Hertz 2014 Annual Report Download - page 257

Download and view the complete annual report

Please find page 257 of the 2014 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

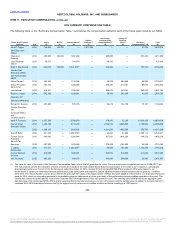

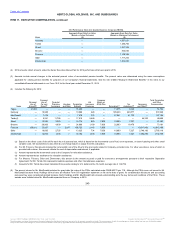

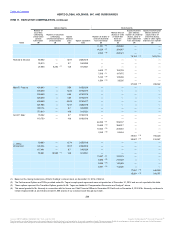

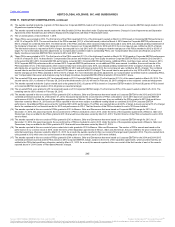

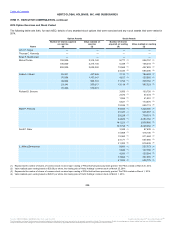

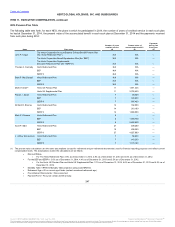

(5) The awards reported include the (i) grants of PSUs based on Corporate EBITDA made in 2014 and (ii) grants of PSUs based on Corporate EBITDA margin made in 2014.

All grants are reported at target.

(6) The awards reported include the awards made to Mr. MacDonald in 2014 as described under “Employment Agreements, Change in Control Agreements and Separation

Agreements-Other Named Executive Officers-Employment Arrangements with Brian P. MacDonald” below.

(7) The unvested options vested on March 1, 2015.

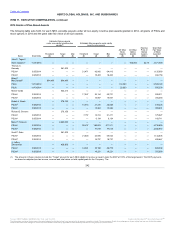

(8) These PSUs were granted in 2012. The first tranche of the PSUs awarded (331/3% of the total award) vested on March 6, 2013 based on Corporate EBITDA performance

of 95.1% of target for 2012. The second tranche of the PSUs awarded (331/3% of the total award) vested on March 6, 2014 based on Corporate EBITDA performance of

98.4% of target for combined 2012-2013. The third tranche of the PSUs awarded, which would normally have been paid in early 2015, was delayed pending restatement of

the Company’s financials. In 2015, after taking into account the change in our Corporate EBITDA for 2012 and 2013, the correct payout was certified as 82.8% of target.

The third tranche above is reported at 98.4% of target, but was paid out in July 2015 at 51.6% of target so that the total payout of the PSUs awarded in 2012 is 82.8% of

target. For more information about the adjustments our Compensation Committee made to outstanding PSUs, see “Compensation Discussion and Analysis-Long-Term

Equity Incentives-Corporate EBITDA PSUs Granted in 2012 and 2013” above.

(9) These PSUs were granted in 2013. The first tranche of the PSUs awarded (331/3% of the total award) vested on March 25, 2014 based on Corporate EBITDA performance

of 66.0% of target for 2013. As described in “Compensation Discussion and Analysis-Long-Term Equity Incentives-Corporate EBITDA PSUs Granted in 2012 and 2013”,

to the extent that 2013-2014 Corporate EBITDA performance exceeded 2013 Corporate EBITDA performance, additional PSUs could have been earned. However, 2013-

2014 Corporate EBITDA performance did not exceed 2013 Corporate EBITDA performance, so no additional PSUs were earned. In addition, the second tranche of the

PSUs awarded (331/3% of the total award), which would normally have been paid in early 2015, was delayed pending restatement of the Company’s financials. In 2015,

after taking into account the change in our Corporate EBITDA for 2013 and performance during 2014, the correct payout was certified as 60.0% of target. The combined

second tranche and third tranche (scheduled to vest in 2016) above is reported at 66.0% of target. The second tranche was paid out in July 2015 at 54.0% of target so

that the total payout of the PSUs awarded in 2013 is 60.0% of target. For more information about the adjustments our Compensation Committee made to outstanding PSUs,

see “Compensation Discussion and Analysis-Long-Term Equity Incentives-Corporate EBITDA PSUs Granted in 2012 and 2013” above.

