Hertz 2014 Annual Report Download - page 246

Download and view the complete annual report

Please find page 246 of the 2014 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

over target, then up to an additional 50% of the target number of awards shall vest based on straight line interpolation between 100% and 115% of

target.

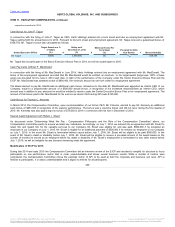

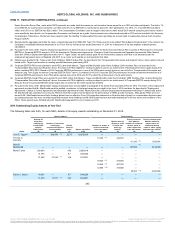

Based on applicable SEC and accounting rules, the 500,000 Transition Options were recognized as granted in 2014. However, the Performance

Options and PSUs were not recognized as granted in 2014 because our Compensation Committee did not establish revenue efficiency targets for

the awards until 2015. As a result, only the Transition Options will be reported in Mr. Tague’s compensation in 2014. The Board and the

Compensation Committee do not intend to grant Mr. Tague any additional equity awards for 2015. For more information about Mr. Tague’s equity

awards and the compensation we reported for such equity awards see and

below.

Pursuant to the terms of Mr. MacDonald’s employment arrangements, he did not receive the PSUs described above. As detailed below, under

we agreed to issue Mr. MacDonald PSUs based on different EBITDA metrics (including the EBITDA of

HERC), as well as certain additional equity awards if HERC became a separate publicly traded company. Mr. MacDonald separated from

employment prior to vesting in any of his awards and accordingly, they were all forfeited, with a cash payment made to Mr. MacDonald in lieu of

such awards pursuant to his letter agreement.

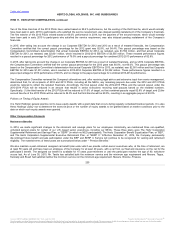

During late 2014 and early 2015 the Compensation Committee reviewed the structure of the long-term incentive plan and concluded that significant

changes to the plan were needed to create the right incentives and strongly align employee and Hertz Holdings’ stockholder interests. The

following changes were implemented in 2015:

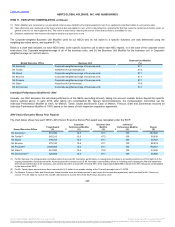

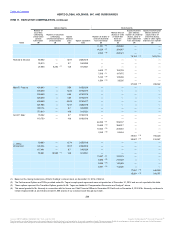

Corporate EBITDA PSUs will now be paid out based on a three-year (instead of the current two-year) performance period and will comprise 50%

(instead of the previous 70%) of each NEO’s long-term equity award. EBITDA targets have been established for 2015, 2016, and 2017, and these

targets are both significantly higher than 2014 EBITDA and increase each year (the 2016 target is 11% higher than 2015 and the 2017 target is

10% higher than 2016). 1/3 of the PSUs will be earned each year on an all-or-nothing basis, depending on whether that year’s target is met.

Assuming continued employment, earned PSUs will vest as a single tranche at the end of three years after the certification of results for the last

performance period covered by the award.The PSUs were generally granted in April 2015, except, due to SEC rules, PSUs will not be granted to

executive officers, including the NEOs, until Hertz Holdings files an effective registration statement on Form S-8. Hertz Holdings expects to grant

such awards prior to December 31, 2015.

Corporate EBITDA Margin PSUs have been eliminated.

Stock options were issued in February of 2015 in an amount equal to the other 50% of each NEO’s intended equity award. Options vest 25% each

year on the anniversary of grant and expire five years after the date of grant. The use of stock options reflects the Compensation Committee’s

view that stockholder interests are best advanced at this time with a stock incentive that only provides value when the price of Hertz Holdings’

common stock increases and, because the stock options expire after five years, requires that price improvement occur in the short- to medium-

time frame.

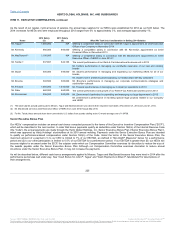

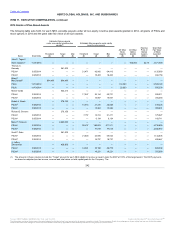

We granted Corporate EBITDA PSUs in both 2012 and 2013, which had the same structure as the 2014 Corporate EBITDA PSUs PSUs could be

earned by the greater of (i) Corporate EBITDA performance in the first year or (ii) Corporate EDITBA performance for the combined first two years.

In the spring of 2014, the Compensation Committee certified actual Corporate EBITDA for 2012-2013 of $3,670.2 million, resulting in the NEOs

earning 98.4% of the target amount of 2012 PSUs. In the spring of 2014, the Compensation Committee certified actual Corporate EBITDA for 2013

of $2,043.7 million, resulting in the NEOs earning 66.0% of the target amount of 2013 PSUs eligible to be earned for 2013.

234

Source: HERTZ GLOBAL HOLDINGS INC, 10-K, July 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.