Hertz 2014 Annual Report Download - page 286

Download and view the complete annual report

Please find page 286 of the 2014 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

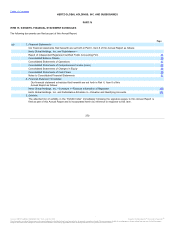

Table of Contents

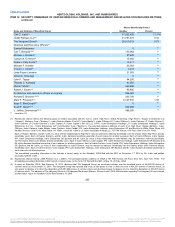

4.3.4 Third Supplemental Indenture, dated as of February 27, 2012, among The Hertz Corporation, as Issuer, the Subsidiary

Guarantors named therein, and Wells Fargo Bank, National Association, as Trustee, relating to the 6.75% Senior Notes

due 2019 (Incorporated by reference to Exhibit 4.4.6 to the Quarterly Report on Form 10-Q of Hertz Global Holdings, Inc.

(File No. 001-33139), as filed on May 4, 2012).

4.3.5 Exchange and Registration Rights Agreement, dated as of March 13, 2012, among The Hertz Corporation, the Guarantors

named therein, and Barclays Capital Inc., as the Initial Purchaser, relating to the 6.75% Senior Notes due 2019 issued as

additional notes (Incorporated by reference to Exhibit 4.4.7 to the Quarterly Report on Form 10-Q of Hertz Global

Holdings, Inc. (File No. 001-33139), as filed on May 4, 2012).

4.3.6 Fourth Supplemental Indenture, dated as of March 30, 2012, among Cinelease Holdings, Inc., Cinelease, Inc.,

Cinelease, LLC, The Hertz Corporation, as Issuer, the Existing Guarantors named therein, and Wells Fargo Bank, National

Association, as Trustee, relating to the 6.75% Senior Notes due 2019 (Incorporated by reference to Exhibit 4.4.8 to the

Quarterly Report on Form 10-Q of Hertz Global Holdings, Inc. (File No. 001-33139), as filed on May 4, 2012).

4.3.7 Fifth Supplemental Indenture, dated as of March 8, 2013, among Dollar Thrifty Automotive Group, Inc., DTG Operations,

Inc., Dollar Rent A Car, Inc., Thrifty, Inc., DTG Supply, Inc., Thrifty Car Sales, Inc., Thrifty Rent-A-Car System, Inc.,

TRAC Asia Pacific, Inc., Thrifty Insurance Agency, Inc., The Hertz Corporation, as Issuer, the Existing Guarantors named

therein, and Wells Fargo Bank, National Association, as Trustee, relating to the 6.75% Senior Notes due 2019

(Incorporated by reference to Exhibit 4.3.7 to the Quarterly Report on Form 10-Q of Hertz Global Holdings, Inc. (File No.

001-33139), as filed on May 2, 2013).

4.3.8 Sixth Supplemental Indenture, dated as of February 5, 2014, among Firefly Rent A Car LLC, The Hertz Corporation, as

Issuer, the Existing Guarantors named therein, and Wells Fargo Bank, National Association, as Trustee, relating to the

6.75% Senior Notes due 2019 (Incorporated by reference to Exhibit 4.3.8 to the Annual Report on Form 10-K of Hertz

Global Holdings, Inc. (File No. 001-33139), as filed on March 19, 2014).

4.4.1 Indenture, dated as of October 16, 2012, between The Hertz Corporation (as successor-in-interest to HDTFS, Inc.), as

Issuer, and Wells Fargo Bank, National Association, as Trustee, providing for the issuance of notes in series

(Incorporated by reference to Exhibit 4.6.1 to the Quarterly Report on Form 10-Q of Hertz Global Holdings, Inc. (File

No. 001-33139), as filed on November 2, 2012).

4.4.2 First Supplemental Indenture, dated as of October 16, 2012, between The Hertz Corporation (as successor-in-interest to

HDTFS, Inc.), as Issuer, and Wells Fargo Bank, National Association, as Trustee, relating to the 5.875% Senior Notes

due 2020 (Incorporated by reference to Exhibit 4.6.2 to the Quarterly Report on Form 10-Q of Hertz Global Holdings, Inc.

(File No. 001-33139), as filed on November 2, 2012).

4.4.3 Second Supplemental Indenture, dated as of October 16, 2012, between The Hertz Corporation (as successor-in-interest

to HDTFS, Inc.), as Issuer, and Wells Fargo Bank, National Association, as Trustee, relating to the 6.250% Senior Notes

due 2022 (Incorporated by reference to Exhibit 4.6.3 to the Quarterly Report on Form 10-Q of Hertz Global Holdings, Inc.

(File No. 001-33139), as filed on November 2, 2012).

4.4.4 Third Supplemental Indenture, dated as of November 19, 2012, among The Hertz Corporation, as Issuer, the Subsidiary

Guarantors named therein, and Wells Fargo Bank, National Association, as Trustee, relating to the 5.875% Senior Notes

due 2020 and the 6.250% Senior Notes due 2022 (Incorporated by reference to Exhibit 4.4.4 of the Registration Statement

on Form S-4 of The Hertz Corporation (File No. 333-186328), as filed on January 31, 2013).

4.4.5 Exchange and Registration Rights Agreement, dated as of November 19, 2012, among The Hertz Corporation, the

Guarantors named therein, and Barclays Capital Inc., Deutsche Bank Securities Inc. and Merrill Lynch, Pierce, Fenner &

Smith Incorporated, as representatives of the several Initial Purchasers, relating to the 5.875% Senior Notes due 2020 and

the 6.250% Senior Notes due 2022 (Incorporated by reference to Exhibit 4.4.5 of the Registration Statement on Form S-4

of The Hertz Corporation (File No. 333-186328), as filed on January 31, 2013).

4.4.6 Fourth Supplemental Indenture, dated as of March 8, 2013, among Dollar Thrifty Automotive Group, Inc., DTG Operations,

Inc., Dollar Rent A Car, Inc., Thrifty, Inc., DTG Supply, Inc., Thrifty Car Sales, Inc., Thrifty Rent-A-Car System, Inc.,

TRAC Asia Pacific, Inc., Thrifty Insurance Agency, Inc., The Hertz Corporation, as Issuer, the Existing Guarantors named

therein, and Wells Fargo Bank, National Association, as Trustee, relating to the 5.875% Senior Notes due 2020 and the

6.250% Senior Notes due 2022 (Incorporated by reference to Exhibit 4.4.6 to the Quarterly Report on Form 10-Q of Hertz

Global Holdings, Inc. (File No. 001-33139), as filed on May 2, 2013).

274

Source: HERTZ GLOBAL HOLDINGS INC, 10-K, July 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.