(10) The unvested PSUs were granted in 2013 and earned based on 2013 Corporate EBITDA margin. The first tranche (331/3%) of the award vested on March 25, 2014. The

second tranche (331/3%) vested on February 28, 2015 and the third tranche (331/3%) will vest on February 28, 2016 contingent on the recipient’s continued employment

(11) The awards reported include the (i) price-vested stock units granted in 2012, (ii) grants of PSUs based on Corporate EBITDA made in 2014 and (iii) grants of PSUs based

on Corporate EBITDA margin made in 2014. All grants are reported at target.

(12) The unvested PSUs were granted in 2013 and earned based on 2013 Corporate EBITDA margin. The first tranche (50%) of the award vested on March 25, 2014. The

remaining tranche (50%) vested on February 28, 2015

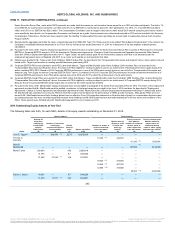

(13) The awards reported in this row consist of PSUs granted in 2013 to Messrs. Sider and Zimmerman that were based on Corporate EBITDA for the 2013 and 2013-2014

combined performance period. As of December 31, 2014, this award represents the second tranche of PSUs scheduled to vest in 2015 based on Corporate EBITDA

performance of 66.0%. Under the terms of the separation agreements of Messrs. Sider and Zimmerman, they are entitled to the PSUs granted in 2013 that would have

otherwise vested by March 31, 2015 and such PSUs reported in this row were subject to additional vesting based on combined 2013-2014 Corporate EBITDA

performance. No additional PSUs were earned for combined 2013-2014 performance. The PSUs are reported above at 66.0% of target, but were earned at 51.6% of target

due to the restatement of our financial results for 2013 and performance in 2014. The third tranche of the PSUs scheduled to vest in 2016 were forfeited.

(14) The awards reported in this row consist of PSUs granted in 2013 to Messrs. Sider and Zimmerman that were based on Corporate EBITDA margin for 2013. As of

December 31, 2014, this award represents the second tranche of PSUs scheduled to vest in 2015. Under the terms of the separation agreements of Messrs. Sider and

Zimmerman, they are entitled to the PSUs granted in 2013 that would have otherwise vested by March 31, 2015. The third tranche of the PSUs scheduled to vest in 2016

were forfeited.

(15) The awards reported in this row consist of PSUs granted in 2013 to Messrs. Sider and Zimmerman that were based on Corporate EBITDA margin for 2013. As of

December 31, 2014, this award represents the second tranche of PSUs scheduled to vest in 2015. Under the terms of the separation agreements of Messrs. Sider and

Zimmerman, they are entitled to the PSUs granted in 2013 that would have otherwise vested by March 31, 2015.

(16) The awards reported in this row consist of price-vested stock units granted in 2012 to Messrs. Sider and Zimmerman. The number of PSUs earned was based on the

performance of our common stock in 2015. Under the terms of the Separation agreements of Messrs. Sider and Zimmerman, they are entitled to the price-vested stock

units that would have otherwise vested by March 31, 2015. As a result, the awards reported in this row consist of the target award granted in 2012. The price-vested stock

units granted in 2012 which are to be earned based on the trading price of our common stock in 2016 were forfeited.

(17) The awards reported in this row consist of PSUs granted in 2014 to Messrs. Sider and Zimmerman that were based on Corporate EBITDA for the 2014 and 2014-2015

combined performance period and the PSUs based on 2014 Corporate EBITDA margin, subject to the terms of the separation agreements, which provides that they are

entitled to the PSUs that would have otherwise vested by March 31, 2015. As a result, the awards reported in this row consist of the first tranche of each of the awards

reported above in "2014 Grants of Plan-Based Awards" at target.

245

Source: HERTZ GLOBAL HOLDINGS INC, 10-K, July 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.