Donlen ABS Program and the RCFC U.S. ABS Program). In addition, the obligations of the

Canadian borrowers under the Senior ABL Facility are guaranteed by their respective subsidiaries, subject to certain exceptions.

The lenders under the Senior Credit Facilities have been granted a security interest in substantially all of the tangible and intangible assets of the

borrowers and guarantors under those facilities, including pledges of the stock of certain of their respective U.S. subsidiaries (subject, in each

case, to certain exceptions, including certain vehicles). Each of the Senior Credit Facilities permits the incurrence of future indebtedness secured

on a basis either equal to or subordinated to the liens securing the applicable Senior Credit Facility or on an unsecured basis. In February 2013 and

March 2013, the Company added Dollar Thrifty and certain of its subsidiaries as guarantors under certain of its debt instruments and credit

facilities, including the Senior Term Facility and in February 2014, the Company added Firefly Rent A Car LLC as a guarantor under certain of its

debt instruments and credit facilities, including the Senior Term Facility.

The Company refers to Hertz and its subsidiaries as the Hertz credit group. The Senior Credit Facilities contain a number of covenants that,

among other things, limit or restrict the ability of the Hertz credit group to dispose of assets, incur additional indebtedness, incur guarantee

obligations, prepay certain indebtedness, make dividends and other restricted payments (including to the parent entities of Hertz and other

persons), create liens, make investments, make acquisitions, engage in mergers, change the nature of their business, engage in certain

transactions with affiliates that are not within the Hertz credit group or enter into certain restrictive agreements limiting the ability to pledge assets.

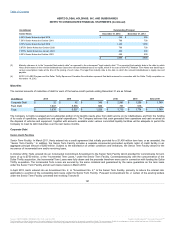

Under the Senior ABL Facility, failure to maintain certain levels of liquidity will subject the Hertz credit group to a contractually specified fixed

charge coverage ratio of not less than 1:1 for the four quarters most recently ended. As of December 31, 2014, the Company was not subject to

such contractually specified fixed charge coverage ratio.

Covenants in the Senior Term Facility restrict payment of cash dividends to any parent of Hertz, including Hertz Holdings, with certain exceptions,

including: (i) in an aggregate amount not to exceed 1% of the greater of a specified minimum amount and the consolidated tangible assets of the

Hertz credit group (which payments are deducted in determining the amount available as described in the next clause (ii)), (ii) in additional amounts

up to a specified available amount determined by reference to, among other things, an amount set forth in the Senior Term Facility plus 50% of net

income from January 1, 2011 to the end of the most recent fiscal quarter for which financial statements of Hertz are available (less certain

investments) and (iii) in additional amounts not to exceed the amount of certain equity contributions made to Hertz.

Covenants in the Senior ABL Facility restrict payment of cash dividends to any parent of Hertz, including Hertz Holdings, except in an aggregate

amount, taken together with certain investments, acquisitions and optional prepayments, not to exceed $200 million. Hertz may also pay additional

cash dividends under the Senior ABL Facility so long as, among other things, (a) no specified default then exists or would arise as a result of

making such dividends, (b) there is at least $200 million of liquidity under the Senior ABL Facility after giving effect to the proposed dividend, and

(c) either (i) if such liquidity is less than $400 million immediately after giving effect to the making of such dividends, Hertz is in compliance with a

specified fixed charge coverage ratio, or (ii) the amount of the proposed dividend does not exceed the sum of (x) 1% of tangible assets plus (y) a

specified available amount determined by reference to, among other things, 50% of net income from January 1, 2011 to the end of the most recent

fiscal quarter for which financial statements of Hertz are available plus (z) a specified amount of certain equity contributions made to Hertz.

See Note 20, "Subsequent Events" regarding additional waivers related to the Senior ABL Facility.

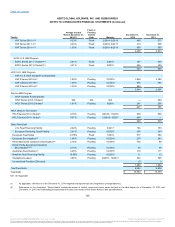

Senior Notes

In September 2010, Hertz issued $700 million aggregate principal amount of the 7.50% Senior Notes due 2018, in December 2010, Hertz issued

$500 million aggregate principal amount of the 7.375% Senior Notes due 2021, in February 2011, Hertz issued $1,000 million aggregate principal

amount of the 6.75% Senior Notes due 2019, and in March 2012, Hertz issued an additional $250 million aggregate principal amount of the 6.75%

Senior Notes due 2019.

123

Source: HERTZ GLOBAL HOLDINGS INC, 10-K, July 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.